Скользящее среднее Арно Легу (ALMA)

Индикаторы, стратегии и библиотеки

A smooth looking indicator created from a mix of ALMA and LRC curves. Includes alternative calculation for both which I came up with through trial and error so a variety of combinations work to varying degrees. Just something I was playing around with that looked pretty nice in the end.

This strategy uses two different Arnaud Legoux Moving Average Lengths, one fast and one slow, to determine crosses for entries. The Arnaud Legoux Moving Average is an improvement to traditional MA's because it reduces lag and smooths the signal line. I have added a volume filter to improve the accuracy of the signals. This script is optimized to be used with...

Greetings Colleagues As it could not be otherwise in the soul series could not miss its own moving average. Here you can enjoy 3 soul moving averages with color variables and alerts on all crosses of the three moving averages /// Quick Explained ALMA /// //Window size: The window size is the look-back period and it is a basic setting of ALMA. //Experienced...

Greetings Colleagues here I published another script of the series "Alma Variant" This script incorporates four different standard signals from Bollinger Band Book. Signals: Bollinger Band Width. Line blue Bollinger Band %B. Line gray Intraday intensity Index “normalized using log(volume)”. Oscillator line in the middle of the indicator with decision color green =...

A simple experiment that using Arnaud Legoux Moving Average tries to help visualize an extended trend and its reversal . You can play with: Alma length Alma offset ( needs sigma not to be 0 ) Alma sigma I hope you find it useful. Feel free to modify it and let me know to test your scripts!

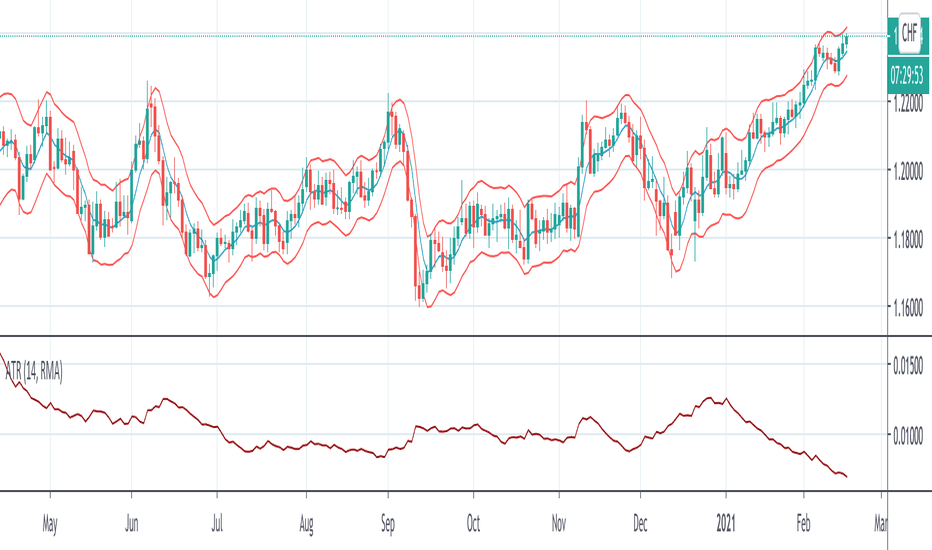

Arnaud Legoux Moving Average With ATR Bands to get an idea of the volatility.

This script is a custom visualization tool to plot 4 Moving Averages (MA). Each MA is customizable; you can: enable (disable) the plot of MA; select whether the MA is an EMA or an SMA; the length; the source (open, close, ...); the offset value (default is 0). Note: The 1st MA is an EMA with length 50. The others MAs are SMA with length 9, 30...

Arnaud Legoux Trend Indicator (ALTI) was designed for Identifying the primary trend, secondary trend and minor trend in a clearer way. Using the trend for continuation trade and detect potential reversals are two common ways to use it. However, combining ALTI with good volume indicators also has special results.Good luck, traders.

This hasn't been done before. People know the ALMA moving average, TradingView, of course, has a built-in function for the ALMA = alma(). But, when you use built-in functions, you can't have a series as a length. Pinecoders put out a bunch of functions for various routines wherein the built-in doesn't allow for a series as a length. I got some help from @everget...

It is an RSI indicator with 3 lines (or 4 if you enable the original RSI in settings): The lime is calculated from high The fuchsia is calculated from low The orange one is calcuated form both high and low , by calculating RSI's up from high and down from low You can also select different moving averages for RSI calculation. (The...

This is Keltner Channelz (KC) with Zero Lag Moving Average (ZLMA as base). It is smoother and has less lag than the original (EMA/SMA) variant. It also can be used as a trend indicator and trend confirmation indicator. The upper and lower bands are green if it is an up trend, and red if a down trend. If both have the same color it is a stronger trend.

Plots the high and low of your chosen moving average. Options are: SMA = Simple Moving Average EMA = Exponential Moving Average WMA = Weighted Moving Average HMA = Hull Moving Average VWMA = Volume Weighted Moving Average RMA = Exponetial Weighted Moving Average ALMA = Arnaud Legoux Moving Average Unbox "Use Current Timeframe" to use chosen timeframe below I...

These ribbons are based on Arnaud Legoux's moving average and combined with Fibonacci levels to create near perfect points of interest. when price action enters one of these bands watch for it's reaction, if price gets rejected expect it to return to the previous band, like wise if the price breaks above one band you can expect it to continue to the next. simple...

Here is a very simple tool that uses the Arnaud Legoux Moving Average(ALMA). The ALMA is based on a normal distribution and is a reliable moving average due to its ability to reduce lag while still keeping a high degree of smoothness. Input Options: -Offset : Value in range {0,1} that adjusts the curve of the Gaussian Distribution. A higher value will result in...

Includes fast and slow Arnaud Legoux Moving Averages (ALMA). ALMA is a moving average based on a Gaussian(normal) distribution that reduces lag while still retaining smoothness. Input Options: -Offset : Value in range {0,1} that adjusts the curve of the Gaussian Distribution. A higher value will result in higher responsiveness but lower smoothness. A lower...

Arnaud Legoux MA > Hull MA Long Hull period default, for use with low timeframe probably not as good if a trading commision is applied etc script open, help yourself :)

![Arnaud Legoux Moving Average Set [DM] 3333: Arnaud Legoux Moving Average Set [DM]](https://s3.tradingview.com/d/DY2l0tAo_mid.png)

![Bollinger Bands Width + %B + Vol. + Intraday Idx Alma var [DM] BL: Bollinger Bands Width + %B + Vol. + Intraday Idx Alma var [DM]](https://s3.tradingview.com/t/TxJINtl6_mid.png)

![AWB - Alma Weird Bands [SilentShiller] BTCUSD: AWB - Alma Weird Bands [SilentShiller]](https://s3.tradingview.com/s/s4k9QBtt_mid.png)

![ALMA Function [FN] - Arnaud Legoux Moving Average ES1!: ALMA Function [FN] - Arnaud Legoux Moving Average](https://s3.tradingview.com/r/rqxaTb6E_mid.png)