marketsmith

Индикаторы, стратегии и библиотеки

The " Danger Signals " indicator, a collaborative creation from the minds at Amphibian Trading and MARA Wealth, serves as your vigilant lookout in the volatile world of stock trading. Drawing from the wisdom encapsulated in "The Trading Mindwheel" and the successful methodologies of legends like William O'Neil and Mark Minervini, this tool is engineered to...

An equity curve is a graphical representation of the change in the value of a trading account over a time period. The equity curve is a direct reflection of a trading strategy's effectiveness. A consistently upward-trending equity curve indicates a successful strategy, while a flat or declining curve may signal the need for adjustment. This indicator takes...

The Power Outage indicator serves as the antithesis to the Power Trend, highlighting periods of extreme weakness or downtrends. Drawing inspiration from the Power Trend, the Power Outage framework was conceived by reversing the logic to highlight periods where being in cash or net short could be beneficial. What Initiates a Power Outage? The high is below...

The Analytics Trading Dashboard is a tool designed to bring key information about a company into an easy-to-view dashboard. The indicator combines Company Info, Fundamental Data, Price & Volume Data, and Analyst Recommendations all into one table. Let’s dive into the details by section: Company Info: Name – Company name. Market Cap – Total dollar market...

The Anchored Relative Strength (RS) Indicator is a tool designed for traders to compare the performance of a selected stock or security against a benchmark index or another security starting from a specific point in time. Traditional Relative Strength The traditional RS line is a popular tool used to compare the performance of a stock, typically calculated as...

Webby's Quick & Grateful Dead RS combines a Relative Strength Line and Moving Averages to help traders hold a core position in a winning stock by identifying moments of strength and weakness in a stocks advance. The Relative Strength (RS) line is something many investors are familiar with. It is used to measure a stocks performance versus the S&P 500 (default...

version=5 This version of the stochastic produces the identical stochastic as used in MarketSmith The three primary differences from a classic stochastic are as follows: 1. Close values only 2. 5-day ema instead of 3-day simple moving averages for smoothing the fast and slow lines 3. Slow and fast lines are truncated to integer values by Mike Scott 2023-09-11

📜 ––––HISTORY & CREDITS–––– The MarketSmith & IBD Style Model Stock Quarters another Utility indicator is an original creation by TintinTrading inspired by Investor's Business Daily and William O'Neil style of presenting information. While going through the Model Stocks that IBD has been publishing, I realized that I wanted to see the exam same Quarterly...

The 'MarketSmith Volumes' is to be used with the 'MarketSmith Indicator' and 'EPS & Sales' in order to mimic fully MarketSmith Graphs with the maximum number of indicators allowed by a free Tradingview Plan: 3 This indicator is no more than a simple volume indicator where all parameters are already adjusted to resemble MarketSmith graphical volumes. Also you...

This script provides you with several indicators that will enable you to mimic MarketSmith charts, even with a free TradingView plan. You can use this script with my ' EPS & Sales ' indicator. MarketSmith-style bars The script offers an original approach to managing candlesticks within the code, making them almost identical to those on MarketSmith. For a...

MarketSmith Daily Market Indicators is designed to mimic the Daily Market Indicators tab found in MarketSmith. This tab contains 4 different secondary indicators to help gauge the health of the overall market. This indicator allows you to choose which of the 4 indicators to show, as well as which index to pull data from, Nasdaq or NYSE. There is also a...

This script displays quarterly earnings per share (EPS) and sales data, and their year-on-year percentage change. The script builds upon the Volume Price and Fundamentals script by Mohit_Kakkar08 and improves upon the array functions to keep the code light-weight & the output as accurate as possible. This script uses diluted EPS data for calculating the...

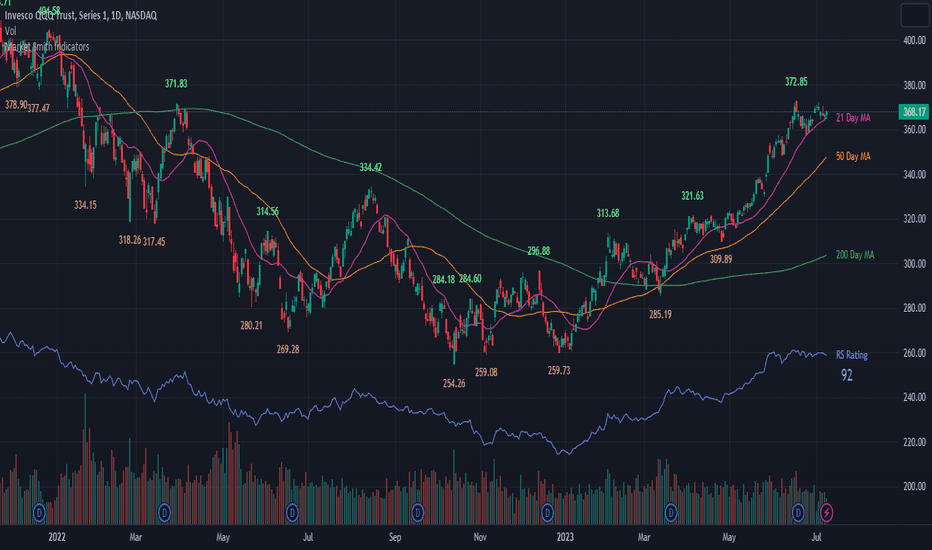

Market Smith has a collection of tools that are useful for identifying stocks. On their charts they have a 21/50/200 day moving averages, high and low pivot points, a relative strength line, and a relative strength rating. This script contains indicators for the following: 21/50/200 Day Moving Averages High and Low pivot points A Relative Strength line A...

Hello everyone. The RS Rating (or Relative Strenght Rating) is a metric that tracks a stock's price performance relative to the rest of the market. Specifically, it looks at a stock's relative strength over the last 52 weeks. It allows you to identify at a glance stocks that are outperforming the market and may be poised for further gains. Designed for break-out...

This indicator gives you the ability to see historical data for each bar on the chart by simply hovering over the high of the bar, similar to the functionality of MarketSmith. Data for each bar includes: Open High Low Close + Change Percentage Change Closing Range Volume Volume Percent based on 50 day average Distance to 4 selectable moving...

Hi everyone, I just adapted a little utility script to visualise EPS % increase (quarters vs Year -1) and sales. I used the code from @ARUN_SAXENA and modified it to fix what I saw as issues. (Using base 3M instead of 1M + request.earnings(syminfo.tickerid, earnings.actual, ignore_invalid_symbol=true) instead of request.financial(syminfo.tickerid,...

CONTAINS 3 OF MY BEST VOLUME INDICATORS ALL FOR THE PRICE OF ONE! CONTAINS: Average Dollar Volume in RED Up/Down Volume Ratio in Green Volume Buzz/Volume Run Rate in BLUE If you would like to get these individually, I also have scripts for that too. Below is information about all three of these indicators, what they do, and why they are...

Dollar volume is simply the volume traded multiplied times the cost of the stock. Dollar volume is an extremely important metric for finding stocks with enough liquidity for market makers to position themselves in. Market Liquidity is defined as market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change...

![[TTI] MarketSmith & IBD Style Model Stock Quarters FSLY: [TTI] MarketSmith & IBD Style Model Stock Quarters](https://s3.tradingview.com/e/egZKC0r7_mid.png)