1. The Market Context — Yen’s Weekend Gap and Mean Reversion Setup

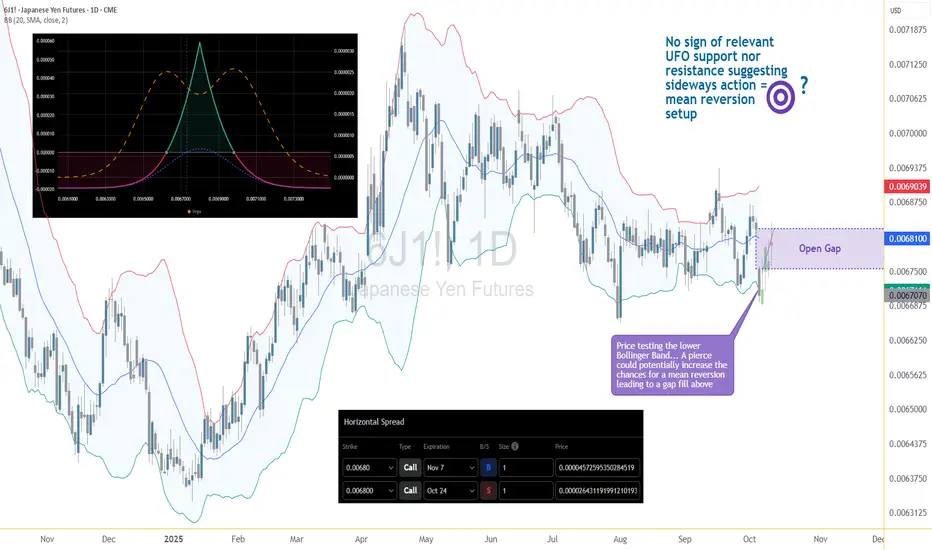

The Japanese Yen futures (6J) reopened after the weekend with an aggressive downside gap, immediately catching the eye of volatility traders. Gaps of this nature are often emotional reactions to global macro news or overnight FX shifts — yet, when structural levels like the Bollinger Band lower boundary are involved, traders begin to anticipate a mean reversion rather than continued momentum.

This is exactly what we see on 6J:

Price plunged into the lower Bollinger Band, finding temporary balance near 0.0067+, while the middle band — representing the 20-period mean — sits around 0.0068+. The gap above remains open, and that area coincides with the Bollinger mean, creating a convergence between technical equilibrium and market memory.

Historically, the Yen tends to exhibit mean reversion behavior after outsized weekend gaps, as liquidity normalizes. That statistical tendency does not guarantee results, but it provides the foundation for a non-directional strategy applied with a slight directional bias — exactly where options on futures can shine.

2. Strategy Rationale — A Non-Directional Tool Used Directionally

Instead of a pure directional play (like buying calls), we opt for a Horizontal Call Spread — also known as a Calendar Spread or Time Spread — positioned around the 0.00680 strike. This structure allows us to express a view on time and volatility, rather than raw price movement.

In essence, we’re using a non-directional strategy (time-based) in a slightly directional context (mean reversion target) — a powerful way to let the clock, not the market, do most of the work.

3. Constructing the 6J Horizontal Call Spread

Let’s break it down with specific contracts:

This combination forms a calendar spread, where both options share the same strike but different expirations. The trade is initiated for a net debit, meaning we pay a small premium upfront for the position.

Mechanics

The position benefits from stabilization, controlled volatility, and time decay alignment — instead of needing a directional surge.

Greeks behave in a nuanced way:

That’s the “slightly directional” essence of this setup — time-sensitive, but gently leaning toward a gap-fill move.

4. Chart Perspective — The Technical Catalyst

The Bollinger Bands® tell the story clearly.

The weekend gap remains unfilled, overlapping perfectly with the Bollinger mean.

Should price gravitate back toward equilibrium, the spread reaches its best reward zone as Oct 24 time decay accelerates.

5. Risk Management — Structuring Control, Not Hope

Every options trade begins with a cost — the net debit — which defines maximum risk. This makes the horizontal spread particularly appealing in uncertain environments.

Here’s the structured approach:

That defines a maximum reward-to-risk ratio of roughly 3:1 when measured against time decay and expected mean reversion distance.

It’s also crucial to track macro catalysts. The Yen can react sharply to U.S. yields or Bank of Japan policy headlines. Avoid holding this position through major FX events if volatility spikes uncontrollably — horizontal spreads work best in stable-to-moderate volatility environments.

Lastly, avoid scaling without liquidity awareness. 6J options are institutionally liquid, but ensure bid–ask stability during execution.

6. CME Context — Contract Specs

Understanding contract size and margin requirements is essential before structuring any options-on-futures strategy.

As of recent CME data, the initial margin for the standard 6J futures contract is around $2,800, though this varies with volatility. Traders using options on futures generally post the premium paid as margin (for debit spreads), which in this case is $237.5 (0.000019/0.0000005 x $6.25).

7. Risk, Reward & Realistic Expectations

The goal here is not to “predict” a direction — it’s to position intelligently around time.

A well-constructed calendar spread lets traders participate in short-term stabilization moves with predefined exposure.

If 6J consolidates and slowly lifts toward 0.0068:

If the Yen collapses further or volatility implodes across the curve, losses remain contained to the initial debit — no margin calls, no open-ended risk.

For advanced traders, layering such spreads across correlated expirations can create calendar ladders, offering continuous time exposure while recycling theta — but that’s a topic for another Blueprint.

8. Key Takeaways

This approach emphasizes professional-grade thinking: controlling variables (time, volatility, strike) rather than chasing price movement.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

The Japanese Yen futures (6J) reopened after the weekend with an aggressive downside gap, immediately catching the eye of volatility traders. Gaps of this nature are often emotional reactions to global macro news or overnight FX shifts — yet, when structural levels like the Bollinger Band lower boundary are involved, traders begin to anticipate a mean reversion rather than continued momentum.

This is exactly what we see on 6J:

Price plunged into the lower Bollinger Band, finding temporary balance near 0.0067+, while the middle band — representing the 20-period mean — sits around 0.0068+. The gap above remains open, and that area coincides with the Bollinger mean, creating a convergence between technical equilibrium and market memory.

Historically, the Yen tends to exhibit mean reversion behavior after outsized weekend gaps, as liquidity normalizes. That statistical tendency does not guarantee results, but it provides the foundation for a non-directional strategy applied with a slight directional bias — exactly where options on futures can shine.

2. Strategy Rationale — A Non-Directional Tool Used Directionally

Instead of a pure directional play (like buying calls), we opt for a Horizontal Call Spread — also known as a Calendar Spread or Time Spread — positioned around the 0.00680 strike. This structure allows us to express a view on time and volatility, rather than raw price movement.

- Objective: capture a modest recovery or stabilization near 0.0068

- Approach: profit from time decay and implied volatility behavior as the front option (short leg) loses value faster than the back month (long leg)

- Outcome: defined risk, limited exposure to violent swings, and a smoother equity curve

In essence, we’re using a non-directional strategy (time-based) in a slightly directional context (mean reversion target) — a powerful way to let the clock, not the market, do most of the work.

3. Constructing the 6J Horizontal Call Spread

Let’s break it down with specific contracts:

- Buy Nov 7 Call (0.00680 strike)

- Sell Oct 24 Call (0.00680 strike)

This combination forms a calendar spread, where both options share the same strike but different expirations. The trade is initiated for a net debit, meaning we pay a small premium upfront for the position.

Mechanics

- As time passes, the shorter-dated Oct 24 call decays faster.

- If price drifts toward the 0.0068 area by the front expiry, the short leg expires near-the-money (or worthless), while the back-month call retains time value.

- The spread expands — producing the ideal outcome.

The position benefits from stabilization, controlled volatility, and time decay alignment — instead of needing a directional surge.

Greeks behave in a nuanced way:

- Theta: positive near the target zone

- Vega: long volatility — the position gains if implied volatility rises in the back month

- Delta: small positive exposure (mild bullish tilt)

That’s the “slightly directional” essence of this setup — time-sensitive, but gently leaning toward a gap-fill move.

4. Chart Perspective — The Technical Catalyst

The Bollinger Bands® tell the story clearly.

- Lower band: 0.00672 → recent test zone

- Mean (20-period average): 0.00681 → target

- Upper band: 0.00690 → secondary resistance

The weekend gap remains unfilled, overlapping perfectly with the Bollinger mean.

Should price gravitate back toward equilibrium, the spread reaches its best reward zone as Oct 24 time decay accelerates.

5. Risk Management — Structuring Control, Not Hope

Every options trade begins with a cost — the net debit — which defines maximum risk. This makes the horizontal spread particularly appealing in uncertain environments.

Here’s the structured approach:

- Entry zone: 0.0067+ area or below the lower Bollinger Band

- Target zone: 0.0068+ (Bollinger mean & partial gap fill)

- Stop: below 0.0066575 (recent intraday swing), or no stop at all since the options strategy provides a limited risk natively.

That defines a maximum reward-to-risk ratio of roughly 3:1 when measured against time decay and expected mean reversion distance.

It’s also crucial to track macro catalysts. The Yen can react sharply to U.S. yields or Bank of Japan policy headlines. Avoid holding this position through major FX events if volatility spikes uncontrollably — horizontal spreads work best in stable-to-moderate volatility environments.

Lastly, avoid scaling without liquidity awareness. 6J options are institutionally liquid, but ensure bid–ask stability during execution.

6. CME Context — Contract Specs

Understanding contract size and margin requirements is essential before structuring any options-on-futures strategy.

- Contract size: 12,500,000 Japanese Yen

- Minimum tick: 0.0000005 USD per JPY

- Tick value: $6.25 per contract

- Trading hours: Nearly 24-hour access Sunday–Friday

As of recent CME data, the initial margin for the standard 6J futures contract is around $2,800, though this varies with volatility. Traders using options on futures generally post the premium paid as margin (for debit spreads), which in this case is $237.5 (0.000019/0.0000005 x $6.25).

7. Risk, Reward & Realistic Expectations

The goal here is not to “predict” a direction — it’s to position intelligently around time.

A well-constructed calendar spread lets traders participate in short-term stabilization moves with predefined exposure.

If 6J consolidates and slowly lifts toward 0.0068:

- The short Oct call decays,

- The long Nov retains premium,

- The spread widens — success.

If the Yen collapses further or volatility implodes across the curve, losses remain contained to the initial debit — no margin calls, no open-ended risk.

For advanced traders, layering such spreads across correlated expirations can create calendar ladders, offering continuous time exposure while recycling theta — but that’s a topic for another Blueprint.

8. Key Takeaways

- Directional calendar spreads can be powerful after emotional gaps.

- 6J’s gap down plus Bollinger reversion potential creates an interesting time-based setup.

- Using non-directional tools directionally provides precision control over risk and exposure.

- Proper risk management defines the edge — not prediction accuracy.

This approach emphasizes professional-grade thinking: controlling variables (time, volatility, strike) rather than chasing price movement.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

🌟 Take This Analysis Further with Our AI Scripts 🎯 | Discover How at tradewithufos.com 🚀 Choose a Subscription: Monthly ᴼᴿ Yearly ᴼᴿ Lifetime 🗓️ | Unlock Intelligent UFO Scripts Free 💡

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

🌟 Take This Analysis Further with Our AI Scripts 🎯 | Discover How at tradewithufos.com 🚀 Choose a Subscription: Monthly ᴼᴿ Yearly ᴼᴿ Lifetime 🗓️ | Unlock Intelligent UFO Scripts Free 💡

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.