Context:

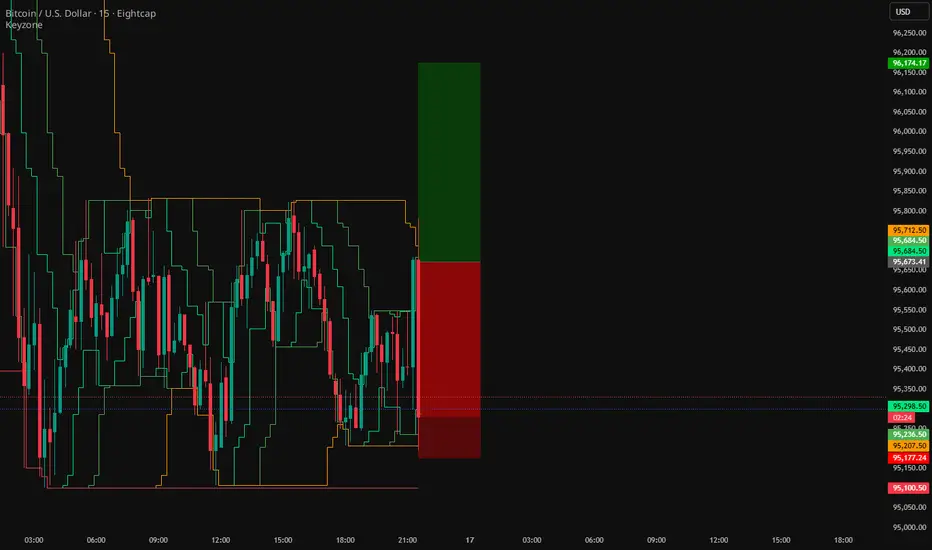

- Price pulled back into the KZ21 zone after a short-term sell-off.

- Overall structure remains range-bound with no valid downside breakdown.

- KZ21 is acting as dynamic support inside the current range.

Signal:

- Multiple rejections around KZ21 / range low with no clean close below.

- Buyers stepped in with a clear bullish reaction and acceptance above support.

- Selling pressure weakened → short-term control shifted to buyers.

Action:

- Buy executed on acceptance above KZ21 after a clear rejection.

- Entry aligns with mean-reversion behavior inside the range (not chasing).

Strategy (1:1):

- Risk: Stop loss placed below the rejection low / below the range floor.

- Reward: Take profit set at 1R targeting the upper range / intraday resistance.

Insight:

- In a ranging market, fading the lower boundary offers better edge than trend-chasing.

- Focus on quick execution and strict risk control; no need to hold for extended moves.

- Clean 1R setup: clear structure, measurable R, easy to follow the plan.

- Price pulled back into the KZ21 zone after a short-term sell-off.

- Overall structure remains range-bound with no valid downside breakdown.

- KZ21 is acting as dynamic support inside the current range.

Signal:

- Multiple rejections around KZ21 / range low with no clean close below.

- Buyers stepped in with a clear bullish reaction and acceptance above support.

- Selling pressure weakened → short-term control shifted to buyers.

Action:

- Buy executed on acceptance above KZ21 after a clear rejection.

- Entry aligns with mean-reversion behavior inside the range (not chasing).

Strategy (1:1):

- Risk: Stop loss placed below the rejection low / below the range floor.

- Reward: Take profit set at 1R targeting the upper range / intraday resistance.

Insight:

- In a ranging market, fading the lower boundary offers better edge than trend-chasing.

- Focus on quick execution and strict risk control; no need to hold for extended moves.

- Clean 1R setup: clear structure, measurable R, easy to follow the plan.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.