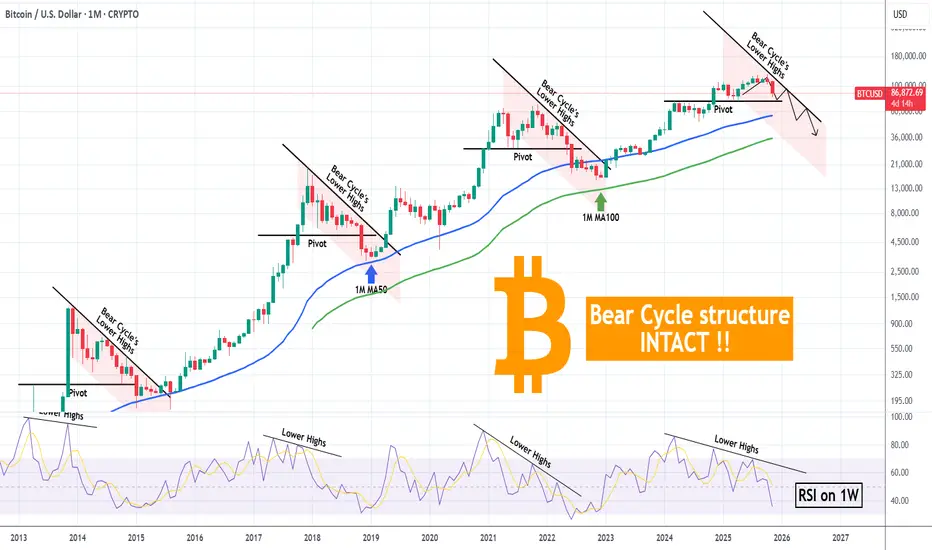

Bitcoin (BTCUSD) is experiencing a short-term rebound, whose possibility of taking place we discussed last week. This rebound can technically test and get rejected on a trend-line that all previous Bear Cycles did, the Lower Highs trend-line.

As you can see, that trend-line has been present during all cyclical corrections, essentially being the Bear Cycle's natural Resistance level. Basically the whole structure of every Bear Cycle has been similar, displaying also a Pivot trend-line, which was either a previous High or a Support and once broken, strong sell-off continuation towards the Cycle's bottom. The first two Cycle's (since 2014), bottomed on their 1M MA50 (blue trend-line), while the last one near the 1M MA100 (green trend-line).

Right now the market almost hit that Pivot and a short-term rebound and rejection on the Lower Highs trend-line, may initiate Phase 2 by February 2026.

Notice also the similar 1W RSI Lower Highs structure among the Bear Cycles, being a Bearish Divergence early call for the Bull Cycle Top.

Based on all the above, it shouldn't be surprising if BTC bottoms near or on its 1M MA100 this time also, even though (as explained on previous analyses), it would be a good idea to start buying after roughly $60000 breaks.

So do you think the Bear Cycle structure of the previous years will be repeated? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

As you can see, that trend-line has been present during all cyclical corrections, essentially being the Bear Cycle's natural Resistance level. Basically the whole structure of every Bear Cycle has been similar, displaying also a Pivot trend-line, which was either a previous High or a Support and once broken, strong sell-off continuation towards the Cycle's bottom. The first two Cycle's (since 2014), bottomed on their 1M MA50 (blue trend-line), while the last one near the 1M MA100 (green trend-line).

Right now the market almost hit that Pivot and a short-term rebound and rejection on the Lower Highs trend-line, may initiate Phase 2 by February 2026.

Notice also the similar 1W RSI Lower Highs structure among the Bear Cycles, being a Bearish Divergence early call for the Bull Cycle Top.

Based on all the above, it shouldn't be surprising if BTC bottoms near or on its 1M MA100 this time also, even though (as explained on previous analyses), it would be a good idea to start buying after roughly $60000 breaks.

So do you think the Bear Cycle structure of the previous years will be repeated? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.