Richard W. Schabacker and Bob Volman are two investors separated by time and methodology. Yet they share one essential thing: both understand the market as a profoundly psychological phenomenon. Influenced by them, I try to trade with maximum simplicity and overwhelming logic.

Today I’m going to share with you one of the most ingenious methods I’ve ever discovered for exploiting high-probability reversals.

Psychological factor: Loss aversion

The pain of a loss is far more intense than the pleasure of an equivalent gain. According to Prospect Theory, developed by Daniel Kahneman and Amos Tversky in 1979, losses psychologically weigh roughly twice as much (or more) as equivalent gains. This causes people to become risk-averse when they are in profit but much more willing to take risks to avoid a certain loss.

In Figure 1 you can see a graphic representation of that pain and loss. Using trendlines, we observe sellers suddenly trapped by aggressive buying pressure.

Figure 1

BTCUSDT (30-minute)

Many of these sellers were undoubtedly stopped out quickly, but I assure you the majority — slaves to the cognitive bias known as loss aversion — will hold their positions hoping for a recovery.

The deeper the losses go, the greater their attachment to the position becomes, along with their desperation. Under that pressure, most of those unfortunate bears will only wish for one thing: a chance to get out of the market at breakeven.

In Figure 2, observe what happens when price returns to the zone where those sellers were originally trapped.

Figure 2

BTCUSDT (30-minute)

In the bullish signals of Figure 2 we can see the confluence of several factors:

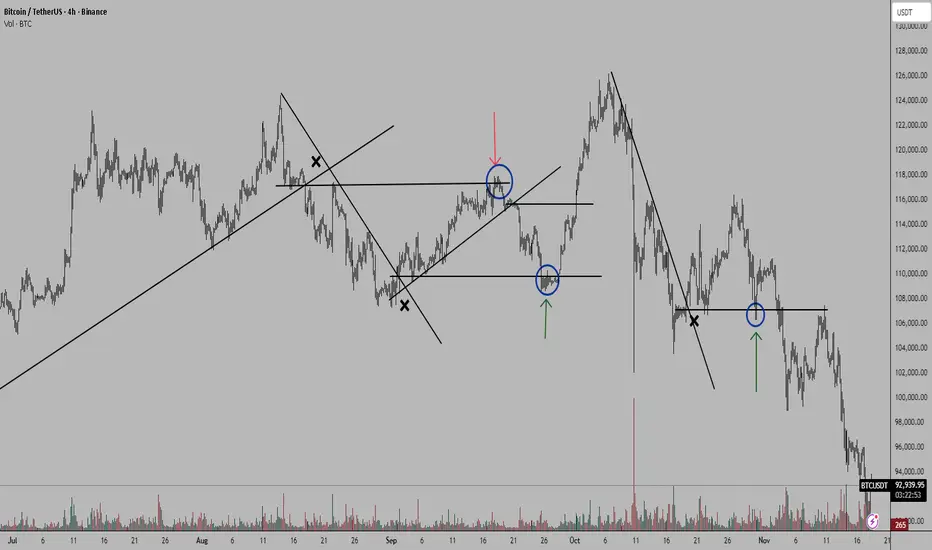

In Figure 3 you can see two examples of groups of buyers who got trapped while expecting continuation of the uptrend. After two deep corrections, most of them only wanted to return to their entry price to escape unscathed.

As soon as price returns to that entry zone, those long positions turn into selling pressure.

Figure 3

BTCUSDT (30-minute)

Figure 4 shows more of the same: desperate bulls and a lot of pain.

Figure 4

USOIL (Daily)

Additional ideas

-Remember: the deeper the pullback, the greater the suffering of the trapped traders. We need them to panic so that, the moment price reaches their entry zone, they close without thinking twice — thereby validating and reinforcing our own positions. (Fibonacci retracements of 0.50, 0.618 and 0.786 are extremely useful for measuring the optimal depth of a pullback)

-Reversal patterns are also essential for our reversal entries because they significantly increase our win rate.

-We must be especially careful when trading against moves with very strong momentum. (characterized by near-vertical price action and disproportionately large candles)

Although I will soon go deeper into the management of this method, I recommend reading the article What nobody ever taught you about risk management (El Especulador magazine, issue 01). You can also read the chapter titled The Probability Principle in Bob Volman’s book Forex Price Action Scalping.

If you enjoyed this article and want me to expand further on this and other topics, stay close.

We won’t be the ones getting trapped.

Today I’m going to share with you one of the most ingenious methods I’ve ever discovered for exploiting high-probability reversals.

Psychological factor: Loss aversion

The pain of a loss is far more intense than the pleasure of an equivalent gain. According to Prospect Theory, developed by Daniel Kahneman and Amos Tversky in 1979, losses psychologically weigh roughly twice as much (or more) as equivalent gains. This causes people to become risk-averse when they are in profit but much more willing to take risks to avoid a certain loss.

In Figure 1 you can see a graphic representation of that pain and loss. Using trendlines, we observe sellers suddenly trapped by aggressive buying pressure.

Figure 1

BTCUSDT (30-minute)

Many of these sellers were undoubtedly stopped out quickly, but I assure you the majority — slaves to the cognitive bias known as loss aversion — will hold their positions hoping for a recovery.

The deeper the losses go, the greater their attachment to the position becomes, along with their desperation. Under that pressure, most of those unfortunate bears will only wish for one thing: a chance to get out of the market at breakeven.

In Figure 2, observe what happens when price returns to the zone where those sellers were originally trapped.

Figure 2

BTCUSDT (30-minute)

In the bullish signals of Figure 2 we can see the confluence of several factors:

- Trapped sellers closing their short positions the moment price reaches breakeven, turning into buying pressure (and living to fight another day).

- Profitable shorts who were riding the previous downtrend taking profits or closing positions after a deep pullback caused by buying strength, now near potential support zones.

- New buyers entering because they see support near the low created by the previous bearish leg (especially if the downtrend has reversed into a range or accumulation phase).

In Figure 3 you can see two examples of groups of buyers who got trapped while expecting continuation of the uptrend. After two deep corrections, most of them only wanted to return to their entry price to escape unscathed.

As soon as price returns to that entry zone, those long positions turn into selling pressure.

Figure 3

BTCUSDT (30-minute)

Figure 4 shows more of the same: desperate bulls and a lot of pain.

Figure 4

USOIL (Daily)

Additional ideas

-Remember: the deeper the pullback, the greater the suffering of the trapped traders. We need them to panic so that, the moment price reaches their entry zone, they close without thinking twice — thereby validating and reinforcing our own positions. (Fibonacci retracements of 0.50, 0.618 and 0.786 are extremely useful for measuring the optimal depth of a pullback)

-Reversal patterns are also essential for our reversal entries because they significantly increase our win rate.

-We must be especially careful when trading against moves with very strong momentum. (characterized by near-vertical price action and disproportionately large candles)

Although I will soon go deeper into the management of this method, I recommend reading the article What nobody ever taught you about risk management (El Especulador magazine, issue 01). You can also read the chapter titled The Probability Principle in Bob Volman’s book Forex Price Action Scalping.

If you enjoyed this article and want me to expand further on this and other topics, stay close.

We won’t be the ones getting trapped.

📖Revista El Especulador:

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

📖Revista El Especulador:

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

drive.google.com/file/d/1Fs8l9xSpZIy5haCb5l0HWzgeAanOifs_/view?usp=drivesdk

👉t.me/ElEspeculador96 (Telegram)

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.