📈 WHAT HAPPENED?

Last week, Bitcoin surprised us with its dynamics: despite the US shutdown, the cryptocurrency showed explosive growth. On the one hand, the shutdown is negative for the global market, people have less trust in the government. On the other hand, Bitcoin acts as an independent ecosystem perceived by people as a hedge asset in relation to fiat.

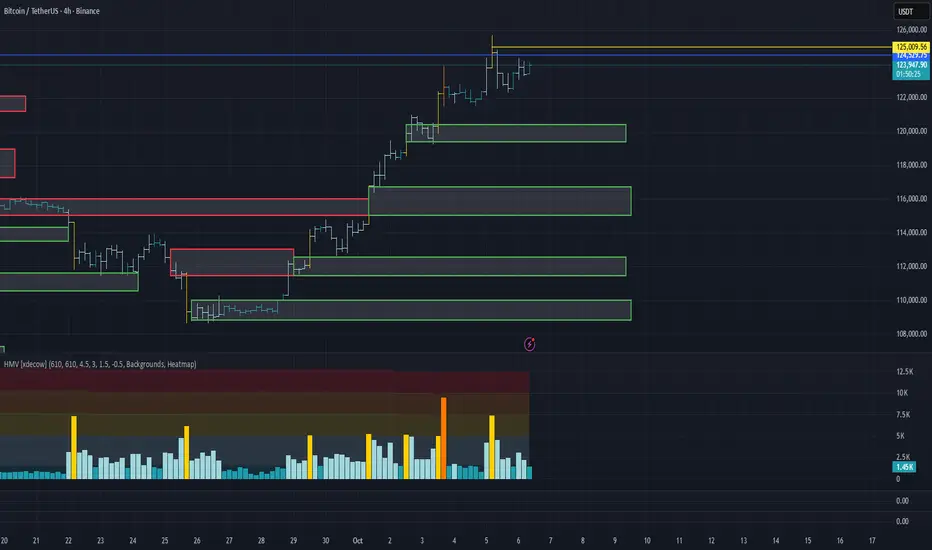

As a result of the massive inflow of liquidity, almost all of the sell zones were broken, with only a few offering resistance. Moreover, the all-time high (ATH) was reached and updated, now standing at $125,700.

💼 WHAT WILL HAPPEN: OR NOT?

The bullish momentum has now slowed down, with a strong absorption of buys. The pricing remains inefficient, increasing the likelihood of a correction.

The key area of attention is $125,000 (cluster anomalies). If there is a reaction from this level, we expect a move towards $120,000, where the nearest buyer activity zone is located.

If there is no reaction and a confident breakout of the current local high, we shift our focus to finding entry points for long trades during corrections.

Buy Zones:

• $120,400–$119,400 (absorption of selling pressure)

• $116,700–$115,000 (pushing volumes, strong chart imbalance)

• $112,500–$111,500 (mirror zone, volume anomalies)

• $110,000–$108,800 (strong absorption of selling pressure)

📰 IMPORTANT DATES

Macroeconomic events this week:

• October 8, Wednesday, 1:00 (UTC) — announcement of the interest rate decision in New Zealand;

• October 8, Wednesday, 19:00 (UTC) — publication of the US FOMC minutes;

• October 9, Thursday, 12:30 (UTC) — speech by US Federal Reserve Chairman Jerome Powell, as well as publication of the number of initial jobless claims in the US;

• October 10, Friday, 12:30 (UTC) — publication of the average hourly wage, unemployment rate, and change in the number of non-agricultural workers in the United States for September.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

Unlock your potential in trading

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Unlock your potential in trading

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.