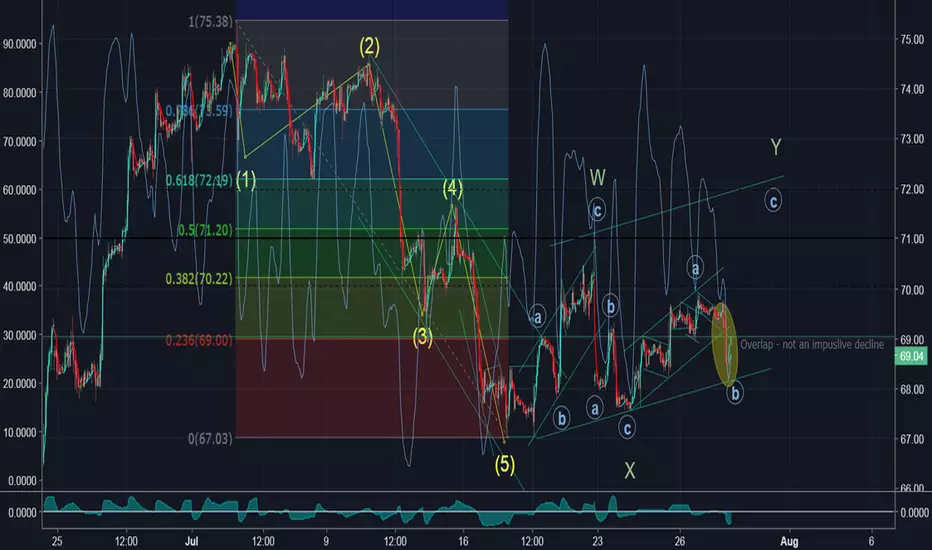

There is a possible one more leg up in WTI. The last decline (elipce mark) is not an impulsive due to the overlap within it.

In case that is true to the market there is some potential in wave Y. RSX 1H is to the upside.

In case that is true to the market there is some potential in wave Y. RSX 1H is to the upside.

Сделка закрыта: достигнута тейк-профит цена

Possible level for the end of the current corrective rise. RSX 1H is still forming the turn to the downside but not yet. This is also can be only the end of wave a in Y. That should be enough to get stop order into break even zone.

Сделка закрыта вручную

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.