1. Understanding Multi-Timeframe Analysis

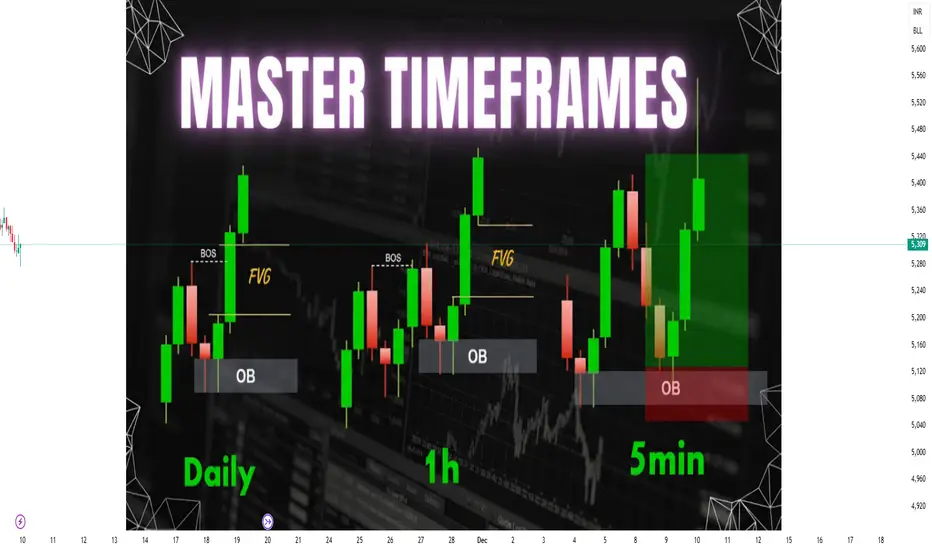

Multi-Timeframe Analysis refers to the process of observing the same security across different timeframes to identify trend alignment, potential reversal zones, and optimal trading opportunities. Every timeframe provides unique insights:

Higher Timeframe: Defines the major trend and key support/resistance zones.

Intermediate Timeframe: Helps identify swing trends within the larger move.

Lower Timeframe: Provides precise entry and exit signals.

For example, a trader analyzing Nifty 50 might observe:

Daily Chart (Positional) for the overall trend direction.

Hourly Chart (Swing) for intermediate momentum.

15-Minute Chart (Intraday) for entry confirmation.

This top-down approach ensures that trades are placed in harmony with the broader market movement rather than against it.

2. The Logic Behind Multi-Timeframe Analysis

Financial markets are fractal in nature, meaning patterns repeat on various time scales. A breakout on a 5-minute chart might just be a retracement on a 1-hour chart, while a downtrend on a daily chart could appear as a bullish trend on a 15-minute chart.

MTA helps traders:

Identify dominant trends (macro view).

Spot short-term countertrends (micro adjustments).

Time entries with high probability setups.

Essentially, it synchronizes multiple layers of information to produce well-informed trading decisions.

3. Types of Traders and Timeframes

Each trader category operates within different time horizons:

A. Intraday Traders

Objective: Capture small price moves within a single trading day.

Timeframes Used: 1-minute, 5-minute, 15-minute, and 1-hour charts.

Holding Period: A few minutes to several hours.

Example: A trader identifies a bullish breakout on the 15-minute chart, confirms strength on the 5-minute chart, and exits before the market close.

B. Swing Traders

Objective: Ride short to medium-term trends lasting several days or weeks.

Timeframes Used: 1-hour, 4-hour, and daily charts.

Holding Period: 2 to 15 days typically.

Example: A bullish pattern on the daily chart confirmed by a 4-hour breakout helps the trader capture a multi-day price rally.

C. Positional Traders

Objective: Trade major trends that can last from weeks to months.

Timeframes Used: Daily, weekly, and monthly charts.

Holding Period: Several weeks to many months.

Example: A trader identifies a long-term uptrend on the weekly chart and holds positions through short-term fluctuations.

Each trader uses MTA to align smaller trends within the context of larger ones.

4. The Top-Down Approach

The Top-Down Approach is a systematic method of conducting multi-timeframe analysis. It involves starting with the highest relevant timeframe and drilling down to lower timeframes for precision.

Step 1: Identify the Major Trend (Higher Timeframe)

Use weekly or daily charts to determine the broader market direction.

Apply moving averages, trendlines, or price structure (higher highs and higher lows).

Example: On the weekly chart, Nifty 50 is in an uptrend.

Step 2: Confirm Momentum (Intermediate Timeframe)

Switch to a 4-hour or 1-hour chart to check if the momentum supports the higher timeframe trend.

Look for consolidation, breakouts, or pullbacks.

Step 3: Refine Entry and Exit (Lower Timeframe)

Use 15-minute or 5-minute charts to time entries and exits.

Identify short-term support, resistance, and candlestick patterns for precision.

This method ensures alignment between long-term direction and short-term trade execution, minimizing false signals and improving accuracy.

5. Example of Multi-Timeframe Analysis in Action

Let’s illustrate with an example:

Weekly Chart (Positional View): Shows a strong uptrend with price above 50-day moving average.

Daily Chart (Swing View): Reveals a bullish flag pattern forming after a rally.

Hourly Chart (Intraday View): Displays a breakout above the flag resistance with volume confirmation.

A positional trader may initiate a long position based on weekly strength, while a swing trader enters after the daily flag breakout. An intraday trader could use the hourly chart to time the exact breakout candle entry.

All three traders align their strategies to the same trend but operate on different time horizons.

6. Tools and Indicators Used in Multi-Timeframe Analysis

Several tools enhance the effectiveness of MTA:

Moving Averages (MA): Identify trend direction and alignment across timeframes (e.g., 20 EMA, 50 SMA).

Relative Strength Index (RSI): Helps confirm momentum consistency.

MACD: Detects shifts in momentum and crossovers aligning with major trends.

Support and Resistance Levels: Define crucial zones visible across charts.

Trendlines and Channels: Show structure of price swings.

Candlestick Patterns: Confirm entry signals on smaller timeframes.

Combining these tools across multiple frames builds confluence—an essential component of successful trading.

7. Advantages of Multi-Timeframe Analysis

Trend Confirmation:

Confirms whether short-term movements align with the long-term trend, improving accuracy.

Reduced False Signals:

Helps filter noise from smaller charts that may mislead traders.

Enhanced Entry Timing:

Allows traders to enter trades at precise moments when all timeframes agree.

Better Risk Management:

By aligning with larger trends, traders can define stop-loss and target levels more logically.

Adaptability Across Strategies:

Suitable for scalping, swing trading, or long-term investing.

8. Challenges in Multi-Timeframe Analysis

While MTA is powerful, it also presents certain difficulties:

Information Overload: Analyzing multiple charts can cause confusion or analysis paralysis.

Conflicting Signals: Short-term and long-term charts may show opposite trends, requiring trader judgment.

Execution Complexity: Managing entries and exits across multiple timeframes demands discipline and experience.

Emotional Bias: Traders may get biased by one timeframe and ignore contradictory evidence.

Therefore, consistency in analysis and clear trading rules are vital to prevent confusion.

9. Tips for Effective Multi-Timeframe Trading

Always start with higher timeframes before moving down.

Use a ratio of 1:4 or 1:6 between timeframes (e.g., daily → 4-hour → 1-hour).

Focus on key support/resistance levels visible across multiple frames.

Avoid overcomplicating; two or three timeframes are usually enough.

Maintain a trading journal to note observations from each timeframe.

Use alerts or automated tools to monitor price behavior when multiple charts are involved.

10. Conclusion

Multi-Timeframe Analysis is not just a technique but a strategic framework that enhances decision-making across trading styles—whether intraday, swing, or positional. By combining insights from different timeframes, traders gain a holistic view of the market, identify high-probability setups, and reduce the risk of false entries.

For intraday traders, MTA refines timing; for swing traders, it offers trend confirmation; and for positional traders, it ensures long-term alignment. When executed with discipline, proper analysis, and risk control, Multi-Timeframe Analysis becomes one of the most reliable methods to trade profitably in volatile markets like India’s NSE and BSE.

Multi-Timeframe Analysis refers to the process of observing the same security across different timeframes to identify trend alignment, potential reversal zones, and optimal trading opportunities. Every timeframe provides unique insights:

Higher Timeframe: Defines the major trend and key support/resistance zones.

Intermediate Timeframe: Helps identify swing trends within the larger move.

Lower Timeframe: Provides precise entry and exit signals.

For example, a trader analyzing Nifty 50 might observe:

Daily Chart (Positional) for the overall trend direction.

Hourly Chart (Swing) for intermediate momentum.

15-Minute Chart (Intraday) for entry confirmation.

This top-down approach ensures that trades are placed in harmony with the broader market movement rather than against it.

2. The Logic Behind Multi-Timeframe Analysis

Financial markets are fractal in nature, meaning patterns repeat on various time scales. A breakout on a 5-minute chart might just be a retracement on a 1-hour chart, while a downtrend on a daily chart could appear as a bullish trend on a 15-minute chart.

MTA helps traders:

Identify dominant trends (macro view).

Spot short-term countertrends (micro adjustments).

Time entries with high probability setups.

Essentially, it synchronizes multiple layers of information to produce well-informed trading decisions.

3. Types of Traders and Timeframes

Each trader category operates within different time horizons:

A. Intraday Traders

Objective: Capture small price moves within a single trading day.

Timeframes Used: 1-minute, 5-minute, 15-minute, and 1-hour charts.

Holding Period: A few minutes to several hours.

Example: A trader identifies a bullish breakout on the 15-minute chart, confirms strength on the 5-minute chart, and exits before the market close.

B. Swing Traders

Objective: Ride short to medium-term trends lasting several days or weeks.

Timeframes Used: 1-hour, 4-hour, and daily charts.

Holding Period: 2 to 15 days typically.

Example: A bullish pattern on the daily chart confirmed by a 4-hour breakout helps the trader capture a multi-day price rally.

C. Positional Traders

Objective: Trade major trends that can last from weeks to months.

Timeframes Used: Daily, weekly, and monthly charts.

Holding Period: Several weeks to many months.

Example: A trader identifies a long-term uptrend on the weekly chart and holds positions through short-term fluctuations.

Each trader uses MTA to align smaller trends within the context of larger ones.

4. The Top-Down Approach

The Top-Down Approach is a systematic method of conducting multi-timeframe analysis. It involves starting with the highest relevant timeframe and drilling down to lower timeframes for precision.

Step 1: Identify the Major Trend (Higher Timeframe)

Use weekly or daily charts to determine the broader market direction.

Apply moving averages, trendlines, or price structure (higher highs and higher lows).

Example: On the weekly chart, Nifty 50 is in an uptrend.

Step 2: Confirm Momentum (Intermediate Timeframe)

Switch to a 4-hour or 1-hour chart to check if the momentum supports the higher timeframe trend.

Look for consolidation, breakouts, or pullbacks.

Step 3: Refine Entry and Exit (Lower Timeframe)

Use 15-minute or 5-minute charts to time entries and exits.

Identify short-term support, resistance, and candlestick patterns for precision.

This method ensures alignment between long-term direction and short-term trade execution, minimizing false signals and improving accuracy.

5. Example of Multi-Timeframe Analysis in Action

Let’s illustrate with an example:

Weekly Chart (Positional View): Shows a strong uptrend with price above 50-day moving average.

Daily Chart (Swing View): Reveals a bullish flag pattern forming after a rally.

Hourly Chart (Intraday View): Displays a breakout above the flag resistance with volume confirmation.

A positional trader may initiate a long position based on weekly strength, while a swing trader enters after the daily flag breakout. An intraday trader could use the hourly chart to time the exact breakout candle entry.

All three traders align their strategies to the same trend but operate on different time horizons.

6. Tools and Indicators Used in Multi-Timeframe Analysis

Several tools enhance the effectiveness of MTA:

Moving Averages (MA): Identify trend direction and alignment across timeframes (e.g., 20 EMA, 50 SMA).

Relative Strength Index (RSI): Helps confirm momentum consistency.

MACD: Detects shifts in momentum and crossovers aligning with major trends.

Support and Resistance Levels: Define crucial zones visible across charts.

Trendlines and Channels: Show structure of price swings.

Candlestick Patterns: Confirm entry signals on smaller timeframes.

Combining these tools across multiple frames builds confluence—an essential component of successful trading.

7. Advantages of Multi-Timeframe Analysis

Trend Confirmation:

Confirms whether short-term movements align with the long-term trend, improving accuracy.

Reduced False Signals:

Helps filter noise from smaller charts that may mislead traders.

Enhanced Entry Timing:

Allows traders to enter trades at precise moments when all timeframes agree.

Better Risk Management:

By aligning with larger trends, traders can define stop-loss and target levels more logically.

Adaptability Across Strategies:

Suitable for scalping, swing trading, or long-term investing.

8. Challenges in Multi-Timeframe Analysis

While MTA is powerful, it also presents certain difficulties:

Information Overload: Analyzing multiple charts can cause confusion or analysis paralysis.

Conflicting Signals: Short-term and long-term charts may show opposite trends, requiring trader judgment.

Execution Complexity: Managing entries and exits across multiple timeframes demands discipline and experience.

Emotional Bias: Traders may get biased by one timeframe and ignore contradictory evidence.

Therefore, consistency in analysis and clear trading rules are vital to prevent confusion.

9. Tips for Effective Multi-Timeframe Trading

Always start with higher timeframes before moving down.

Use a ratio of 1:4 or 1:6 between timeframes (e.g., daily → 4-hour → 1-hour).

Focus on key support/resistance levels visible across multiple frames.

Avoid overcomplicating; two or three timeframes are usually enough.

Maintain a trading journal to note observations from each timeframe.

Use alerts or automated tools to monitor price behavior when multiple charts are involved.

10. Conclusion

Multi-Timeframe Analysis is not just a technique but a strategic framework that enhances decision-making across trading styles—whether intraday, swing, or positional. By combining insights from different timeframes, traders gain a holistic view of the market, identify high-probability setups, and reduce the risk of false entries.

For intraday traders, MTA refines timing; for swing traders, it offers trend confirmation; and for positional traders, it ensures long-term alignment. When executed with discipline, proper analysis, and risk control, Multi-Timeframe Analysis becomes one of the most reliable methods to trade profitably in volatile markets like India’s NSE and BSE.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.