TL;DR: Biggest volatility magnets land mid-to-late week (NVDA Wed PM, GDP/Claims Thu, PCE Fri). For Monday, first decision is the 6492–6496 overhead band. Acceptance above = continuation; rejection = range rotation lower.

⸻

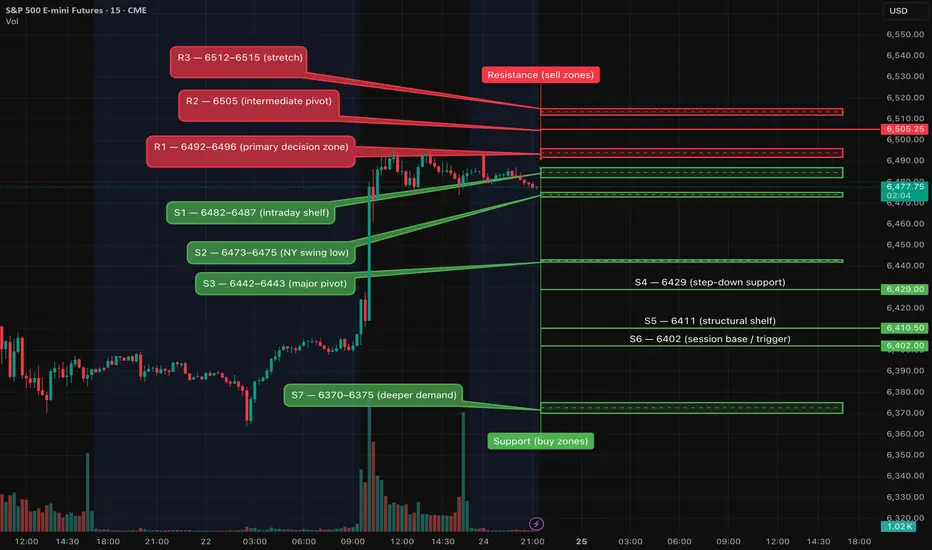

Key Levels (current structure)

Resistance (sell zones)

• R3: 6512–6515 (stretch)

• R2: 6505

• R1: 6492–6496 ← primary decision zone

Support (buy zones)

• S1: 6482–6487 ← intraday shelf

• S2: 6473–6475 ← prior NY swing low

• S3: 6442–6443

• S4: 6429

• S5: 6411

• S6: 6402

• S7: 6370–6375 ← deeper demand

⸻

Monday 8/25 – Scenario Map

Bullish Continuation

• Trigger: 5-minute close & hold above 6492–6496 (no quick reclaim).

• Path: 6505 → 6512/6515; allow for momentum extension if Tuesday’s data are benign.

• Invalidate: Fast reclaim below 6487 after breakout.

Range → Fade

• Trigger: Clear rejection at 6492–6496 (seller response + lower high on 5-minute).

• Path: 6482–6484 → 6473–6475; loss of 6473 opens 6443 → 6429.

• Invalidate: Reclaim/hold > 6490 on a 5-minute close.

Timing note (Mon): Morning housing print around 10:00 ET can nudge yields/ES; treat the first spike cautiously.

⸻

Week at a Glance (ET)

Mon 8/25

• 10:00 – New Home Sales (Jul)

Tue 8/26

• 8:30 – Durable Goods (Jul, advance)

• 9:00 – S&P CoreLogic Case-Shiller Home Prices (Jun)

• 10:00 – Conference Board Consumer Confidence (Aug)

Wed 8/27

• 1:00 – U.S. 5-Year Note Auction

• 5:00 pm – NVIDIA (NVDA) earnings (key AI/mega-cap impulse)

Thu 8/28

• 8:30 – GDP (Q2, 2nd est.)

• 8:30 – Initial Jobless Claims

• 10:00 – Pending Home Sales (Jul)

• 1:00 – U.S. 7-Year Note Auction

Fri 8/29

• 8:30 – PCE & Core PCE (Jul)

• 9:45 – Chicago PMI (Aug)

• 10:00 – Univ. of Michigan Sentiment (Final, Aug)

⸻

Playbook & Risk (how I’ll trade it)

• Wait for the first confirming 5-minute close at the trigger; no entries on wicks.

• Shorts: 5-minute confirmation is enough unless flipping a firmly bullish 15-minute trend (then require the 15-minute validation to size up).

• Management: Time-stop 15–20 min without progress; max 2 attempts per idea.

• Windows: Prefer NY AM (9:45–11:30 ET) and PM (13:30–15:30 ET). Avoid fresh risk ±3–5 min around scheduled releases.

• Into big events: Stay lighter into NVDA (Wed PM) and PCE (Fri AM); let the print set the tone.

⸻

What I’m Watching

• Rates path after Powell → if inflation cools, dips likely get bought; a hot PCE flips that.

• Auction tones (Wed/Thu 1:00) → quick yield swings can drive intraday ES rotations.

• Breadth & leaders → if AI/mega-cap strength broadens, upside extends; if leadership narrows into NVDA, expect chop.

⸻

Key Levels (current structure)

Resistance (sell zones)

• R3: 6512–6515 (stretch)

• R2: 6505

• R1: 6492–6496 ← primary decision zone

Support (buy zones)

• S1: 6482–6487 ← intraday shelf

• S2: 6473–6475 ← prior NY swing low

• S3: 6442–6443

• S4: 6429

• S5: 6411

• S6: 6402

• S7: 6370–6375 ← deeper demand

⸻

Monday 8/25 – Scenario Map

Bullish Continuation

• Trigger: 5-minute close & hold above 6492–6496 (no quick reclaim).

• Path: 6505 → 6512/6515; allow for momentum extension if Tuesday’s data are benign.

• Invalidate: Fast reclaim below 6487 after breakout.

Range → Fade

• Trigger: Clear rejection at 6492–6496 (seller response + lower high on 5-minute).

• Path: 6482–6484 → 6473–6475; loss of 6473 opens 6443 → 6429.

• Invalidate: Reclaim/hold > 6490 on a 5-minute close.

Timing note (Mon): Morning housing print around 10:00 ET can nudge yields/ES; treat the first spike cautiously.

⸻

Week at a Glance (ET)

Mon 8/25

• 10:00 – New Home Sales (Jul)

Tue 8/26

• 8:30 – Durable Goods (Jul, advance)

• 9:00 – S&P CoreLogic Case-Shiller Home Prices (Jun)

• 10:00 – Conference Board Consumer Confidence (Aug)

Wed 8/27

• 1:00 – U.S. 5-Year Note Auction

• 5:00 pm – NVIDIA (NVDA) earnings (key AI/mega-cap impulse)

Thu 8/28

• 8:30 – GDP (Q2, 2nd est.)

• 8:30 – Initial Jobless Claims

• 10:00 – Pending Home Sales (Jul)

• 1:00 – U.S. 7-Year Note Auction

Fri 8/29

• 8:30 – PCE & Core PCE (Jul)

• 9:45 – Chicago PMI (Aug)

• 10:00 – Univ. of Michigan Sentiment (Final, Aug)

⸻

Playbook & Risk (how I’ll trade it)

• Wait for the first confirming 5-minute close at the trigger; no entries on wicks.

• Shorts: 5-minute confirmation is enough unless flipping a firmly bullish 15-minute trend (then require the 15-minute validation to size up).

• Management: Time-stop 15–20 min without progress; max 2 attempts per idea.

• Windows: Prefer NY AM (9:45–11:30 ET) and PM (13:30–15:30 ET). Avoid fresh risk ±3–5 min around scheduled releases.

• Into big events: Stay lighter into NVDA (Wed PM) and PCE (Fri AM); let the print set the tone.

⸻

What I’m Watching

• Rates path after Powell → if inflation cools, dips likely get bought; a hot PCE flips that.

• Auction tones (Wed/Thu 1:00) → quick yield swings can drive intraday ES rotations.

• Breadth & leaders → if AI/mega-cap strength broadens, upside extends; if leadership narrows into NVDA, expect chop.

If you want to contact me Email: info@algoindex.com or algoindex.com

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

If you want to contact me Email: info@algoindex.com or algoindex.com

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.