I wrote a post on August 19th - Big Picture View of Price - You can see it in the related publication section to the right along with yesterday's trade plan that triggered a great short squeeze.

I wrote on August 19th - "6468 was the level that sold off in late July. Could this be the same level that causes another big sell off? I have NO idea, that is not my job.

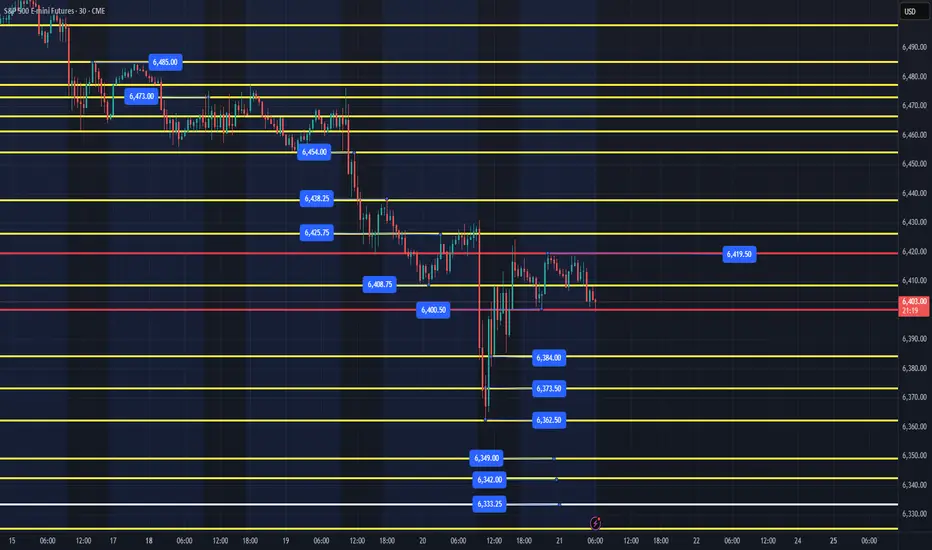

I find levels that institutions step in and buy/sell at. I follow the institutions footprint and enter trades using my edge at predefined levels." - What happened the past 2 days of trading? We lost 100+ pts and institutions stepped in at 6362 for a short squeeze yesterday.

What will happen today? I have NO Idea, that is not my job. It is to find levels that institutions are accumulating and follow them when price goes up. When ES flushes like yesterday, you have to get out the way and let price reclaim a level above and enter and ride along. Every trader has their own entry and exit strategy. That is more important than just finding levels, unless you are a scalper!

---------------------------------------------------------------------------------------------------------------------

August 21st - Daily Trade Plan - 6am EST

Overnight price has been trading in a tight range between 6400 and 6420. IF, we are going to continue higher we need to reclaim 6420 and work up the levels with 6438, 6454 being the top targets above. Ideally, we see price flush 6400, recover and we can enter to move back up the range. IF, price cannot reclaim 6400-03, we will need to find support below at one of the levels in yellow (6384, 6373, 6362), reclaim and work back up to retest the 6400-03 level.

My lean is that IF, we cannot break above 6420, we have a high probability of retesting yesterday's 6362 low. IF, we cannot clear 6384 from below, I will be looking for reactions at 6349, 6342, 6333, for another squeeze higher.

After yesterday's flush, there will be FOMO from retail traders, and they will think the next short will be another 50+pts. We could easily trap shorts and snap back very fast at any of the levels below.

I will post an update at 10am EST.

I wrote on August 19th - "6468 was the level that sold off in late July. Could this be the same level that causes another big sell off? I have NO idea, that is not my job.

I find levels that institutions step in and buy/sell at. I follow the institutions footprint and enter trades using my edge at predefined levels." - What happened the past 2 days of trading? We lost 100+ pts and institutions stepped in at 6362 for a short squeeze yesterday.

What will happen today? I have NO Idea, that is not my job. It is to find levels that institutions are accumulating and follow them when price goes up. When ES flushes like yesterday, you have to get out the way and let price reclaim a level above and enter and ride along. Every trader has their own entry and exit strategy. That is more important than just finding levels, unless you are a scalper!

---------------------------------------------------------------------------------------------------------------------

August 21st - Daily Trade Plan - 6am EST

Overnight price has been trading in a tight range between 6400 and 6420. IF, we are going to continue higher we need to reclaim 6420 and work up the levels with 6438, 6454 being the top targets above. Ideally, we see price flush 6400, recover and we can enter to move back up the range. IF, price cannot reclaim 6400-03, we will need to find support below at one of the levels in yellow (6384, 6373, 6362), reclaim and work back up to retest the 6400-03 level.

My lean is that IF, we cannot break above 6420, we have a high probability of retesting yesterday's 6362 low. IF, we cannot clear 6384 from below, I will be looking for reactions at 6349, 6342, 6333, for another squeeze higher.

After yesterday's flush, there will be FOMO from retail traders, and they will think the next short will be another 50+pts. We could easily trap shorts and snap back very fast at any of the levels below.

I will post an update at 10am EST.

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.