🟡 Gold Futures Hedge Update

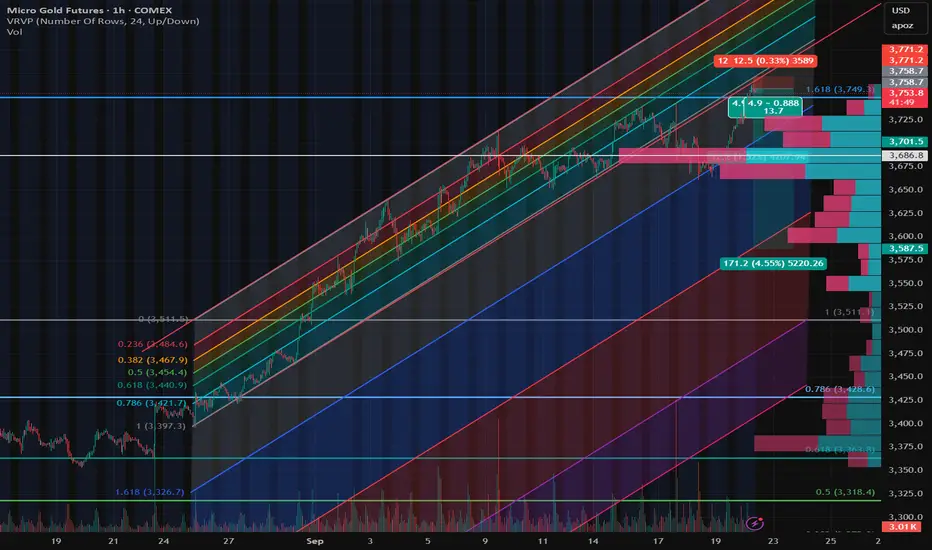

Our previous short setup reached the first take profit, confirming that hedging into overextension made sense. Long-term bias on gold remains bullish, but short-term conditions still look stretched, and we’re preparing for another protective hedge.

This is not a bearish reversal call — the goal is to lock in gains and protect profits as gold presses into heavy resistance.

📍 Trade Setup (Short Hedge)

⚖️ Rationale

📊 Plan: Scale into shorts near resistance with defined risk, peel off at TP1 and TP2, leave a runner for deeper correction potential. If gold breaks and holds above 3,790, hedge is invalidated and focus shifts back to long setups.

Our previous short setup reached the first take profit, confirming that hedging into overextension made sense. Long-term bias on gold remains bullish, but short-term conditions still look stretched, and we’re preparing for another protective hedge.

This is not a bearish reversal call — the goal is to lock in gains and protect profits as gold presses into heavy resistance.

📍 Trade Setup (Short Hedge)

- Entry (Short): 3,750 (Fib 1.618 extension + HVN resistance)

- Stop Loss (SL): 3,780 (above channel top + HVN cluster)

- Take Profit 1 (TP1): 3,700 – 3,685 (volume node / mid-channel support)

- Take Profit 2 (TP2): 3,587 (next HVN + structural support)

- Take Profit 3 (Stretch): 3,510 – 3,500 (Fib retrace + channel low)

⚖️ Rationale

- Gold has been overextended on the short-term chart, pressing into Fib and channel resistance with signs of stalling.

- Volume profile highlights key support/resistance nodes that align with Fib levels.

- Taking partial profits on the way down while keeping risk tight ensures the hedge protects without overcommitting against the dominant bullish trend.

📊 Plan: Scale into shorts near resistance with defined risk, peel off at TP1 and TP2, leave a runner for deeper correction potential. If gold breaks and holds above 3,790, hedge is invalidated and focus shifts back to long setups.

Заявка отменена

We got invalidated here as soon as the market opened still looking for the correction but taking a different perspective on it now.🚀 Founder of SciQua | Strategy. Simulation. Signals.

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

🚀 Founder of SciQua | Strategy. Simulation. Signals.

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

TradingView indicators, backtesting tools, weekly contests, and live market analysis.

Join free, compete, win, and stay updated at sciqua.com

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.