Hello Everyone,

For most people, retirement planning starts with the question – “How will I get monthly income once I stop working?”

The answer is – Systematic Withdrawal Plan (SWP). With SWP, you can actually create your own pension and enjoy a stress-free retirement.

What is SWP?

A Systematic Withdrawal Plan allows you to invest a lump sum amount in a mutual fund and withdraw a fixed sum every month (or quarter/year). It’s just like receiving a pension or salary, while your remaining money continues to stay invested and grow.

Why SWP Works Like a Pension

Why Multi-Asset Funds Work Best for SWP

SWP is most effective when your investment is diversified across equity, debt, and gold – which is exactly what multi-asset funds offer.

That’s why multi-asset funds are often considered the best option for long-term SWPs.

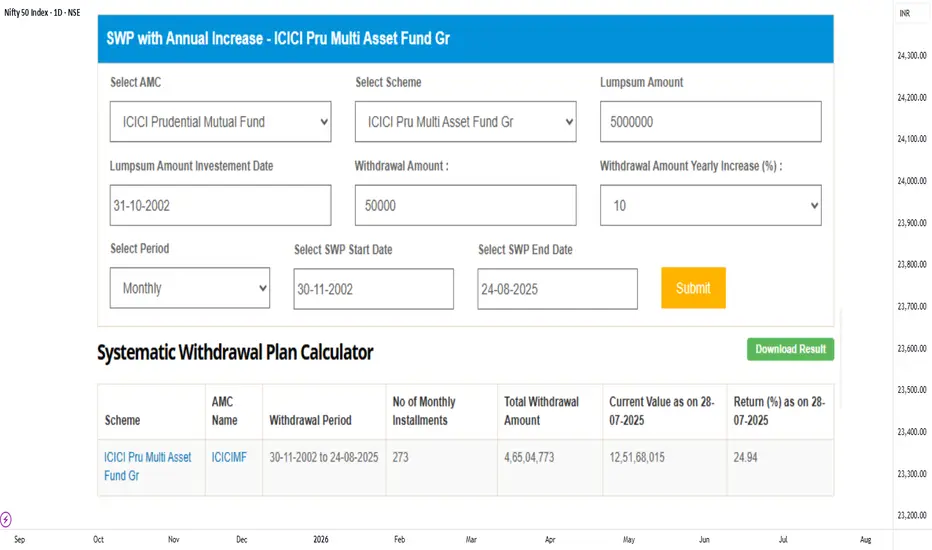

Real Example (Past Data)

Suppose an investor invested ₹50 lakh in 2002 in a multi-asset fund.

Note: This is based on past returns. Future results may differ. Returns are never guaranteed in markets.

But just think of it this way – if 2002 was your starting point, and today was 2025, this is the power of SWP you would have experienced.

Rahul’s Tip

SIP helps you build wealth.

SWP helps you enjoy wealth.

If you want financial independence after retirement, don’t wait for government or company pensions. Create your own with SWPs in multi-asset funds.

If this helped, like/follow/comment.

For most people, retirement planning starts with the question – “How will I get monthly income once I stop working?”

The answer is – Systematic Withdrawal Plan (SWP). With SWP, you can actually create your own pension and enjoy a stress-free retirement.

What is SWP?

A Systematic Withdrawal Plan allows you to invest a lump sum amount in a mutual fund and withdraw a fixed sum every month (or quarter/year). It’s just like receiving a pension or salary, while your remaining money continues to stay invested and grow.

Why SWP Works Like a Pension

- Steady Cash Flow: You can set up regular monthly withdrawals, which creates a reliable income stream for your retirement needs.

- Inflation Protection: Unlike traditional pensions or FDs where income is fixed, in SWP you can increase your withdrawal every year. This way, your monthly income grows in line with rising living costs.

- Wealth Preservation: Even though you withdraw regularly, your remaining corpus is invested and keeps compounding. Over long periods, this can multiply your wealth.

- Tax Efficiency: Compared to interest income from FDs, SWPs are more tax-friendly as withdrawals are treated as capital gains. This means potentially lower taxes and higher take-home income.

- Flexibility: You can change the withdrawal amount, frequency, or even stop the SWP anytime depending on your needs. No traditional pension gives this much flexibility.

Why Multi-Asset Funds Work Best for SWP

SWP is most effective when your investment is diversified across equity, debt, and gold – which is exactly what multi-asset funds offer.

- Equity portion helps your wealth grow faster.

- Debt portion provides stability and regular income.

- Gold acts as a hedge during uncertain times.

That’s why multi-asset funds are often considered the best option for long-term SWPs.

Real Example (Past Data)

Suppose an investor invested ₹50 lakh in 2002 in a multi-asset fund.

- He started withdrawing ₹50,000 per month, increasing it by 10% every year.

- By 2025, he had already withdrawn ₹4.65 crore (like a monthly pension).

- Yet, his remaining corpus grew to around ₹12.5 crore.

Note: This is based on past returns. Future results may differ. Returns are never guaranteed in markets.

But just think of it this way – if 2002 was your starting point, and today was 2025, this is the power of SWP you would have experienced.

Rahul’s Tip

SIP helps you build wealth.

SWP helps you enjoy wealth.

If you want financial independence after retirement, don’t wait for government or company pensions. Create your own with SWPs in multi-asset funds.

If this helped, like/follow/comment.

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.