✅ Current Market Status:

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

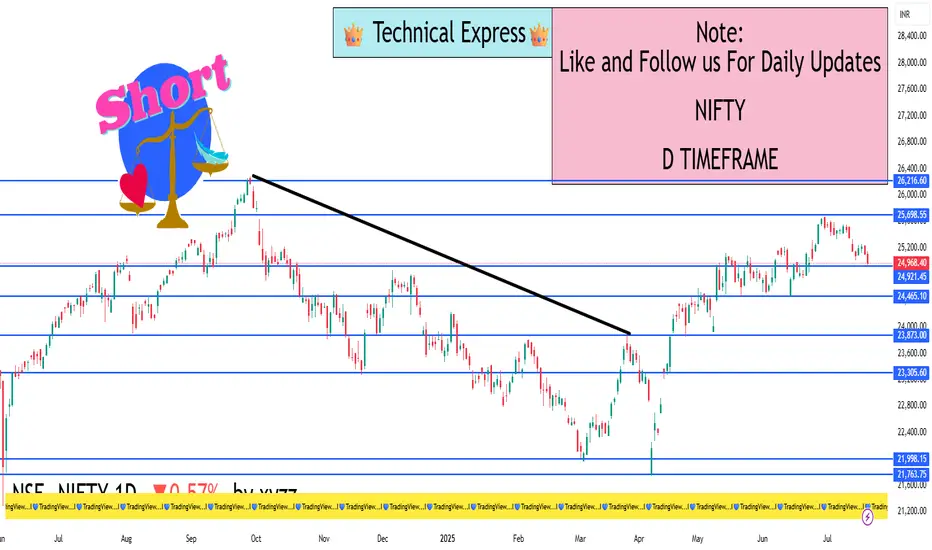

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

Closing Price: ₹24,972.50

Change: –95.20 points

Percentage Change: –0.38%

Day’s Range: ₹24,905.60 – ₹25,095.10

52-Week Range: ₹19,638.30 – ₹25,194.60

🔍 Key Technical Levels:

📌 Support Zones:

Support 1: ₹24,900 – Intraday low and key psychological level

Support 2: ₹24,750 – Previous breakout zone

Support 3: ₹24,500 – Short-term trendline base

📌 Resistance Zones:

Resistance 1: ₹25,100 – Day’s high and minor barrier

Resistance 2: ₹25,200 – All-time high

Resistance 3: ₹25,500 – Next potential rally target if breakout succeeds

🕯️ Candlestick Pattern:

Recent Candle: Bearish candle after range-bound session

Price Action: Failed to sustain above ₹25,100

Implication: Weakness around highs, possible pullback toward support

📊 Market Structure Summary:

Nifty formed a double top near ₹25,200, indicating exhaustion

Currently testing ₹24,900 – if broken, next support is ₹24,750

A breakout will only be valid above ₹25,200 with strong volume

🧠 Institutional Behavior:

Likely profit booking near highs

No major signs of heavy accumulation

May re-enter above ₹25,200 or below ₹24,500 for value buying

🔚 Summary:

🔴 Short-Term Bias: Slightly Bearish

🟡 Watch Levels: ₹24,900 (support) and ₹25,200 (resistance)

✅ Buyers: Wait for breakout above ₹25,200

⚠️ Sellers: Watch for breakdown below ₹24,900 or ₹24,750

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.