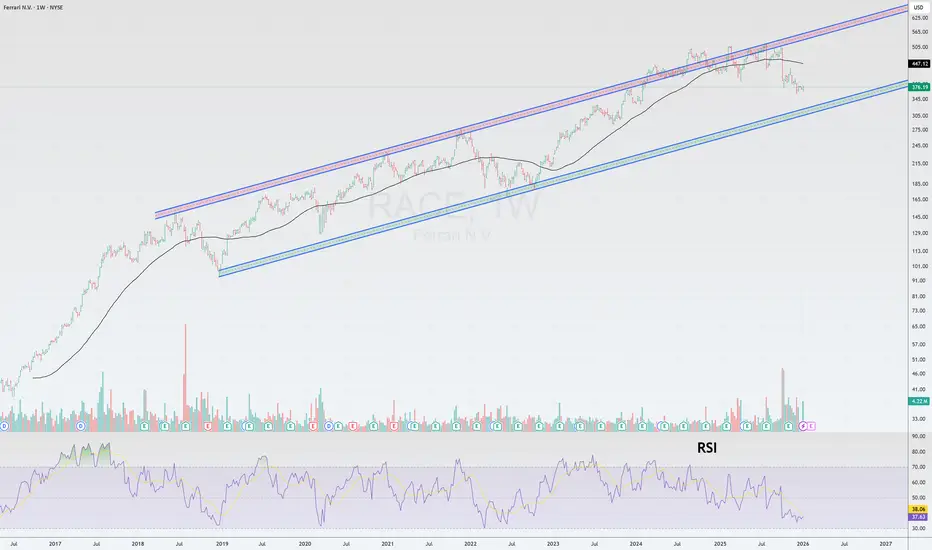

FERRARI ( RACE): A Buying Opportunity or an Investor Trap?

RACE): A Buying Opportunity or an Investor Trap?

Shares of the Italian legend slumped following the October Capital Markets Day, as the market was disappointed by a modest growth forecast.

During this key investor event, Ferrari made two major announcements that triggered the correction:

Conservative 2030 Targets: The company set a revenue target of approximately €9 billion. This implies a compound annual growth rate (CAGR) of only ~5%—significantly lower than in previous years.

EV Strategy Shift: The projected share of all-electric models by 2030 was halved, from 40% to 20%. The focus has shifted toward "horizontal diversification," emphasizing more limited-edition models.

The market perceived this as a slowdown in the growth story.

However, management emphasizes that growth will not be driven by volume, but by a richer product mix, personalization, and price increases.

What the market may have underestimated:

Despite the conservative forecasts, the company continues to demonstrate phenomenal operational efficiency.

Ahead of Schedule: At Investor Day, Ferrari raised its guidance, announcing it would hit its 2026 profitability targets a year early (in 2025).

Shareholder Returns: A €2 billion share buyback program (3.34% of market cap) has been completed, and a new €3.5 billion buyback program for 2026–2030 has been approved.

Dividends: The payout ratio increased from 35% to 40% of adjusted net profit.

Strong Demand: The order book is full until 2027. Scarcity and anticipation remains a core pillar of the brand’s value.

Key Figures:

🔎

Shares of the Italian legend slumped following the October Capital Markets Day, as the market was disappointed by a modest growth forecast.

During this key investor event, Ferrari made two major announcements that triggered the correction:

Conservative 2030 Targets: The company set a revenue target of approximately €9 billion. This implies a compound annual growth rate (CAGR) of only ~5%—significantly lower than in previous years.

EV Strategy Shift: The projected share of all-electric models by 2030 was halved, from 40% to 20%. The focus has shifted toward "horizontal diversification," emphasizing more limited-edition models.

The market perceived this as a slowdown in the growth story.

However, management emphasizes that growth will not be driven by volume, but by a richer product mix, personalization, and price increases.

What the market may have underestimated:

Despite the conservative forecasts, the company continues to demonstrate phenomenal operational efficiency.

Ahead of Schedule: At Investor Day, Ferrari raised its guidance, announcing it would hit its 2026 profitability targets a year early (in 2025).

Shareholder Returns: A €2 billion share buyback program (3.34% of market cap) has been completed, and a new €3.5 billion buyback program for 2026–2030 has been approved.

Dividends: The payout ratio increased from 35% to 40% of adjusted net profit.

Strong Demand: The order book is full until 2027. Scarcity and anticipation remains a core pillar of the brand’s value.

Key Figures:

🔎

🔎 Full Research :

🌐 t.me/A3MInvestments

🌐 t.me/A3MInvestments

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

🔎 Full Research :

🌐 t.me/A3MInvestments

🌐 t.me/A3MInvestments

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.