Key Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

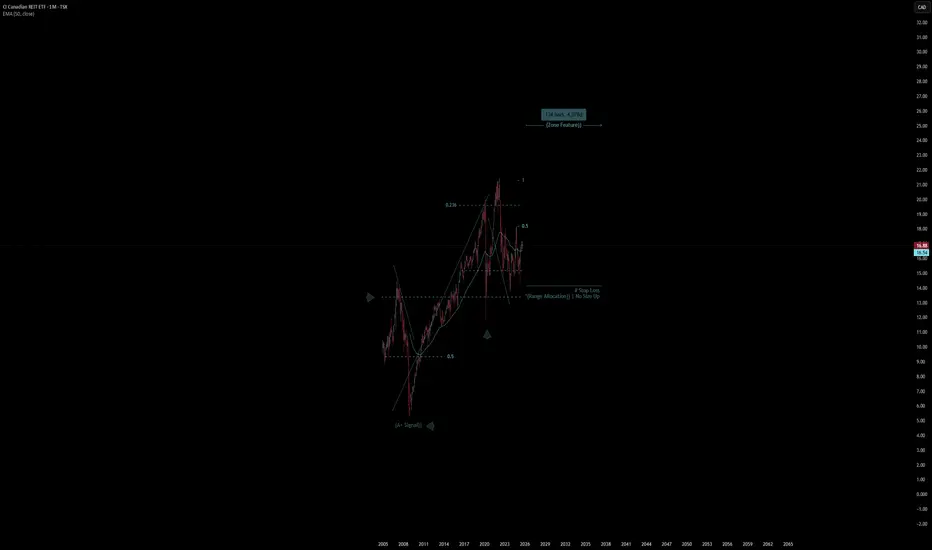

# CI Canadian REIT ETF

- Double Formation

* (A+ SIgnal)) - *50EMA - Long Entry | Subdivision 1

* (Range Allocation)) - *1.5RR | Completed Survey

* 134 bars, 4078d | Date Range Method - *Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 12.00 CAD

* Entry At 15.00 CAD

* Take Profit At 20.00 CAD

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# CI Canadian REIT ETF

- Double Formation

* (A+ SIgnal)) - *50EMA - Long Entry | Subdivision 1

* (Range Allocation)) - *1.5RR | Completed Survey

* 134 bars, 4078d | Date Range Method - *Uptrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 12.00 CAD

* Entry At 15.00 CAD

* Take Profit At 20.00 CAD

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.