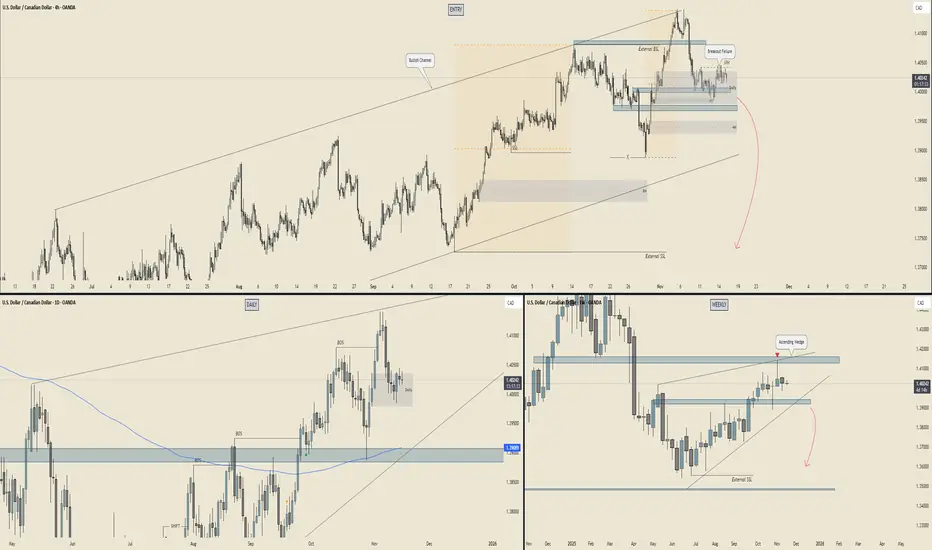

🧱 WEEKLY – The Big Dog View

Bias: 🐻 Bearish pressure building

Why:

Price is pushing into that massive weekly supply while sitting inside an ascending wedge — textbook distribution energy.

The wedge resistance + supply block is basically a double whammy ceiling.

Reaction wicks show buyers getting tired… sellers warming up.

Beneath current price? A HUGE vacuum of clean, unmitigated price action → easy liquidity to the downside.

🎯 Weekly Target Zones:

1.3900–1.3850 = first stop (mid-range demand)

1.3650–1.3550 = main deep target

External SSL much lower = long-term magnet

👉 Weekly says: “Yo… down only unless we get a breakout above supply.”

📆 DAILY – Internal Structure Rolling Over

Bias: 🐻 Turning bearish

Why: Daily BOS formed on the drop → clear bearish intent.

Price pulled back into a fresh daily supply, reacted cleanly, and is now stalling.

Daily is coiling under resistance = distribution micro-pattern.

As long as the daily mitigation block holds, rallies are just liquidity grabs.

🔥 Daily Key Levels:

Hold below 1.4070 = bearish continuation

Break below 1.3950 = flush into 1.3900

Lose 1.3900 = full send toward 1.38 → 1.37

👉 Daily is setting up the breakdown leg.

⏳ 4H – The Execution Chart (The Juice)

Bias: 🐻 Bearish retest + roll

Why: The 4H bullish channel got broken → structure shift.

We even have a breakout failure at the top = classic “trap the buyers then nuke it.”

4H supply stacking beautifully (Daily + 4H combo).

Price trapped sideways waiting for a trigger → likely a fake-out pop then drop, or a straight collapse.

📌 4H Key Areas:

4H supply: 1.4030–1.4060 = Sell zone

4H support: 1.3950 = Break this → waterfall

Next demand: 1.3880 then the huge imbalance to 1.3800

🎯 4H Targets:

Short-term: 1.3950

Medium: 1.3880

Main: 1.3800

🚀 SUMMARY – USD/CAD Forecast

🔥 Overall Bias: BEARISH (Weekly + Daily + 4H aligned)

🔽 Direction: Expect downside continuation

🎯 Main Target: 1.3800

🧯 Invalidation: Clean daily close above 1.4070 (rare unless oil nukes or USD goes parabolic)

✨ The Likely Path:

Small 4H pullback into supply

Break of 1.3950 internal floor

Fast slide into 1.3880

Larger drop toward 1.3800–1.3750

Bias: 🐻 Bearish pressure building

Why:

Price is pushing into that massive weekly supply while sitting inside an ascending wedge — textbook distribution energy.

The wedge resistance + supply block is basically a double whammy ceiling.

Reaction wicks show buyers getting tired… sellers warming up.

Beneath current price? A HUGE vacuum of clean, unmitigated price action → easy liquidity to the downside.

🎯 Weekly Target Zones:

1.3900–1.3850 = first stop (mid-range demand)

1.3650–1.3550 = main deep target

External SSL much lower = long-term magnet

👉 Weekly says: “Yo… down only unless we get a breakout above supply.”

📆 DAILY – Internal Structure Rolling Over

Bias: 🐻 Turning bearish

Why: Daily BOS formed on the drop → clear bearish intent.

Price pulled back into a fresh daily supply, reacted cleanly, and is now stalling.

Daily is coiling under resistance = distribution micro-pattern.

As long as the daily mitigation block holds, rallies are just liquidity grabs.

🔥 Daily Key Levels:

Hold below 1.4070 = bearish continuation

Break below 1.3950 = flush into 1.3900

Lose 1.3900 = full send toward 1.38 → 1.37

👉 Daily is setting up the breakdown leg.

⏳ 4H – The Execution Chart (The Juice)

Bias: 🐻 Bearish retest + roll

Why: The 4H bullish channel got broken → structure shift.

We even have a breakout failure at the top = classic “trap the buyers then nuke it.”

4H supply stacking beautifully (Daily + 4H combo).

Price trapped sideways waiting for a trigger → likely a fake-out pop then drop, or a straight collapse.

📌 4H Key Areas:

4H supply: 1.4030–1.4060 = Sell zone

4H support: 1.3950 = Break this → waterfall

Next demand: 1.3880 then the huge imbalance to 1.3800

🎯 4H Targets:

Short-term: 1.3950

Medium: 1.3880

Main: 1.3800

🚀 SUMMARY – USD/CAD Forecast

🔥 Overall Bias: BEARISH (Weekly + Daily + 4H aligned)

🔽 Direction: Expect downside continuation

🎯 Main Target: 1.3800

🧯 Invalidation: Clean daily close above 1.4070 (rare unless oil nukes or USD goes parabolic)

✨ The Likely Path:

Small 4H pullback into supply

Break of 1.3950 internal floor

Fast slide into 1.3880

Larger drop toward 1.3800–1.3750

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.