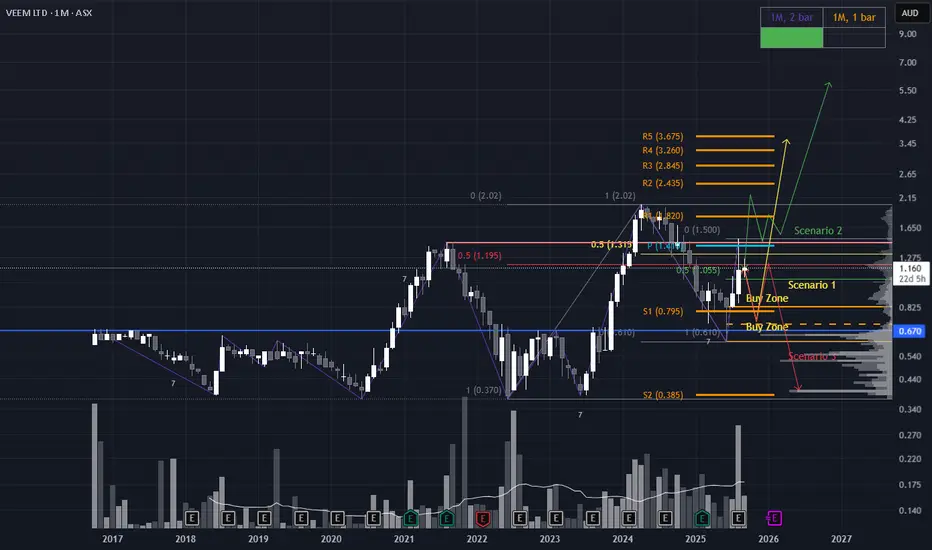

Scenario 1 (yellow line): Strategic Pullback to Value Zone

Price retraces to the ~$0.67 region, aligning with a Low Volume Node (LVN) and the Fair Value Gap from the June candle. A bullish reversal candle in this zone would signal a high-probability long setup, suggesting accumulation at a key structural level.

Scenario 2 (green line): Breakout & Reaccumulation Above Resistance

The most bullish scenario unfolds if price decisively breaks and closes above the major resistance at $1.50. A successful reaccumulation above this level would confirm strength, offering a textbook pullback entry for continuation higher.

Scenario 3: (red line) Rejection & Macro Lower High

Price pulls back but fails to hold above the ~$1.16 zone, facing rejection. A subsequent break of the recent lows would confirm a macro lower high (LH), shifting the bias toward bearish continuation and invalidating bullish setups.

Price retraces to the ~$0.67 region, aligning with a Low Volume Node (LVN) and the Fair Value Gap from the June candle. A bullish reversal candle in this zone would signal a high-probability long setup, suggesting accumulation at a key structural level.

Scenario 2 (green line): Breakout & Reaccumulation Above Resistance

The most bullish scenario unfolds if price decisively breaks and closes above the major resistance at $1.50. A successful reaccumulation above this level would confirm strength, offering a textbook pullback entry for continuation higher.

Scenario 3: (red line) Rejection & Macro Lower High

Price pulls back but fails to hold above the ~$1.16 zone, facing rejection. A subsequent break of the recent lows would confirm a macro lower high (LH), shifting the bias toward bearish continuation and invalidating bullish setups.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.