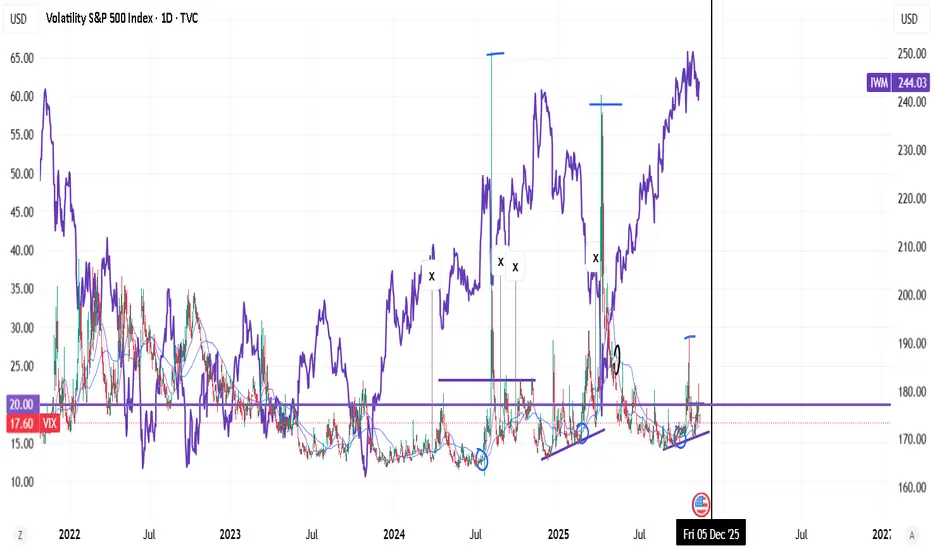

Where VIX gets 10/20/50 upswings, goes in patterns (structure). it seems it's a bad period for small caps.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Заметка

why does this matter?, when u get correction. You rather stick with faang or quality, not momentum stocks. You lose time. Qullamaggie said he succeeded only like 30% of times.Заметка

also. Peak "Lower Highs" (LHIGH) is always the start of new Risk on. Заметка

here's proof with $IONQ. Falling VIX and falling

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.