Information Summary:

NATO issued a strong warning regarding Russia's violation of Estonian airspace, heightening uncertainty in international relations. Gold, as a non-sovereign, default-free safe-haven asset, attracted significant safe-haven inflows.

US President Trump's statement, stating that Ukraine is expected to retake its former territory with NATO support, and his tough rhetoric regarding the Russia-Ukraine situation further rattled market sentiment. Meanwhile, during the UN General Assembly, he met with Muslim leaders from various countries to discuss the Gaza conflict and other issues, and these developments also caused significant fluctuations in gold prices.

Market Analysis:

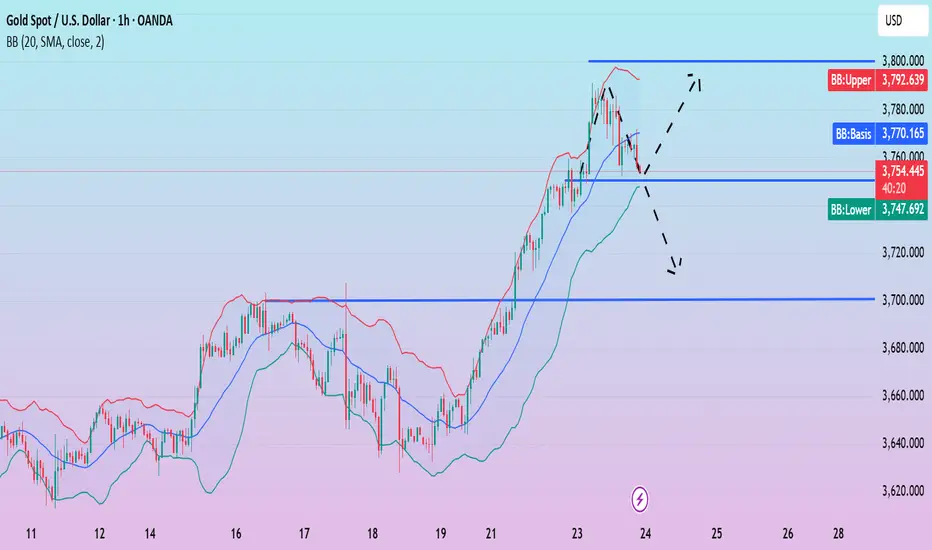

Gold rose and then retreated on Tuesday, closing with a bullish candlestick pattern with an upper shadow. This candlestick pattern reveals two signals. From a bullish perspective, the real body of the bullish candlestick indicates that the overall market still has upward momentum, and the rise and fall have not completely reversed the short-term strong trend. However, the trend indicates resistance near 3790. Selling pressure has significantly increased near this key resistance level, and a brief tussle between bulls and bears has begun in this area.

Quaid believes that the short-term focus should be on market corrections. The current price correction is about to touch the lower track of the Bollinger band. If it stabilizes above 3750 in the short term, the price is expected to hit 3800 again. If the rebound in this correction is weak, the price will most likely retreat and touch 3700.

NATO issued a strong warning regarding Russia's violation of Estonian airspace, heightening uncertainty in international relations. Gold, as a non-sovereign, default-free safe-haven asset, attracted significant safe-haven inflows.

US President Trump's statement, stating that Ukraine is expected to retake its former territory with NATO support, and his tough rhetoric regarding the Russia-Ukraine situation further rattled market sentiment. Meanwhile, during the UN General Assembly, he met with Muslim leaders from various countries to discuss the Gaza conflict and other issues, and these developments also caused significant fluctuations in gold prices.

Market Analysis:

Gold rose and then retreated on Tuesday, closing with a bullish candlestick pattern with an upper shadow. This candlestick pattern reveals two signals. From a bullish perspective, the real body of the bullish candlestick indicates that the overall market still has upward momentum, and the rise and fall have not completely reversed the short-term strong trend. However, the trend indicates resistance near 3790. Selling pressure has significantly increased near this key resistance level, and a brief tussle between bulls and bears has begun in this area.

Quaid believes that the short-term focus should be on market corrections. The current price correction is about to touch the lower track of the Bollinger band. If it stabilizes above 3750 in the short term, the price is expected to hit 3800 again. If the rebound in this correction is weak, the price will most likely retreat and touch 3700.

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Похожие публикации

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.