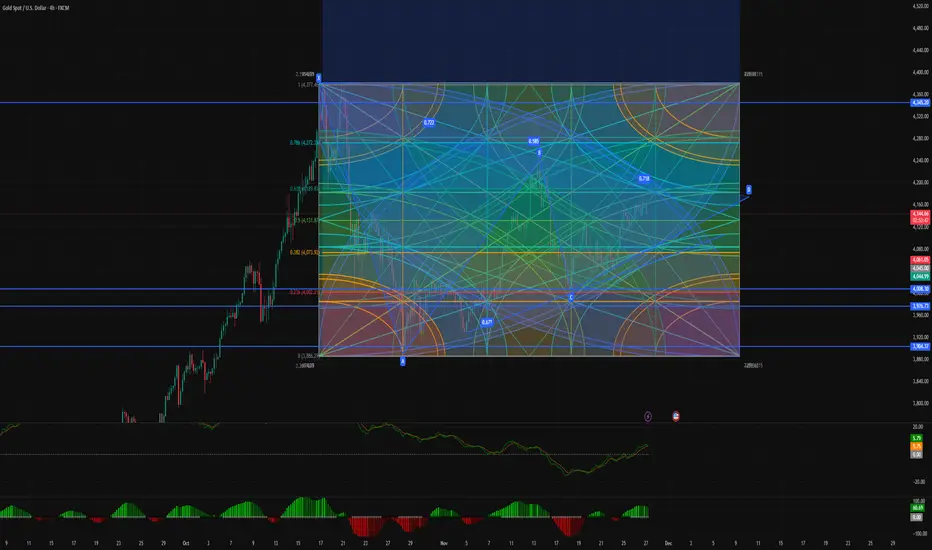

Gold is approaching one of the most important time pivot zones of the week.

Based on a combination of Gann analysis, Harmonic patterns (ABCD), Time Cycles, and momentum structure, the market is showing signs of a potential bullish reversal.

✅ Why a Bullish Move Is Likely

Several major signals are aligning:

1️⃣ Time Cycle Confluence – Strong Pivot at 9 PM UTC+2:00

Multiple time cycles, Gann angles, and the hexagonal time-star all converge around the same time window.

This type of confluence is rare — and usually marks the beginning of a new directional wave.

2️⃣ Corrective Structure Into Point D

The recent move into the D-point shows corrective behavior, not impulsive selling.

This indicates the market is preparing for a shift in direction.

3️⃣ Momentum Divergence

RSI and MACD are showing clear bullish divergence, confirming loss of bearish strength.

4️⃣ Accumulation Instead of Distribution

The last candles show:

Smaller bodies

Lower volume on the downside

Long wicks

This is typical accumulation behavior, not continuation selling.

🎯 Bullish Scenario (Primary Expectation)

If the time pivot triggers as expected, gold may start a new upward wave with potential targets:

4170

4215

4270

Extension target: 4340 if strong momentum develops.

A strong close above the micro-resistance confirms the bullish wave.

Based on a combination of Gann analysis, Harmonic patterns (ABCD), Time Cycles, and momentum structure, the market is showing signs of a potential bullish reversal.

✅ Why a Bullish Move Is Likely

Several major signals are aligning:

1️⃣ Time Cycle Confluence – Strong Pivot at 9 PM UTC+2:00

Multiple time cycles, Gann angles, and the hexagonal time-star all converge around the same time window.

This type of confluence is rare — and usually marks the beginning of a new directional wave.

2️⃣ Corrective Structure Into Point D

The recent move into the D-point shows corrective behavior, not impulsive selling.

This indicates the market is preparing for a shift in direction.

3️⃣ Momentum Divergence

RSI and MACD are showing clear bullish divergence, confirming loss of bearish strength.

4️⃣ Accumulation Instead of Distribution

The last candles show:

Smaller bodies

Lower volume on the downside

Long wicks

This is typical accumulation behavior, not continuation selling.

🎯 Bullish Scenario (Primary Expectation)

If the time pivot triggers as expected, gold may start a new upward wave with potential targets:

4170

4215

4270

Extension target: 4340 if strong momentum develops.

A strong close above the micro-resistance confirms the bullish wave.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.