📊

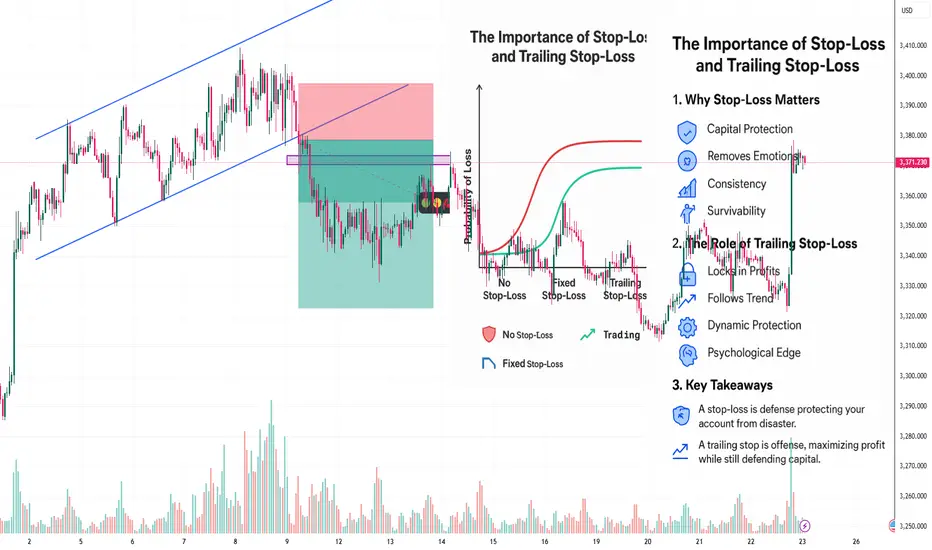

🔹 1. Why Stop-Loss Matters

Capital Protection: Prevents small losses from turning into account-destroying drawdowns.

Removes Emotions: Cuts the trade automatically, avoiding fear/hope-driven decisions.

Consistency: Keeps your risk per trade fixed, aligning with your strategy.

Survivability: The #1 rule in trading is not to lose big; stop-loss ensures you stay in the game.

🔹 2. The Role of Trailing Stop-Loss

Locks in Profits: Moves along with price to secure gains while keeping the trade open.

Follows Trend: Keeps you in winning trades longer, capturing extended moves.

Dynamic Protection: Adjusts with market momentum instead of staying static.

Psychological Edge: Reduces the stress of “when to exit,” as the market decides for you.

🔹 3. Key Takeaways

A stop-loss is defense, protecting your account from disaster.

A trailing stop is offense, maximizing profit while still defending capital.

Together, they form a balanced risk management system:

Stop-loss = Control the downside.

Trailing stop = Let the upside run.

🔹 1. Why Stop-Loss Matters

Capital Protection: Prevents small losses from turning into account-destroying drawdowns.

Removes Emotions: Cuts the trade automatically, avoiding fear/hope-driven decisions.

Consistency: Keeps your risk per trade fixed, aligning with your strategy.

Survivability: The #1 rule in trading is not to lose big; stop-loss ensures you stay in the game.

🔹 2. The Role of Trailing Stop-Loss

Locks in Profits: Moves along with price to secure gains while keeping the trade open.

Follows Trend: Keeps you in winning trades longer, capturing extended moves.

Dynamic Protection: Adjusts with market momentum instead of staying static.

Psychological Edge: Reduces the stress of “when to exit,” as the market decides for you.

🔹 3. Key Takeaways

A stop-loss is defense, protecting your account from disaster.

A trailing stop is offense, maximizing profit while still defending capital.

Together, they form a balanced risk management system:

Stop-loss = Control the downside.

Trailing stop = Let the upside run.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.