Gold (XAUUSD) continues to show relentless strength as the DXY weakens and markets price in the likelihood of a FED rate cut.

With investors fleeing cash and rushing into safe havens, gold remains the natural choice – and momentum suggests we could see new highs forming day after day until year-end if USD comes under further pressure.

🔎 Macro Outlook

FED rate cuts are increasingly expected → bearish USD, bullish Gold.

Geopolitical tensions fuel demand for safe-haven assets.

Liquidity keeps favoring the upside – no strong reason for profit-taking yet.

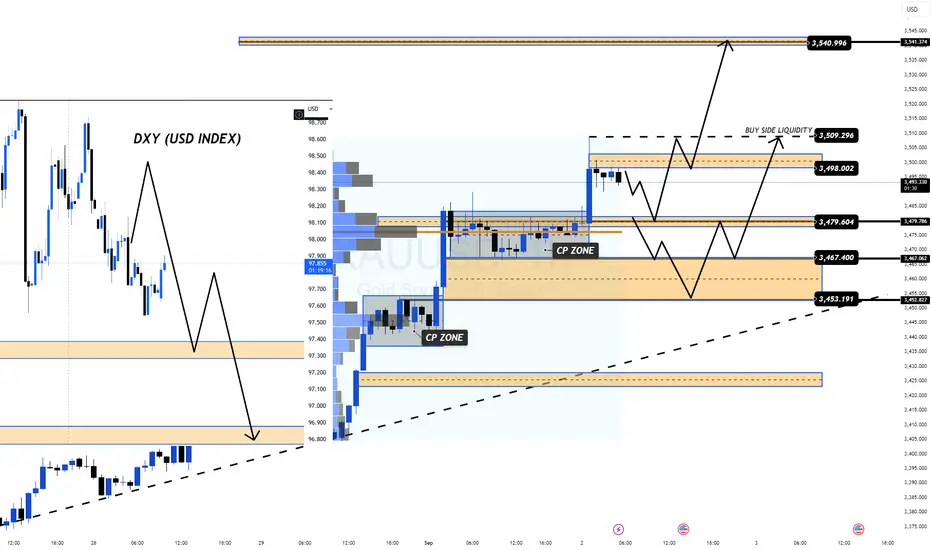

📊 Technical Outlook (H1 / H4)

Gold has been forming sideway accumulation zones with heavy volume, followed by strong breakouts. This structure shows that buyers are still in full control.

Support Zones (Buy Zones):

3,482 – 3,480

SL: 3,474

Targets: 3,486 – 3,490 – 3,495 – 3,500 – 3,505 – 3,510 – 3,520 – 3,530 – 3,540 – ???

Resistance Zones (Sell Zones):

3,540 – 3,542

SL: 3,548

Targets: 3,530 – 3,520 – 3,510 – 3,500 – ???

As long as price respects accumulation structures, the bias remains strongly bullish. Only a clear sentiment shift or exhaustion at higher FIBO extensions would justify mid-term selling.

⚠️ Key Reminder

These days, volatility is extremely high. Expect sudden liquidity sweeps and spikes. Stick to your TP/SL discipline to protect capital – the market is punishing anyone careless.

💡 Conclusion:

The path of least resistance for Gold remains up. The safest strategy is Buy-the-Dip while respecting risk management.

✅ If you found this analysis useful, don’t forget to like 👍 and follow MMFLOW TRADING to stay updated with the next Gold setups.

With investors fleeing cash and rushing into safe havens, gold remains the natural choice – and momentum suggests we could see new highs forming day after day until year-end if USD comes under further pressure.

🔎 Macro Outlook

FED rate cuts are increasingly expected → bearish USD, bullish Gold.

Geopolitical tensions fuel demand for safe-haven assets.

Liquidity keeps favoring the upside – no strong reason for profit-taking yet.

📊 Technical Outlook (H1 / H4)

Gold has been forming sideway accumulation zones with heavy volume, followed by strong breakouts. This structure shows that buyers are still in full control.

Support Zones (Buy Zones):

3,482 – 3,480

SL: 3,474

Targets: 3,486 – 3,490 – 3,495 – 3,500 – 3,505 – 3,510 – 3,520 – 3,530 – 3,540 – ???

Resistance Zones (Sell Zones):

3,540 – 3,542

SL: 3,548

Targets: 3,530 – 3,520 – 3,510 – 3,500 – ???

As long as price respects accumulation structures, the bias remains strongly bullish. Only a clear sentiment shift or exhaustion at higher FIBO extensions would justify mid-term selling.

⚠️ Key Reminder

These days, volatility is extremely high. Expect sudden liquidity sweeps and spikes. Stick to your TP/SL discipline to protect capital – the market is punishing anyone careless.

💡 Conclusion:

The path of least resistance for Gold remains up. The safest strategy is Buy-the-Dip while respecting risk management.

✅ If you found this analysis useful, don’t forget to like 👍 and follow MMFLOW TRADING to stay updated with the next Gold setups.

Сделка активна

🟡 GOLD UPDATE – Key Level in Action 🟡Gold tapped our resistance zone perfectly 🚀.

Now showing SELL pressure — but only a confirmed H1–H2 setup can drag price lower.

👉 Without confirmation, upside target 3530 still valid.

✅ Congrats to those who followed our Key Levels — profits delivered again!

⚠️ Market volatility remains extreme.

🔔 Next plan update coming soon from MMFLOW TRADING.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+1rXbCGqCUAoyMmU9

Похожие публикации

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.