Graco Inc.: Quietly Outperforming Peers with Trust and Execution

The Quiet Outperformer

Over the past two decades, a little-known industrial name has delivered a total return that leaves many households blue chips behind. Graco Inc. (NYSE: GGG), best known for its pumps, sprayers, and fluid handling systems, doesn't make headlines or features in hot growth lists. Yet, through market cycles, it has steadily expanded its revenue base, grown profitability, and rewarded shareholders with a combination of rising dividends and a share price that has multiplied many times over.

The company's success is easy to overlook because it operates in a niche most investors never think about, the precise movement of liquids in manufacturing, construction, and maintenance. It's a business with few glamour points, but one with durable demand and a customer base that rarely switches once the systems are in place. This quiet reliability, paired with disciplined capital allocation, has allowed Graco to outperform the market while staying largely under the radar.

Where the Moat Hides

Graco's moat is rooted less in technology leaps than in the reliability of its products and the reach of its service network. Once a contractor or manufacturer installs a Graco system, the equipment becomes mission-critical: paint sprayers, lubrication pumps, or coating systems that must function flawlessly to keep operations running smoothly. If a Graco unit fails, the blame falls squarely on Graco. But if a cheaper alternative fails, the contractor who chose it carries the blame. This subtle but powerful dynamic builds loyalty to the brand and discourages substitution.

The advantage is reinforced by Graco's dense installed base and global service network. Replacement parts, technicians, and product expertise are readily available, reducing downtime and ensuring continuity. That breadth of support creates confidence for customers making long-term capital decisions. Competitors like Flowserve or Pentair may compete in overlapping areas, but few match Graco's combination of installed base depth and service responsiveness.

Reliability and reputation are, therefore, not just marketing slogans; they form the practical core of Graco's moat. Customers pay for predictability, and Graco's long-standing trust makes switching both risky and unnecessary.

Financial Power in Disguise

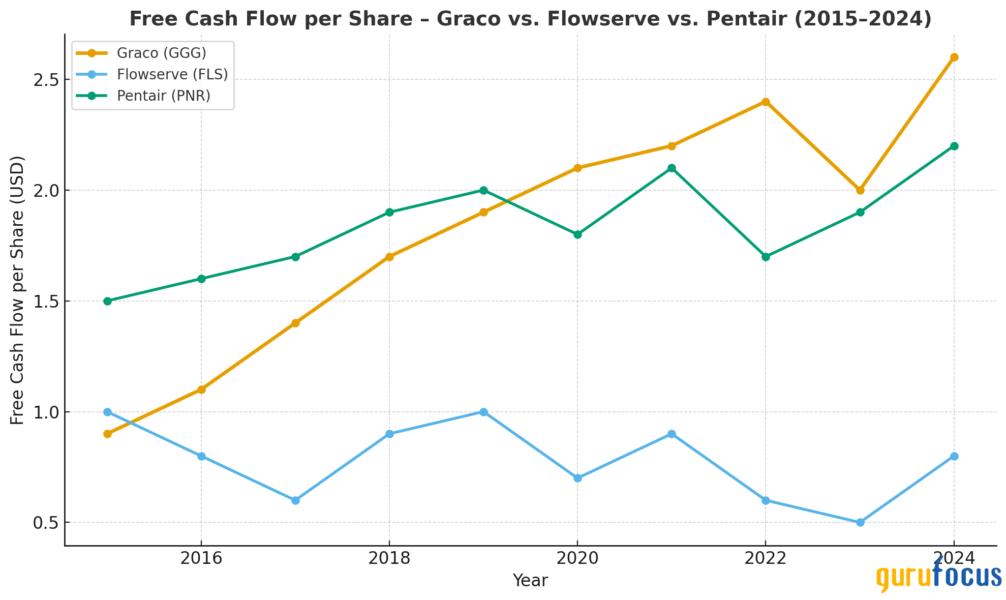

Behind its quiet reputation, Graco runs one of the most efficient operations in the industrial sector. Over the past decade, returns on invested capital have consistently exceeded 20%, while gross margins remain above 50% and operating margins hover in the high 20s. Free cash flow conversion is near complete in most years, turning reported profit almost entirely into usable cash. This combination allows management to reinvest, return capital to shareholders, and still maintain a balance sheet with minimal debt.

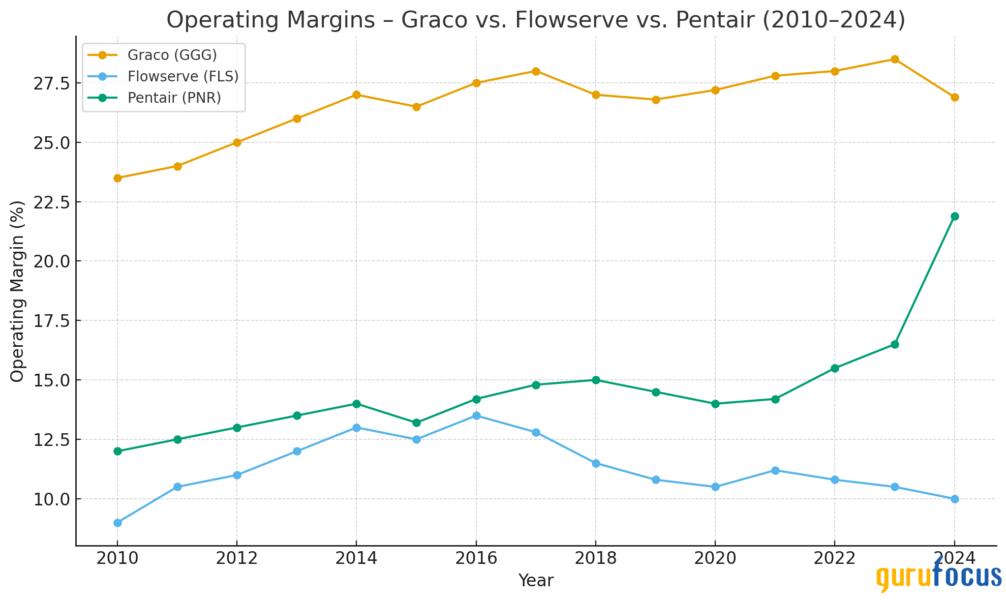

The numbers stand out even more in context. Compared with peers such as IDEX, Flowserve, Pentair, and Ingersoll Rand, Graco has consistently posted higher margins and stronger returns on capital. For example, Flowserve and Pentair generate operating margins in the mid-teens, while Graco's remain close to double that level. IDEX and Ingersoll Rand deliver respectable growth, but their return profiles have not matched Graco's ability to compound both earnings and cash flow at elevated levels year after year. The gap highlights that Graco is not simply a steady performer, but an exceptional one relative to its competitive set.

On valuation, Graco trades at a premium multiple, often above 25x earnings, compared with the high-teens averages of peers. Relative valuation makes sense given its quality, but an outright owner's perspective adds nuance. At today's prices, the company offers a free cash flow yield of roughly 3% to 4%. For an acquirer, this means paying up front for a business that throws off cash at modest yields unless those earnings continue to grow at high incremental returns.

This circles back to the total addressable market. Graco still operates in markets with fragmented competition and opportunities for replacement and efficiency upgrades. The installed base continues to expand globally, particularly in emerging economies where demand for industrial finishing, lubrication, and coatings is growing. That suggests room to reinvest at strong returns for years ahead. However, if growth in TAM slows, management may be tempted to use its pristine balance sheet to pursue acquisitions, a strength in terms of capacity, but a potential risk if deals dilute the company's quality.

Operating margins have remained consistently higher at Graco than at peers like Flowserve and Pentair, highlighting its superior execution over more than a decade.

Smart Money's Glance

Graco's steady economics have not gone unnoticed by seasoned investors. Mairs & Power, the Minnesota-based firm known for favoring locally rooted businesses with durable advantages, has owned Graco shares for more than 15 years. That long holding period reflects deep conviction in the company's ability to reinvest and deliver consistent shareholder returns.

Another notable long-term holder is Renaissance Technologies (Trades, Portfolio) (Trades, Portfolio) , the quantitative powerhouse, which has also maintained exposure to Graco for well over a decade. The persistence of both a traditional fundamental shop like Mairs & Power and a data-driven quant giant like Renaissance underscores the company's rare mix of predictable financial performance and steady execution. Importantly, both funds were buyers again in the second quarter of this year, signaling continued confidence in Graco's prospects even at today's premium valuation.

Other investors, including Mario Gabelli (Trades, Portfolio) (Trades, Portfolio) 's Gamco Investors and Terry Smith's Fundsmith, highlight the stock's appeal across styles: from value-driven to quality-focused. The common thread is recognition that Graco's dense service network, reliable brand, and efficient operations create a business that can deliver for decades, a trait long-term capital appreciates.

Why It Stays Under the Radar

Graco's relative invisibility comes from its niche positioning. It doesn't sell consumer brands, it rarely pursues headline-grabbing acquisitions, and its core products, pumps, sprayers, and coating systems, are not the type of businesses most investors boast about owning. That lack of excitement keeps it off the radar, even as the stock has steadily outperformed.

The main risk is cyclicality. A slowdown in industrial and construction spending can delay equipment purchases, and at a premium valuation, any pause in growth could pressure the stock. Another risk lies in the balance sheet: its lack of debt is a strength today, but if market growth slows, management may feel pressure to deploy leverage on acquisitions that could dilute the company's quality advantage.

The chart below shows how free cash flow per share dipped during the 20192020 and 20222023 periods, yet Graco rebounded quickly while peers struggled to regain momentum.

Yet these concerns are balanced by structural strengths. The dense installed base and service revenue streams provide ballast in downturns, while global expansion of industrial finishing and coating markets extends Graco's runway. Its advantage rests less on technology leaps than on reputation and service reliability, the kind of edge that endures across decades rather than product cycles.

That combination of durability, cash generation, and low visibility explains why Graco continues to sleepwalk past peers. Investors who value predictability over flash often find that the quiet names are the ones that keep delivering long after the spotlight has moved elsewhere.