Broader indices rally continues in third week; these small-caps rise up to 36%

The outperformance from broader indices continued in third consecutive week, adding 1-2 percent amid buying across the sectors with DII support and favourable global markets.

For the week, Nifty50 rose 213.05 points or 0.83 percent to close at 25,327.05, while the BSE Sensex index gained 721.53 points or 0.88 percent to close at 82,626.23.

BSE mid, Large-cap indices added 1 percent each, while Small-cap index jumped 2 percent.

Foreign Institutional Investors' (FIIs) outflow extended in the 12th straight week, as they sold equities worth Rs 1,327.38 crore, while Domestic Institutional Investors (DII) continued their buying in 23nd week, as they bought equities worth Rs 11,177.37 crore.

Among sectors, except Nifty FMCG (down 0.5 percent), all other indices ended higher with Nifty PSU Bank index added nearly 5 percent, Nifty Realty index rose over 4 percent, Nifty Defence index added 3.4 percent, Nifty Energy, Oil & Gas rose 2 percent each.

"Indian equities closed the week on a firm note, supported by broad-based gains, with mid- and small-cap stocks leading the momentum. Robust domestic institutional inflows offset FII selling, cushioning downside risks and sustaining the recent rally," said Vinod Nair, Head of Research, Geojit Investments.

"With GST rationalisation set to take effect next week and festive demand expected to strengthen, investor attention turned toward consumption-driven sectors. Autos and real estate attracted increased buying interest, while export-oriented segments such as IT and pharma gained from improved global liquidity and progress in U.S.- India trade talks. Valuation discipline remained evident, with profit booking in overvalued counters and renewed buying in attractively priced segments like PSU banks."

"Going forward, investors will closely track key U.S. macro indicators—including GDP, jobless claims, and core inflation—for cues on the Fed’s policy trajectory. On the domestic front, the upcoming manufacturing PMI will serve as a timely barometer of industrial sentiments, offering early signs of a much-awaited demand revival. With resilient domestic fundamentals and a weakening U.S. dollar, conditions appear favourable for renewed FII inflows, which could further boost Indian equities in the week ahead," he added.

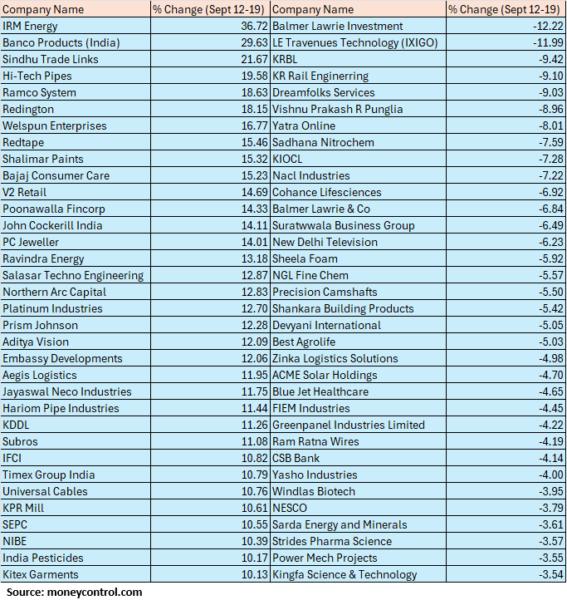

The BSE Small-cap index added 2 percent with IRM Energy, Banco Products (India), Sindhu Trade Links, Hi-Tech Pipes, Ramco System, Redington, Welspun Enterprises, Redtape, Shalimar Paints, Bajaj Consumer Care adding 15-36 percent, while Balmer Lawrie Investment, LE Travenues Technology (IXIGO), KRBL, KR Rail Engineering, Dreamfolks Services fell between 9-12 percent.

Where is Nifty50 headed?

Shrikant Chouhan, Head Equity Research, Kotak Securities

Indian equity markets delivered positive weekly returns amid broader strength in the global equities. Rally in the global markets was supported by the 25 bps rate cut announced by the US Fed. In India, the larger indices like Nifty 50 and Sensex 30 moved higher this week by around 1%. The midcap and small-cap index outperformed the larger peers with BSE Midcap and BSE Small-cap index posting weekly gains of 1.5-2%.

In view of positive momentum, almost all the key sectoral indices posted positive returns. BSE Realty index led with gains of 4% whereas the FMGC index was an underperformer with flattish returns.

India’s CPI inflation was 2.1% in August, as food prices contracted by 0.7%. The GST rate cuts is expected to keep the inflation trajectory under control in the next few quarters.

GST rate cut comes into effect from next week and that is expected to keep consumption and other stocks benefiting from lower GST rate in focus. Markets would continue to look for clarity on the US tariff situation and its impact on economic growth.

Rupak De, Senior Technical Analyst at LKP Securities

Nifty slipped on Friday after forming a hanging man pattern in the previous session. While the short-term trend continues to favor the bulls, a mild pullback from the current level looks possible.

On the lower side, support is placed at 25,150, below which the trend may weaken.

However, if the index manages to stay above 25,150, it could move towards 25,500. A decisive move above 25,500 may then open the road to 26,000.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

Technically, this market action indicates a formation of short-term top reversal pattern. Larger degree bullish pattern like higher tops and bottoms is intact on the daily chart and further weakness from here could form a new higher bottom of the pattern. Nifty on the weekly chart formed a long bull candle this week which is for the third consecutive sessions.

The near-term uptrend of Nifty remains intact. Further consolidation or minor dip could be a buying opportunity by next week. Immediate support is placed at 25150 and a sustainable move above 25500 could pull Nifty towards the next hurdle of 25700 levels.

Amol Athawale, VP Technical Research, Kotak Securities

We are of the view that the short-term market outlook remains bullish, but due to temporary overbought conditions, range-bound activity may occur in the near future. Hence, buying on dips and selling on rallies would be the ideal strategy for traders.

For traders, the key support zones are around 25,200/82300 and 25,150-25,100/82100-81900, while resistance levels are at 25,450-25,500/83200-83400 and 25,600/83700. Below 25,100/81900, the uptrend could become vulnerable.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.