More than 50 smallcaps rise up to 54% as broader indices outperform

Broader indices ended higher and continued the outperformance in the second consecutive week amid volatility led by persistent FII selling, mixed earnings so far and inline Fed rate cut with hawkish tone.

BSE Mid and Smallcap indices rose 1 percent and 0.7 percent, respectively.

BSE Sensex index shed 273.17 points or 0.32 percent to end at 83,938.71 and Nifty50 declined 155.75 points or 0.60 percent to close at 25,722.10.

The Domestic Institutional Investors (DII) continued their buying on 28th week, as they bought equities worth Rs 18,804.26 crore, while the Foreign Institutional Investors' (FIIs) sold equities worth Rs 2102 crore.

However, on month-on-month basis, the selling from FII shrink as they sold equities of Rs 2,346.89 crore, while DII bought equities worth Rs 52,794.02 crore.

On the sectoral front, Nifty PSU Bank index rose 4.7%, Nifty Oil & Gas index gained 3%, Nifty Metal index rose 2.5%, Nifty Energy index rose 1.8%. On the other hand, Nifty Healthcare, Auto, Private Bank indices down 1% each.

"The Indian markets wrapped up the last week of October with profit booking as investors took some chips off the table after the sustained rally. While PSU banks surged on reports of a potential hike in foreign investment limits, metal counters gleamed on renewed optimism after China’s pledge to rein in steel overcapacity and signs of progress in US-China trade talks. In contrast, capital market stocks lost momentum as SEBI’s proposed overhaul of TER structures weighed on sentiment," said Vinod Nair, Head of Research, Geojit Investment.

"The precious metals faced extreme volatility, extending a sharp fall from their recent record highs, owing to strengthening US dollar and aggressive profit-booking after the strong rally. Although the Fed delivered the expected rate cut, diminishing prospects of another reduction in December pushed the US 10-year Treasury yield higher.""Looking ahead, the market will closely monitor the nations’ trade talks with the US and the ongoing corporate earnings season, which so far has delivered mixed results.

Moreover, any dips are expected to attract buying interest across core sectors, given the expectation of a better H2, being supported by monetary and fiscal support," he added.

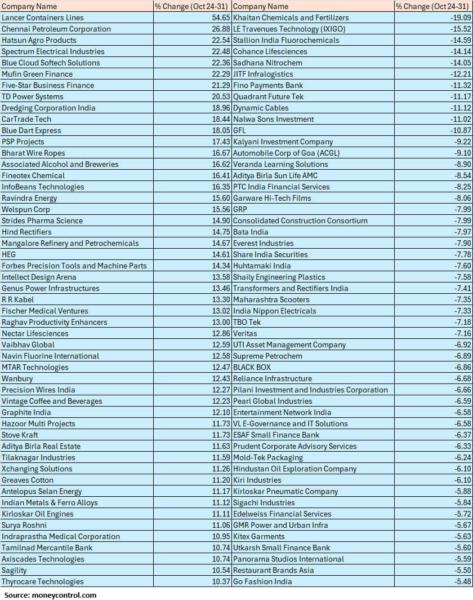

The BSE Small-cap index rose 0.7 percent with Lancer Containers Lines, Chennai Petroleum Corporation, Hatsun Agro Products, Spectrum Electrical Industries, Blue Cloud, Softech Solutions, Mufin Green Finance, Five-Star Business Finance, TD Power Systems rising between 20-54 percent, while Khaitan Chemicals and Fertilizers, LE Travenues Technology (IXIGO), Stallion India Fluorochemicals, Cohance Lifesciences, Sadhana Nitrochem, JITF Infralogistics, Fino Payments Bank, Quadrant Future Tek, Dynamic Cables, Nalwa Sons Investment, GFL shed between 10-19 percent.

Where is Nifty50 headed?

Siddhartha Khemka - Head of Research, Wealth Management, Motilal Oswal Financial Services

Going ahead, markets are likely to remain range-bound with a positive bias as investors monitor global developments, foreign fund flows, and next week’s focus will also be on monthly auto sales figures, which will offer cues on festive-season demand trends, alongside quarterly results from SBI, Bharti Airtel, Titan, and Tata Chemicals. Resilient domestic fundamentals continue to offer support, even as external uncertainties may cap near-term upside.

Amol Athawale, VP Technical Research, Kotak Securities

The short-term market outlook remains positive. We believe that the 25,700–25,650/83900-83700 zone will act as a crucial support level for traders, while 26,000/85000 and 26,100/85300 could serve as key resistance areas for the bulls. A successful breakout above 26,100/85300 could push the market toward 26,250–26,350/85800-86100. Conversely, if the market falls below 25,650/83700, sentiment could turn negative, potentially slipping to 25,500–25,450/83300-83100.

Hrishikesh Yedve, AVP Technical and Derivative Research, Asit C. Mehta Investment Interrmediates

On the weekly scale, the index has formed a shooting star candle, indicating profit booking at higher levels. However, the Nifty index is still holding above the support of 25,670. If the index sustains below 25,670, weakness could extend towards 25,450–25,400 levels, where the next major demand zone is placed. On the higher side, 26,100 is acting as a stiff resistance. As long as Nifty remains below this level, any bounce should be used for booking profits.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.