OPEN-SOURCE SCRIPT

Обновлено SuperTrend + Relative Volume (Kernel Optimized)

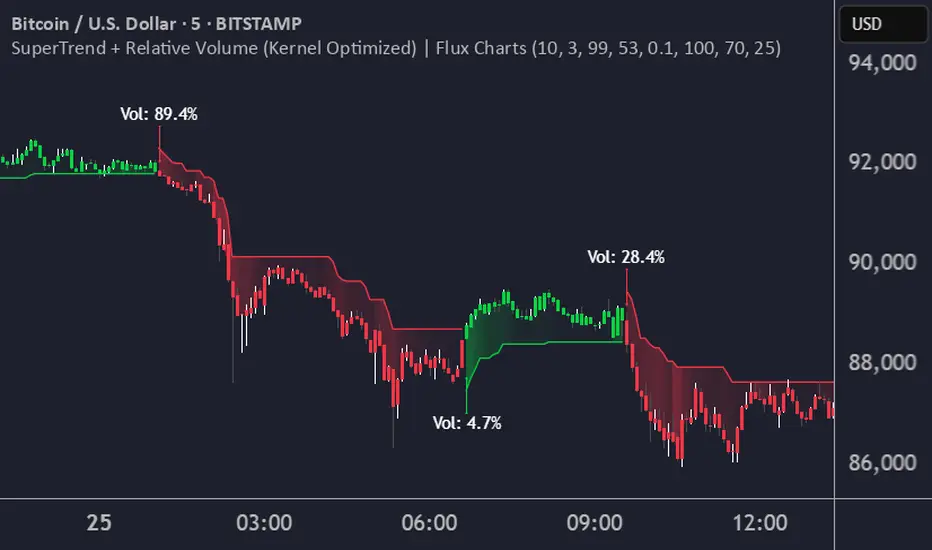

Introducing our new KDE Optimized Supertrend + Relative Volume Indicator!

This innovative indicator combines the power of the Supertrend indicator along with Relative Volume. It utilizes the Kernel Density Estimation (KDE) to estimate the probability of a candlestick marking a significant trend break or reversal.

❓How to Interpret the KDE %:

The KDE % is a crucial metric that reflects the likelihood that the current candlestick represents a true break in the SuperTrend line, supported by an increase in relative volume. It estimates the probability of a trend shift or continuation based on historical SuperTrend breaks and volume patterns:

Low KDE %: A lower probability that the current break is significant. Price action is less likely to reverse, and the trend may continue.

Moderate KDE - High KDE %: An increased possibility that a trend reversal or consolidation could occur. Traders should start watching for confirmation signals.

📌How Does It Work?

The SuperTrend indicator uses the Average True Range (ATR) to determine the direction of the trend and identifies when the price crosses the SuperTrend line, signaling a potential trend reversal. Here's how the KDE Optimized SuperTrend Indicator works:

⚙️Settings:

SuperTrend Settings:

KDE Settings:

This innovative indicator combines the power of the Supertrend indicator along with Relative Volume. It utilizes the Kernel Density Estimation (KDE) to estimate the probability of a candlestick marking a significant trend break or reversal.

❓How to Interpret the KDE %:

The KDE % is a crucial metric that reflects the likelihood that the current candlestick represents a true break in the SuperTrend line, supported by an increase in relative volume. It estimates the probability of a trend shift or continuation based on historical SuperTrend breaks and volume patterns:

Low KDE %: A lower probability that the current break is significant. Price action is less likely to reverse, and the trend may continue.

Moderate KDE - High KDE %: An increased possibility that a trend reversal or consolidation could occur. Traders should start watching for confirmation signals.

📌How Does It Work?

The SuperTrend indicator uses the Average True Range (ATR) to determine the direction of the trend and identifies when the price crosses the SuperTrend line, signaling a potential trend reversal. Here's how the KDE Optimized SuperTrend Indicator works:

- SuperTrend Calculation: The SuperTrend indicator is calculated, and when the price breaks above (bullish) or below (bearish) the SuperTrend line, it is logged as a significant event.

- Relative Volume: For each break in the SuperTrend line, we calculate the relative volume (current volume vs. the average volume over a defined period). High relative volume can suggest stronger confirmation of the trend break.

- KDE Array Calculation: KDE is applied to the break points and relative volume data:

- Define the KDE options: Bandwidth, Number of Steps, and Array Range (Array Max - Array Min).

- Create a density range array using the defined number of steps, corresponding to potential break points.

- Apply a Gaussian kernel function to the break points and volume data to estimate the likelihood of the trend break being significant.

- KDE Value and Signal Generation: The KDE array is updated as each break occurs. The KDE % is calculated for the breakout candlestick, representing the likelihood of the trend break being significant. If the KDE value exceeds the defined activation threshold, a darker bullish or bearish arrow is plotted after bar confirmation. If the KDE value falls below the threshold, a more transparent arrow is drawn, indicating a possible but lower probability break.

⚙️Settings:

SuperTrend Settings:

- ATR Length: The period over which the Average True Range (ATR) is calculated.

- Multiplier: The multiplier applied to the ATR to determine the SuperTrend threshold.

KDE Settings:

- Bandwidth: Determines the smoothness of the KDE function and the width of the influence of each break point.

- Number of Bins (Steps): Defines the precision of the KDE algorithm, with higher values offering more detailed calculations.

- KDE Threshold %: The level at which relative volume is considered significant for confirming a break.

- Relative Volume Length: The number of historic candles used in calculating KDE %

Информация о релизе

Updated KDE LimitИнформация о релизе

Updated default settings to improve ease of use Информация о релизе

Split the KDE in two for bullish and bearish signals. Bullish and Bearish KDE's now use buy and sell volume respectively. Информация о релизе

Refactoring + update signal conditionsИнформация о релизе

- Updated recalculation period

- Volume calculation logic to use a average ratio

Информация о релизе

Swapped ratio for sell volumeИнформация о релизе

Added KDE percent based gradient for fill colorИнформация о релизе

Add setting to disable KDE percentage text Информация о релизе

- Added trend coloring

- Added setting to disable display of SuperTrend Line

- Added setting to disable display of SuperTrend fill gradient

- Updated threshold activation setting to be used as an additional condition to trigger a directional change

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Access Flux Charts' exclusive indicators: fluxcharts.com/

Join our Discord community: discord.gg/FluxCharts

Join our Discord community: discord.gg/FluxCharts

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Access Flux Charts' exclusive indicators: fluxcharts.com/

Join our Discord community: discord.gg/FluxCharts

Join our Discord community: discord.gg/FluxCharts

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.