OPEN-SOURCE SCRIPT

Обновлено Stoch PRO + Dynamic EMA (EMA cross)

Stoch PRO + Dynamic EMA Documentation

Overview:

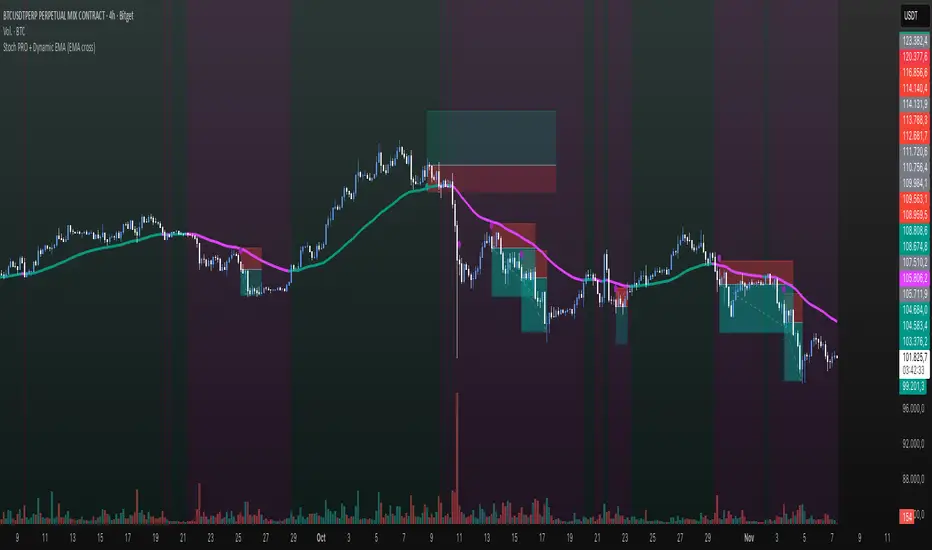

- Pine Script v6 overlay indicator combining a trend-colored EMA with a Stochastic oscillator to highlight midline momentum shifts.

- Designed for TradingView charts (Indicators → Import) as a visual aid for timing entries within trend-following setups.

- Crafted and optimized around BTCUSDT on the 4h timeframe; adapt inputs before applying to other markets or intervals.

Inputs:

- EMA Length (default 50): smoothing window for the dynamic EMA; lower values respond faster but whipsaw more.

- Stochastic K Length (20): lookback for the raw %K calculation.

- Stochastic K Smoothing (3): SMA applied to %K to reduce noise.

- Stochastic D Smoothing (3): SMA over %K to produce the companion %D line.

Visual Elements:

- EMA plotted on price with linewidth 3; teal when close > EMA, fuchsia otherwise.

- Background tinted teal/fuchsia at high transparency (≈92) to reinforce the current trend bias without obscuring price bars.

Oscillator Logic:

- %K = ta.stoch(high, low, close, kLength); smoothed with ta.sma(kRaw, kSmooth).

- %D = ta.sma(k, dSmooth).

- Focus is on the midline (50) rather than traditional 20/80 extremes to emphasize rapid momentum flips.

Signals:

- Buy: %K crossing above 50 while close > EMA (teal state). Plots tiny teal circle below the bar.

- Sell: %K crossing below 50 while close < EMA (fuchsia state). Plots tiny purple circle above the bar.

Trading Workflow Tips:

- Use EMA/background color for directional bias, then confirm with %K 50-cross to refine entries.

- Consider higher-timeframe trend filters or price-action confirmation to avoid range chop.

- Stops often sit just beyond the EMA; adjust thresholds (e.g., 55/45) if too many false positives occur.

- Always plan risk/reward upfront—define TP/SL levels that fit your strategy and backtest them thoroughly before trading live.

Alerts & Extensions:

- Wrap crossUp/crossDown in alertcondition() if TradingView alerts are needed.

- For automation/backtesting, convert logic to a strategy() script or add position management rules.

Overview:

- Pine Script v6 overlay indicator combining a trend-colored EMA with a Stochastic oscillator to highlight midline momentum shifts.

- Designed for TradingView charts (Indicators → Import) as a visual aid for timing entries within trend-following setups.

- Crafted and optimized around BTCUSDT on the 4h timeframe; adapt inputs before applying to other markets or intervals.

Inputs:

- EMA Length (default 50): smoothing window for the dynamic EMA; lower values respond faster but whipsaw more.

- Stochastic K Length (20): lookback for the raw %K calculation.

- Stochastic K Smoothing (3): SMA applied to %K to reduce noise.

- Stochastic D Smoothing (3): SMA over %K to produce the companion %D line.

Visual Elements:

- EMA plotted on price with linewidth 3; teal when close > EMA, fuchsia otherwise.

- Background tinted teal/fuchsia at high transparency (≈92) to reinforce the current trend bias without obscuring price bars.

Oscillator Logic:

- %K = ta.stoch(high, low, close, kLength); smoothed with ta.sma(kRaw, kSmooth).

- %D = ta.sma(k, dSmooth).

- Focus is on the midline (50) rather than traditional 20/80 extremes to emphasize rapid momentum flips.

Signals:

- Buy: %K crossing above 50 while close > EMA (teal state). Plots tiny teal circle below the bar.

- Sell: %K crossing below 50 while close < EMA (fuchsia state). Plots tiny purple circle above the bar.

Trading Workflow Tips:

- Use EMA/background color for directional bias, then confirm with %K 50-cross to refine entries.

- Consider higher-timeframe trend filters or price-action confirmation to avoid range chop.

- Stops often sit just beyond the EMA; adjust thresholds (e.g., 55/45) if too many false positives occur.

- Always plan risk/reward upfront—define TP/SL levels that fit your strategy and backtest them thoroughly before trading live.

Alerts & Extensions:

- Wrap crossUp/crossDown in alertcondition() if TradingView alerts are needed.

- For automation/backtesting, convert logic to a strategy() script or add position management rules.

Информация о релизе

Stoch PRO + Dynamic EMA DocumentationOverview:

- Pine Script v6 overlay indicator combining a trend-colored EMA with a Stochastic oscillator to highlight midline momentum shifts.

- Designed for TradingView charts (Indicators → Import) as a visual aid for timing entries within trend-following setups.

- Crafted and optimized around BTCUSDT on the 4h timeframe; adapt inputs before applying to other markets or intervals.

Inputs:

- EMA Length (default 50): smoothing window for the dynamic EMA; lower values respond faster but whipsaw more.

- Stochastic K Length (20): lookback for the raw %K calculation.

- Stochastic K Smoothing (3): SMA applied to %K to reduce noise.

- Stochastic D Smoothing (3): SMA over %K to produce the companion %D line.

Visual Elements:

- EMA plotted on price with linewidth 3; teal when close > EMA, fuchsia otherwise.

- Background tinted teal/fuchsia at high transparency (≈92) to reinforce the current trend bias without obscuring price bars.

Oscillator Logic:

- %K = ta.stoch(high, low, close, kLength); smoothed with ta.sma(kRaw, kSmooth).

- %D = ta.sma(k, dSmooth).

- Focus is on the midline (50) rather than traditional 20/80 extremes to emphasize rapid momentum flips.

Signals:

- Buy: %K crossing above 50 while close > EMA (teal state). Plots tiny teal circle below the bar.

- Sell: %K crossing below 50 while close < EMA (fuchsia state). Plots tiny purple circle above the bar.

Trading Workflow Tips:

- Use EMA/background color for directional bias, then confirm with %K 50-cross to refine entries.

- Consider higher-timeframe trend filters or price-action confirmation to avoid range chop.

- Stops often sit just beyond the EMA; adjust thresholds (e.g., 55/45) if too many false positives occur.

- Always plan risk/reward upfront—define TP/SL levels that fit your strategy and backtest them thoroughly before trading live.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.