OPEN-SOURCE SCRIPT

Anrazzi - EMAs/ATR - 1.0.2

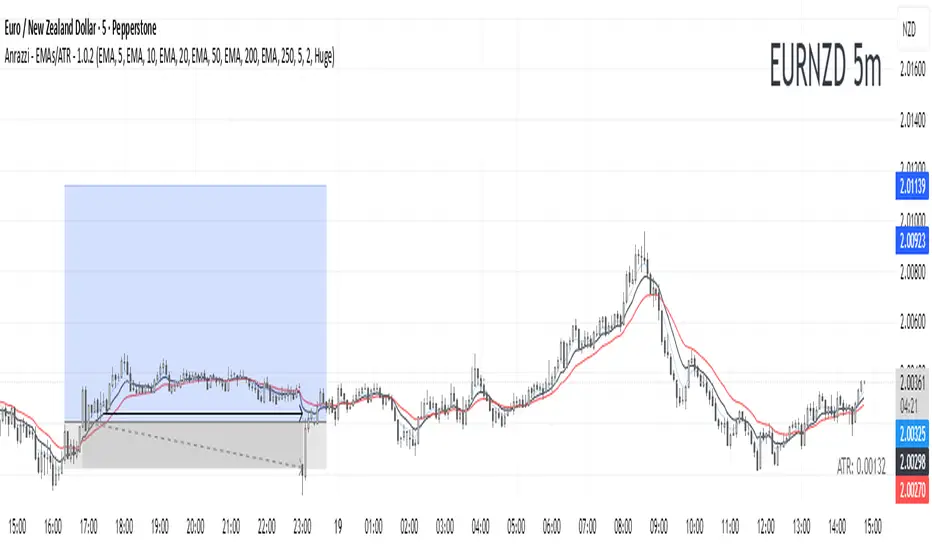

The Anrazzi – EMAs/ATR indicator is a multi-purpose overlay designed to help traders track trend direction and market volatility in a single clean tool.

It plots up to six customizable moving averages (MAs) and an Average True Range (ATR) value directly on your chart, allowing you to quickly identify market bias, dynamic support/resistance, and volatility levels without switching indicators.

This script is ideal for traders who want a simple, configurable, and efficient way to combine trend-following signals with volatility-based position sizing.

📌 Key Features

Six Moving Averages (MA1 → MA6)

Toggle each MA on/off individually

Choose between EMA or SMA for each

Customize length and color

Perfect for spotting trend direction and pullback zones

ATR Display

Uses Wilder’s ATR formula (ta.rma(ta.tr(true), 14))

Can be calculated on current or higher timeframe

Adjustable multiplier for position sizing (e.g., 1.5× ATR stops)

Displays cleanly in the bottom-right corner

Custom Watermark

Displays symbol + timeframe in top-right

Adjustable color and size for streamers, screenshots, or clear charting

Compact UI

Organized with group and inline inputs for quick configuration

Lightweight and optimized for real-time performance

⚙️ How It Works

MAs: The script uses either ta.ema() or ta.sma() to compute each moving average based on the user-selected type and length.

ATR: The ATR is calculated using ta.rma(ta.tr(true), 14) (Wilder’s smoothing), and optionally scaled by a multiplier for easier use in risk management.

Tables: ATR value and watermark are displayed using table.new() so they stay anchored to the screen regardless of zoom level.

📈 How to Use

Enable the MAs you want to track and adjust their lengths, type, and colors.

Enable ATR if you want to see volatility — optionally select a higher timeframe for broader context.

Use MAs to:

Identify overall trend direction (e.g. price above MA20 = bullish)

Spot pullback zones for entries

See when multiple MAs cluster together as support/resistance zones

Use ATR value to:

Size your stop-loss dynamically (e.g. stop = entry − 1.5×ATR)

Detect volatility breakouts (ATR spikes = market expansion)

🎯 Recommended For

Day traders & swing traders

Trend-following & momentum strategies

Volatility-based risk management

Traders who want a clean, all-in-one dashboard

It plots up to six customizable moving averages (MAs) and an Average True Range (ATR) value directly on your chart, allowing you to quickly identify market bias, dynamic support/resistance, and volatility levels without switching indicators.

This script is ideal for traders who want a simple, configurable, and efficient way to combine trend-following signals with volatility-based position sizing.

📌 Key Features

Six Moving Averages (MA1 → MA6)

Toggle each MA on/off individually

Choose between EMA or SMA for each

Customize length and color

Perfect for spotting trend direction and pullback zones

ATR Display

Uses Wilder’s ATR formula (ta.rma(ta.tr(true), 14))

Can be calculated on current or higher timeframe

Adjustable multiplier for position sizing (e.g., 1.5× ATR stops)

Displays cleanly in the bottom-right corner

Custom Watermark

Displays symbol + timeframe in top-right

Adjustable color and size for streamers, screenshots, or clear charting

Compact UI

Organized with group and inline inputs for quick configuration

Lightweight and optimized for real-time performance

⚙️ How It Works

MAs: The script uses either ta.ema() or ta.sma() to compute each moving average based on the user-selected type and length.

ATR: The ATR is calculated using ta.rma(ta.tr(true), 14) (Wilder’s smoothing), and optionally scaled by a multiplier for easier use in risk management.

Tables: ATR value and watermark are displayed using table.new() so they stay anchored to the screen regardless of zoom level.

📈 How to Use

Enable the MAs you want to track and adjust their lengths, type, and colors.

Enable ATR if you want to see volatility — optionally select a higher timeframe for broader context.

Use MAs to:

Identify overall trend direction (e.g. price above MA20 = bullish)

Spot pullback zones for entries

See when multiple MAs cluster together as support/resistance zones

Use ATR value to:

Size your stop-loss dynamically (e.g. stop = entry − 1.5×ATR)

Detect volatility breakouts (ATR spikes = market expansion)

🎯 Recommended For

Day traders & swing traders

Trend-following & momentum strategies

Volatility-based risk management

Traders who want a clean, all-in-one dashboard

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.