OPEN-SOURCE SCRIPT

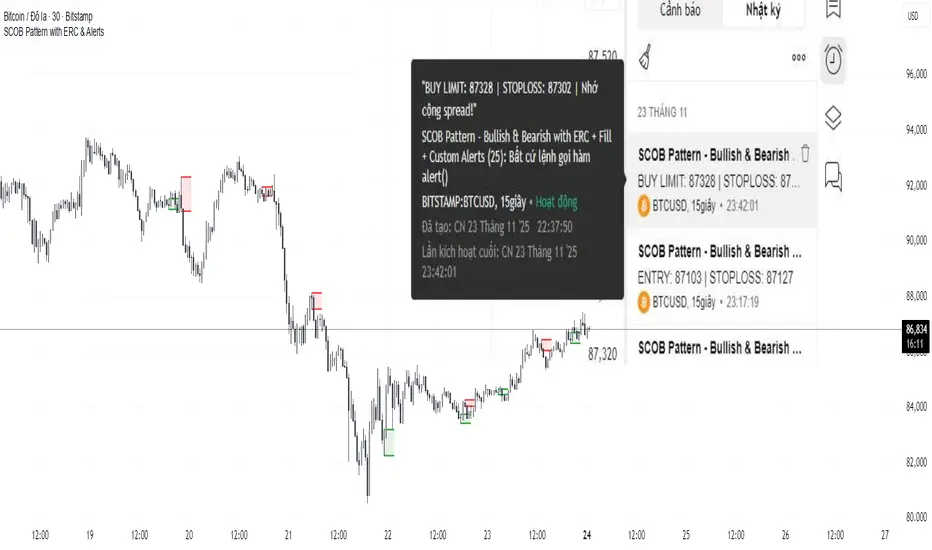

SCOB Pattern with ERC & Alerts

Single Candle Block (SC0B) consists of a single candle appearing at a significant price level, indicating a confirmed reversal in price direction from that particular area of interest.

SCOB is primarily used to confirm and execute trades.

Using a single candle block to enter a trade minimizes risk and maximizes reward.

Single bullish candle block?

1st candle closes at bullish point of interest with a short or long wick.

2nd candle sweeps the low of previous(1st) candle and closes above the low of previous candle.

3rd candle closes above the high of 2nd candle.

How to trade with Scob bullish.

To Trade using Bullish SCOB you have to wait for price to come down and test the single candle order block.

When price tests the SCOB you can directly execute a buy trade or for a precise entry you can wait for a market structure shift in lower time frame.

Scob discount is the opposite of price increase.

This strategy should only be used when price "sweeps through key lever, liquidity, imbalance, poi htf areas.

This indicator will add a filter to help you reduce signal noise.

Use the "Use engulfing candle to test" function to filter the 3rd candle.

Only search for Scob if the 3rd candle is an Engulfing candle.

The logic for finding Engulfing candles can be changed based on the "% maximum wick length" option. The default is that the candle wick is 25% of the total candle wick length.

You can also use the alert function when Scob appears

With Smart money concept, no strategy is perfect in trading, so you should not risk too much of your capital on this strategy.

To be safer, always remember to use stop loss for every trade.

SCOB is primarily used to confirm and execute trades.

Using a single candle block to enter a trade minimizes risk and maximizes reward.

Single bullish candle block?

1st candle closes at bullish point of interest with a short or long wick.

2nd candle sweeps the low of previous(1st) candle and closes above the low of previous candle.

3rd candle closes above the high of 2nd candle.

How to trade with Scob bullish.

To Trade using Bullish SCOB you have to wait for price to come down and test the single candle order block.

When price tests the SCOB you can directly execute a buy trade or for a precise entry you can wait for a market structure shift in lower time frame.

Scob discount is the opposite of price increase.

This strategy should only be used when price "sweeps through key lever, liquidity, imbalance, poi htf areas.

This indicator will add a filter to help you reduce signal noise.

Use the "Use engulfing candle to test" function to filter the 3rd candle.

Only search for Scob if the 3rd candle is an Engulfing candle.

The logic for finding Engulfing candles can be changed based on the "% maximum wick length" option. The default is that the candle wick is 25% of the total candle wick length.

You can also use the alert function when Scob appears

With Smart money concept, no strategy is perfect in trading, so you should not risk too much of your capital on this strategy.

To be safer, always remember to use stop loss for every trade.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.