OPEN-SOURCE SCRIPT

Unicorn ICT Signals [TradingFinder] Breaker Block + FVG Zones

🔵Introduction

The "ICT Unicorn Model" trading strategy in the "Inner Circle Trader" (ICT) style is one of the well-known strategies in the world of Forex and financial market trading.

The ICT methodology was developed by Michael Huddleston and is based on technical analysis and Price Action concepts.

This style focuses specifically on interpreting price movements and identifying optimal entry and exit points in the market.

In the Unicorn strategy, traders seek points where the probability of price reversal or trend continuation is high. This strategy is primarily based on recognizing and analyzing Price Action patterns and market structure.

By understanding"ICT Unicorn Model", traders can make more informed decisions about where to enter or exit trades, thereby increasing their chances of success in the market.

🟣Understanding the Breaker Block

A Breaker Block is a specialized form of an Order Block that changes its role after a key market level is broken. Typically, an Order Block is an area on the chart where large institutional orders are likely to be placed, providing strong support or resistance.

However, when this area is breached, and the price moves in the opposite direction, it transforms into what is known as a Breaker Block. This shift indicates a reversal in market sentiment, turning the previous support into resistance or vice versa, thereby signaling a potential trend change to traders.

🟣The Significance of the Fair Value Gap (FVG)

The Fair Value Gap (FVG) refers to an area on a price chart where the price rapidly moves through a level, leaving behind a gap. This gap represents an imbalance between supply and demand and is often seen as a potential area for price to return and fill the gap.

These zones are crucial for traders as they can indicate future price movements, providing opportunities to enter or exit trades.

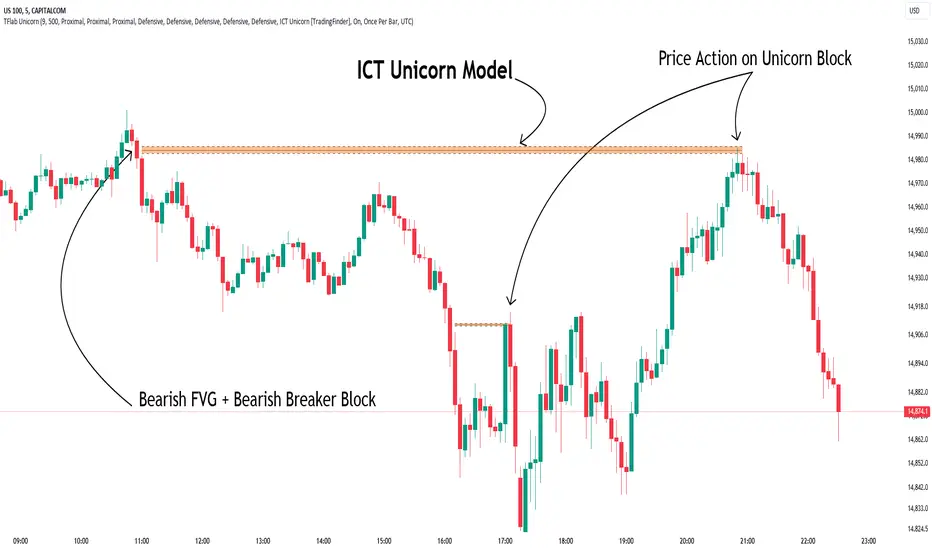

🟣Defining the ICT Unicorn Model

When an FVG overlaps with a Breaker Block, it forms a highly significant trading area known as a Unicorn. This overlap creates an ideal zone for traders to enter the market, as it combines two powerful technical signals.

The Unicorn Model is therefore considered an optimal strategy for identifying precise entry and exit points in the financial markets.

Demand ICT Unicorn Model:

Supply ICT Unicorn Model:

🔵How to Use

🟣Bullish ICT Unicorn

The Bullish ICT Unicorn model is applicable when the market is in an uptrend, and traders are seeking buying opportunities.

Follow these steps to identify Bullish ICT Unicorn:

🟣Bearish ICT Unicorn

The Bearish ICT Unicorn model is used when the market is in a downtrend, and traders are looking for selling opportunities.

To identify Bearish ICT Unicorn, follow these steps:

🔵Setting

🟣Global Setting

Pivot Period of Order Blocks Detector: Enter the desired pivot period to identify the Order Block.

Order Block Validity Period (Bar): You can specify the maximum time the Order Block remains valid based on the number of candles from the origin.

Mitigation Level Breaker Block: Determining the basic level of a Breaker Block. When the price hits the basic level, the Breaker Block due to mitigation.

Mitigation Level FVG: Determining the basic level of a FVG. When the price hits the basic level, the FVG due to mitigation.

Mitigation Level Unicorn: Determining the basic level of a Unicorn Block. When the price hits the basic level, the Unicorn Block due to mitigation.

🟣Unicorn Block Display

Show All Unicorn Block: If it is turned off, only the last Order Block will be displayed.

Demand Unicorn Block: Show or not show and specify color.

Supply Unicorn Block: Show or not show and specify color.

🟣Breaker Block Display

Show All Breaker Block: If it is turned off, only the last Breaker Block will be displayed.

Demand Main Breaker Block: Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

Supply Main Breaker Block: Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

🟣Fair Value Gap Display

Show Bullish FVG: Toggles the display of demand-related boxes.

Show Bearish FVG: Toggles the display of supply-related boxes.

🟣Logic Settings

🟣Order Block Refinement

Refine Order Blocks: Enable or disable the refinement feature. Mode selection.

🟣FVG Filter

FVG Filter: This refines the number of identified FVG areas based on a specified algorithm to focus on higher quality signals and reduce noise.

Types of FVG filters:

🟣Alert

Alert Name: The name of the alert you receive.

Alert ICT Unicorn Model Block Mitigation:

On / Off

Message Frequency:

This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone:

The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

🔵Conclusion

The Unicorn Model in ICT, utilizing the concepts of Breaker Blocks and Fair Value Gaps, provides an effective tool for identifying entry and exit points in financial markets. By offering more precise signals, this model helps traders make better decisions and minimize trading risks.

Success in applying this model requires practice and a deep understanding of market structure, but it can significantly improve trading performance.

The "ICT Unicorn Model" trading strategy in the "Inner Circle Trader" (ICT) style is one of the well-known strategies in the world of Forex and financial market trading.

The ICT methodology was developed by Michael Huddleston and is based on technical analysis and Price Action concepts.

This style focuses specifically on interpreting price movements and identifying optimal entry and exit points in the market.

In the Unicorn strategy, traders seek points where the probability of price reversal or trend continuation is high. This strategy is primarily based on recognizing and analyzing Price Action patterns and market structure.

By understanding"ICT Unicorn Model", traders can make more informed decisions about where to enter or exit trades, thereby increasing their chances of success in the market.

🟣Understanding the Breaker Block

A Breaker Block is a specialized form of an Order Block that changes its role after a key market level is broken. Typically, an Order Block is an area on the chart where large institutional orders are likely to be placed, providing strong support or resistance.

However, when this area is breached, and the price moves in the opposite direction, it transforms into what is known as a Breaker Block. This shift indicates a reversal in market sentiment, turning the previous support into resistance or vice versa, thereby signaling a potential trend change to traders.

🟣The Significance of the Fair Value Gap (FVG)

The Fair Value Gap (FVG) refers to an area on a price chart where the price rapidly moves through a level, leaving behind a gap. This gap represents an imbalance between supply and demand and is often seen as a potential area for price to return and fill the gap.

These zones are crucial for traders as they can indicate future price movements, providing opportunities to enter or exit trades.

🟣Defining the ICT Unicorn Model

When an FVG overlaps with a Breaker Block, it forms a highly significant trading area known as a Unicorn. This overlap creates an ideal zone for traders to enter the market, as it combines two powerful technical signals.

The Unicorn Model is therefore considered an optimal strategy for identifying precise entry and exit points in the financial markets.

Demand ICT Unicorn Model:

Supply ICT Unicorn Model:

🔵How to Use

🟣Bullish ICT Unicorn

The Bullish ICT Unicorn model is applicable when the market is in an uptrend, and traders are seeking buying opportunities.

Follow these steps to identify Bullish ICT Unicorn:

- Identify the Bullish Breaker Block: Locate an area where the price moved upward after breaking an Order Block. This area now acts as a Breaker Block.

- Identify the Bullish FVG: Look for a Fair Value Gap near the Breaker Block.

- Confirm the Unicorn: When the Bullish Breaker Block and Bullish FVG overlap, a Bullish Unicorn is confirmed. Traders can enter a buy position when the price returns to this zone.

🟣Bearish ICT Unicorn

The Bearish ICT Unicorn model is used when the market is in a downtrend, and traders are looking for selling opportunities.

To identify Bearish ICT Unicorn, follow these steps:

- Identify the Bearish Breaker Block: Find an area where the price moved downward after breaking an Order Block. This area now acts as a Breaker Block.

- Identify the Bearish FVG: Check if a Fair Value Gap has formed near the Breaker Block.

- Confirm the Unicorn: When the Bearish Breaker Block and Bearish FVG overlap, a Bearish Unicorn is confirmed. Traders can enter a sell position when the price returns to this zone.

🔵Setting

🟣Global Setting

Pivot Period of Order Blocks Detector: Enter the desired pivot period to identify the Order Block.

Order Block Validity Period (Bar): You can specify the maximum time the Order Block remains valid based on the number of candles from the origin.

Mitigation Level Breaker Block: Determining the basic level of a Breaker Block. When the price hits the basic level, the Breaker Block due to mitigation.

Mitigation Level FVG: Determining the basic level of a FVG. When the price hits the basic level, the FVG due to mitigation.

Mitigation Level Unicorn: Determining the basic level of a Unicorn Block. When the price hits the basic level, the Unicorn Block due to mitigation.

🟣Unicorn Block Display

Show All Unicorn Block: If it is turned off, only the last Order Block will be displayed.

Demand Unicorn Block: Show or not show and specify color.

Supply Unicorn Block: Show or not show and specify color.

🟣Breaker Block Display

Show All Breaker Block: If it is turned off, only the last Breaker Block will be displayed.

Demand Main Breaker Block: Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

Supply Main Breaker Block: Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Breaker Block: Show or not show and specify color.

🟣Fair Value Gap Display

Show Bullish FVG: Toggles the display of demand-related boxes.

Show Bearish FVG: Toggles the display of supply-related boxes.

🟣Logic Settings

🟣Order Block Refinement

Refine Order Blocks: Enable or disable the refinement feature. Mode selection.

🟣FVG Filter

FVG Filter: This refines the number of identified FVG areas based on a specified algorithm to focus on higher quality signals and reduce noise.

Types of FVG filters:

- Very Aggressive Filter: Adds a condition where, for an upward FVG, the last candle's highest price must exceed the middle candle's highest price, and for a downward FVG, the last candle's lowest price must be lower than the middle candle's lowest price. This minimally filters out FVGs.

- Aggressive Filter: Builds on the Very Aggressive mode by ensuring the middle candle is not too small, filtering out more FVGs.

- Defensive Filter: Adds criteria regarding the size and structure of the middle candle, requiring it to have a substantial body and specific polarity conditions, filtering out a significant number of FVGs.

- Very Defensive Filter: Further refines filtering by ensuring the first and third candles are not small-bodied doji candles, retaining only the highest quality signals.

🟣Alert

Alert Name: The name of the alert you receive.

Alert ICT Unicorn Model Block Mitigation:

On / Off

Message Frequency:

This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone:

The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

🔵Conclusion

The Unicorn Model in ICT, utilizing the concepts of Breaker Blocks and Fair Value Gaps, provides an effective tool for identifying entry and exit points in financial markets. By offering more precise signals, this model helps traders make better decisions and minimize trading risks.

Success in applying this model requires practice and a deep understanding of market structure, but it can significantly improve trading performance.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.