PROTECTED SOURCE SCRIPT

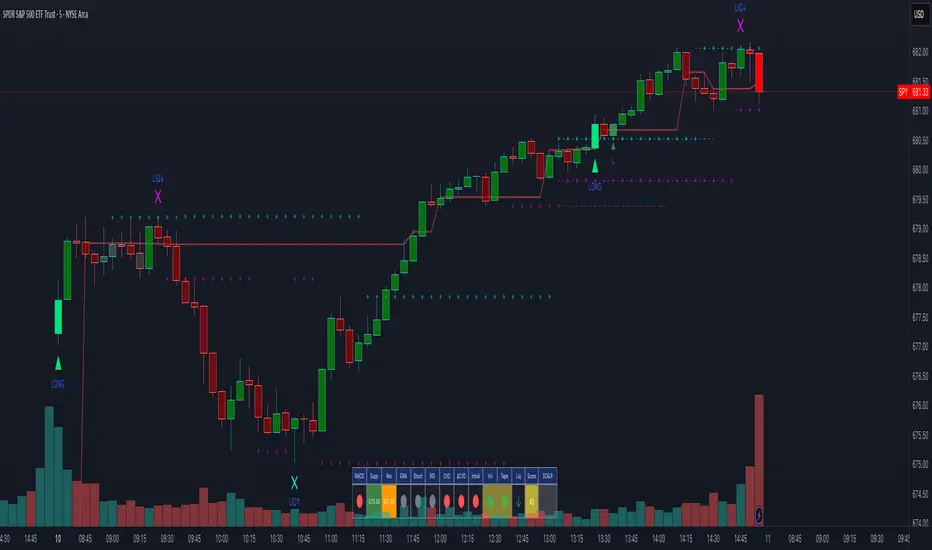

Scalping Dashboard - Volume Candles + Liquidity Zones

Scalping Dashboard - Volume Candles + Liquidity Zones

📊 Overview

A comprehensive scalping indicator designed for high-frequency traders on 1-5 minute timeframes. This all-in-one dashboard combines volume analysis, order flow metrics, technical indicators, and institutional liquidity zones to identify high-probability scalping opportunities.

🎯 Key Features

✅ Multi-Timeframe Analysis

Fast MACD (5/13/5) for momentum

Quick EMAs (9/20/50) for trend direction

Rapid Stochastic (5/3/3) for oversold/overbought conditions

Fast RSI (7) for extreme readings

✅ Advanced Order Flow Metrics

CVD (Cumulative Volume Delta): Tracks buy vs sell pressure over time

Delta Momentum: Measures acceleration in buying/selling

Buy/Sell Pressure Ratio: Real-time balance of market forces

Order Flow Imbalance: Detects aggressive buying or selling

Tape Speed: Measures how fast volume is hitting the market

✅ Institutional Liquidity Zones

Buy-Side Liquidity: Areas above price where short stop losses cluster

Sell-Side Liquidity: Areas below price where long stop losses cluster

Liquidity Sweeps: Detects "stop hunts" by institutions before reversals

✅ Volume-Based Candle Coloring

Visual representation of volume intensity

Extreme, High, Normal, and Low volume categories

Fully customizable color schemes

✅ Dynamic Support/Resistance

Volume-weighted price levels

Automatically updates every 3 bars

Shows distance to key levels

📈 Dashboard Indicators Explained

The bottom-left dashboard displays 14 real-time metrics:

▸ MACD (●)

Green = Bullish momentum

Red = Bearish momentum

Gray = Neutral

▸ Supp (Price)

Support level

Green highlight = at support (good for long entry)

▸ Res (Price)

Resistance level

Orange highlight = at resistance (good for short entry)

▸ EMA (●)

Green = Price above EMAs (bullish)

Red = Price below EMAs (bearish)

▸ Stoch (●)

Green = Oversold (<20)

Red = Overbought (>80)

Gray = Neutral

▸ RSI (●)

Green = Oversold (<30)

Red = Overbought (>70)

Gray = Neutral

▸ CVD (●)

Green = Cumulative buying pressure

Red = Cumulative selling pressure

▸ ΔCVD (●)

Green = Increasing buy pressure

Red = Increasing sell pressure

▸ Imbal (●)

Green = Buy imbalance (>2:1 ratio)

Red = Sell imbalance

▸ Vol (●)

Green/Yellow background = Volume surge (>2x average)

▸ Tape (●)

Green/Yellow background = Fast tape (>1.5x speed)

▸ Liq (↑↓●)

↑ = Bullish sweep or near sell-side liquidity

↓ = Bearish sweep or near buy-side liquidity

● = Neutral

▸ Score (#L or #S)

Quality score (0-8) for Long or Short setups

Higher numbers = Better quality trade

▸ SCALP (LONG/SHORT/WAIT)

Primary signal

Bright color = High quality (score ≥5)

Dim color = Decent quality (score =4)

Gray = Wait for better setup

🎨 Candle Color System

Volume-Based Colors

Bright Green/Red: Extreme volume (>2.5x average) - Major moves

Medium Green/Red: High volume (>1.5x average) - Strong activity

Dull Green/Red: Normal volume - Standard market activity

Gray: Low volume (<0.5x average) - Avoid trading

Signal-Based Colors

Lime: Strong Long signal (score ≥5)

Green: Decent Long signal (score =4)

Orange: Strong Short signal (score ≥5)

Red: Decent Short signal (score =4)

Candle Color Modes (adjustable in settings):

Volume Only: Pure volume intensity

Volume + Signals: Signals override volume when present (default)

Signals Only: Only shows entry signals

🔵 Chart Indicators

Support & Resistance Lines

Green Line: Volume-weighted support level

Red Line: Volume-weighted resistance level

Lines update dynamically based on 100-bar volume profile

Liquidity Zones

Cyan Circles/Dashed Lines: Buy-side liquidity (above price)

Where short stop losses cluster

Potential targets for bullish moves

Institutions may push price here before reversing down

Magenta Circles/Dashed Lines: Sell-side liquidity (below price)

Where long stop losses cluster

Potential targets for bearish moves

Institutions may push price here before reversing up

Entry Markers

Large Green Triangle (▲): High quality long entry (score ≥5)

Small Green Triangle (▲): Decent long entry (score =4)

Large Orange Triangle (▼): High quality short entry (score ≥5)

Small Red Triangle (▼): Decent short entry (score =4)

Liquidity Sweep Markers

Cyan X-Cross (below bar): Bullish liquidity sweep - "LIQ↑"

Price swept sell-side liquidity and reversed up

Strong buy signal

Magenta X-Cross (above bar): Bearish liquidity sweep - "LIQ↓"

Price swept buy-side liquidity and reversed down

Strong sell signal

🎯 How to Use This Indicator

For Long Scalps (Buy):

Wait for Dashboard Signal: SCALP = "LONG" with score ≥5

Confirm Multiple Green Dots: Look for EMA, CVD, ΔCVD, Imbal all green

Check Volume: Vol or Tape should show yellow background (surge)

Look for Confluence:

Price at or near Support level (green highlight)

Price near Sell-Side Liquidity (magenta line below)

RSI oversold (green dot)

Large green triangle appears on chart

Best Entry: On a bullish liquidity sweep (cyan X-cross)

For Short Scalps (Sell):

Wait for Dashboard Signal: SCALP = "SHORT" with score ≥5

Confirm Multiple Red Dots: Look for EMA, CVD, ΔCVD, Imbal all red

Check Volume: Vol or Tape should show yellow background (surge)

Look for Confluence:

Price at or near Resistance level (orange highlight)

Price near Buy-Side Liquidity (cyan line above)

RSI overbought (red dot)

Large orange triangle appears on chart

Best Entry: On a bearish liquidity sweep (magenta X-cross)

Three Types of Scalping Setups:

1. Quick Scalp (Fastest - 1-5 minute holds)

MACD or Stochastic crossover + Volume surge

At Support/Resistance level

Score ≥4

2. Momentum Scalp (Ride the wave - 5-15 minute holds)

Strong EMA alignment + CVD slope positive

Order flow imbalance + Fast tape

Volume surge with price structure

Score ≥5

3. Reversal Scalp (Fade extremes - 3-10 minute holds)

Stochastic + RSI extreme readings

At Support/Resistance OR liquidity sweep

CVD momentum reversal

Score ≥6

⚙️ Recommended Settings

Timeframes

Primary: 1-minute, 2-minute, 5-minute

Confirmation: Use 15-minute chart for overall trend direction

Asset Types

Forex pairs (high liquidity)

Crypto (BTC, ETH with high volume)

Futures (ES, NQ)

Major stocks during market hours

Risk Management

Target: 1-3 times your stop loss

Stop Loss: Below nearest liquidity zone for longs, above for shorts

Position Size: Never risk more than 1% per trade

Score ≥5: Take full position size

Score =4: Take half position size or skip

🔧 Customization Options

Input Groups

MACD Settings

Fast Length: 5 (scalping optimized)

Slow Length: 13

Signal Length: 5

EMA Settings

EMA 9, 20, 50 (fast scalping EMAs)

Stochastic Settings

%K Length: 5

%D Smoothing: 3

Smooth: 3

CVD Settings

MA Length: 10 (for CVD smoothing)

RSI Settings

Length: 7 (fast RSI)

Overbought: 70

Oversold: 30

Volume Settings

MA Length: 10

Extreme Multiplier: 2.5x

High Multiplier: 1.5x

Low Multiplier: 0.5x

Liquidity Zone Settings

Lookback Periods: 20

Swing Strength: 3

Show Liquidity Zones: On/Off

Show Liquidity Sweeps: On/Off

Support/Resistance Settings

Volume Lookback: 100 bars (~2 hours on 1-min chart)

Order Flow Settings

Imbalance Threshold: 2.0 (2:1 ratio)

Color Customization

All volume colors customizable

All signal colors customizable

All liquidity colors customizable

📊 Volume Legend (Top Right)

The small table in the top-right corner shows the volume intensity key:

Extreme: >2.5x average volume

High: >1.5x average volume

Normal: 0.5x to 1.5x average volume

Low: <0.5x average volume

🔔 Built-in Alerts

Set up these alerts to never miss a trade:

High Quality Long Scalp: Triggers when entry_long and score ≥5

High Quality Short Scalp: Triggers when entry_short and score ≥5

Bullish Liquidity Sweep: Triggers when sell-side liquidity is swept

Bearish Liquidity Sweep: Triggers when buy-side liquidity is swept

To set up: Right-click chart → Add Alert → Select condition → Create

💡 Pro Tips

Understanding Liquidity Zones

Buy-Side Liquidity = Where shorts have their stops = Price tends to wick up here

Sell-Side Liquidity = Where longs have their stops = Price tends to wick down here

Liquidity Sweep = Institution triggers stops, absorbs liquidity, then reverses

Best trades = Enter AFTER the sweep when price reverses back

Reading the Dashboard

All Green Dots + Yellow Volume = Strong Long Setup

All Red Dots + Yellow Volume = Strong Short Setup

Mixed Colors = Choppy/Neutral = Wait

Score 6+ = Highest probability trades

Score 3 or less = Avoid

Confluence is Key

Never trade on a single indicator. Wait for:

Dashboard score ≥5

Volume surge (yellow background)

At support/resistance OR liquidity zone

CVD and momentum aligned

Price structure confirmation (triangle marker)

Avoid These Situations

❌ Low volume periods (gray candles)

❌ Dashboard shows "WAIT"

❌ Score below 4

❌ No volume surge during entry

❌ Trading against higher timeframe trend

Best Trading Sessions

Forex: London open (3-5 AM EST), NY open (8-10 AM EST)

Crypto: Works 24/7, best during high volume periods

Stocks: First hour (9:30-10:30 AM EST), last hour (3-4 PM EST)

Futures: US session open (9:30 AM EST)

🎓 Understanding the Scoring System

The indicator calculates a quality score (0-8) for both long and short setups:

+1 point for each:

EMA bias aligned (price above/below EMA structure)

CVD momentum bias aligned (buying/selling pressure)

Buy/Sell pressure ratio aligned (>1.5x or <0.67x)

Volume strength (surge detected)

Order flow imbalance (>2:1 ratio)

Tape speed (>1.3x average)

Price structure (higher highs or lower lows)

Liquidity bias (sweep detected)

Score Interpretation:

7-8: Extremely high probability (rare, take immediately)

6: Very high probability (excellent trade)

5: High probability (good trade)

4: Decent probability (acceptable with tight stop)

3 or less: Low probability (wait for better setup)

📋 Quick Reference Card

Entry Checklist

Dashboard shows LONG or SHORT

Score is ≥5

Multiple indicators aligned (green or red dots)

Volume surge present (yellow background)

At support/resistance or liquidity zone

Triangle marker appeared on chart

Risk:Reward ratio is at least 1:2

Exit Strategy

Take Profit: At opposite liquidity zone or resistance/support

Stop Loss: Below sell-side liquidity (longs) or above buy-side liquidity (shorts)

Trail Stop: Move to breakeven after 1:1 risk:reward achieved

⚠️ Important Notes

This is NOT a holy grail: No indicator is 100% accurate. Always use proper risk management.

Backtest first: Paper trade or backtest on your specific instrument before using real money.

Market conditions matter: This indicator works best in trending or volatile markets, not in tight consolidation.

Combine with price action: Use the indicator as confluence with your own price action reading.

Adjust for your instrument: Different assets may require tweaking the sensitivity settings.

Lower timeframes = More noise: 1-minute charts have more false signals than 5-minute charts.

🔄 Version History

v1.0 - Initial release

Multi-indicator dashboard

Volume-based candle coloring

Support/Resistance detection

Entry signal generation

v2.0 - Current version

Added liquidity zone detection

Added liquidity sweep identification

Enhanced scoring system (now 0-8)

Added liquidity bias to entries

New alerts for liquidity sweeps

Improved dashboard with Liq indicator

📞 Support & Feedback

If you find this indicator helpful, please:

⭐ Give it a boost

💬 Share your results in the comments

🐛 Report any bugs or issues

💡 Suggest improvements

Disclaimer: This indicator is for educational purposes only. Trading involves significant risk. Past performance does not guarantee future results. Always trade responsibly and never risk more than you can afford to lose.

🏆 Credits

Created for serious scalpers who want institutional-level insights on retail charts. Combines order flow analysis, volume profiling, and liquidity mapping into one comprehensive tool.

Happy Scalping! 🚀📈

📊 Overview

A comprehensive scalping indicator designed for high-frequency traders on 1-5 minute timeframes. This all-in-one dashboard combines volume analysis, order flow metrics, technical indicators, and institutional liquidity zones to identify high-probability scalping opportunities.

🎯 Key Features

✅ Multi-Timeframe Analysis

Fast MACD (5/13/5) for momentum

Quick EMAs (9/20/50) for trend direction

Rapid Stochastic (5/3/3) for oversold/overbought conditions

Fast RSI (7) for extreme readings

✅ Advanced Order Flow Metrics

CVD (Cumulative Volume Delta): Tracks buy vs sell pressure over time

Delta Momentum: Measures acceleration in buying/selling

Buy/Sell Pressure Ratio: Real-time balance of market forces

Order Flow Imbalance: Detects aggressive buying or selling

Tape Speed: Measures how fast volume is hitting the market

✅ Institutional Liquidity Zones

Buy-Side Liquidity: Areas above price where short stop losses cluster

Sell-Side Liquidity: Areas below price where long stop losses cluster

Liquidity Sweeps: Detects "stop hunts" by institutions before reversals

✅ Volume-Based Candle Coloring

Visual representation of volume intensity

Extreme, High, Normal, and Low volume categories

Fully customizable color schemes

✅ Dynamic Support/Resistance

Volume-weighted price levels

Automatically updates every 3 bars

Shows distance to key levels

📈 Dashboard Indicators Explained

The bottom-left dashboard displays 14 real-time metrics:

▸ MACD (●)

Green = Bullish momentum

Red = Bearish momentum

Gray = Neutral

▸ Supp (Price)

Support level

Green highlight = at support (good for long entry)

▸ Res (Price)

Resistance level

Orange highlight = at resistance (good for short entry)

▸ EMA (●)

Green = Price above EMAs (bullish)

Red = Price below EMAs (bearish)

▸ Stoch (●)

Green = Oversold (<20)

Red = Overbought (>80)

Gray = Neutral

▸ RSI (●)

Green = Oversold (<30)

Red = Overbought (>70)

Gray = Neutral

▸ CVD (●)

Green = Cumulative buying pressure

Red = Cumulative selling pressure

▸ ΔCVD (●)

Green = Increasing buy pressure

Red = Increasing sell pressure

▸ Imbal (●)

Green = Buy imbalance (>2:1 ratio)

Red = Sell imbalance

▸ Vol (●)

Green/Yellow background = Volume surge (>2x average)

▸ Tape (●)

Green/Yellow background = Fast tape (>1.5x speed)

▸ Liq (↑↓●)

↑ = Bullish sweep or near sell-side liquidity

↓ = Bearish sweep or near buy-side liquidity

● = Neutral

▸ Score (#L or #S)

Quality score (0-8) for Long or Short setups

Higher numbers = Better quality trade

▸ SCALP (LONG/SHORT/WAIT)

Primary signal

Bright color = High quality (score ≥5)

Dim color = Decent quality (score =4)

Gray = Wait for better setup

🎨 Candle Color System

Volume-Based Colors

Bright Green/Red: Extreme volume (>2.5x average) - Major moves

Medium Green/Red: High volume (>1.5x average) - Strong activity

Dull Green/Red: Normal volume - Standard market activity

Gray: Low volume (<0.5x average) - Avoid trading

Signal-Based Colors

Lime: Strong Long signal (score ≥5)

Green: Decent Long signal (score =4)

Orange: Strong Short signal (score ≥5)

Red: Decent Short signal (score =4)

Candle Color Modes (adjustable in settings):

Volume Only: Pure volume intensity

Volume + Signals: Signals override volume when present (default)

Signals Only: Only shows entry signals

🔵 Chart Indicators

Support & Resistance Lines

Green Line: Volume-weighted support level

Red Line: Volume-weighted resistance level

Lines update dynamically based on 100-bar volume profile

Liquidity Zones

Cyan Circles/Dashed Lines: Buy-side liquidity (above price)

Where short stop losses cluster

Potential targets for bullish moves

Institutions may push price here before reversing down

Magenta Circles/Dashed Lines: Sell-side liquidity (below price)

Where long stop losses cluster

Potential targets for bearish moves

Institutions may push price here before reversing up

Entry Markers

Large Green Triangle (▲): High quality long entry (score ≥5)

Small Green Triangle (▲): Decent long entry (score =4)

Large Orange Triangle (▼): High quality short entry (score ≥5)

Small Red Triangle (▼): Decent short entry (score =4)

Liquidity Sweep Markers

Cyan X-Cross (below bar): Bullish liquidity sweep - "LIQ↑"

Price swept sell-side liquidity and reversed up

Strong buy signal

Magenta X-Cross (above bar): Bearish liquidity sweep - "LIQ↓"

Price swept buy-side liquidity and reversed down

Strong sell signal

🎯 How to Use This Indicator

For Long Scalps (Buy):

Wait for Dashboard Signal: SCALP = "LONG" with score ≥5

Confirm Multiple Green Dots: Look for EMA, CVD, ΔCVD, Imbal all green

Check Volume: Vol or Tape should show yellow background (surge)

Look for Confluence:

Price at or near Support level (green highlight)

Price near Sell-Side Liquidity (magenta line below)

RSI oversold (green dot)

Large green triangle appears on chart

Best Entry: On a bullish liquidity sweep (cyan X-cross)

For Short Scalps (Sell):

Wait for Dashboard Signal: SCALP = "SHORT" with score ≥5

Confirm Multiple Red Dots: Look for EMA, CVD, ΔCVD, Imbal all red

Check Volume: Vol or Tape should show yellow background (surge)

Look for Confluence:

Price at or near Resistance level (orange highlight)

Price near Buy-Side Liquidity (cyan line above)

RSI overbought (red dot)

Large orange triangle appears on chart

Best Entry: On a bearish liquidity sweep (magenta X-cross)

Three Types of Scalping Setups:

1. Quick Scalp (Fastest - 1-5 minute holds)

MACD or Stochastic crossover + Volume surge

At Support/Resistance level

Score ≥4

2. Momentum Scalp (Ride the wave - 5-15 minute holds)

Strong EMA alignment + CVD slope positive

Order flow imbalance + Fast tape

Volume surge with price structure

Score ≥5

3. Reversal Scalp (Fade extremes - 3-10 minute holds)

Stochastic + RSI extreme readings

At Support/Resistance OR liquidity sweep

CVD momentum reversal

Score ≥6

⚙️ Recommended Settings

Timeframes

Primary: 1-minute, 2-minute, 5-minute

Confirmation: Use 15-minute chart for overall trend direction

Asset Types

Forex pairs (high liquidity)

Crypto (BTC, ETH with high volume)

Futures (ES, NQ)

Major stocks during market hours

Risk Management

Target: 1-3 times your stop loss

Stop Loss: Below nearest liquidity zone for longs, above for shorts

Position Size: Never risk more than 1% per trade

Score ≥5: Take full position size

Score =4: Take half position size or skip

🔧 Customization Options

Input Groups

MACD Settings

Fast Length: 5 (scalping optimized)

Slow Length: 13

Signal Length: 5

EMA Settings

EMA 9, 20, 50 (fast scalping EMAs)

Stochastic Settings

%K Length: 5

%D Smoothing: 3

Smooth: 3

CVD Settings

MA Length: 10 (for CVD smoothing)

RSI Settings

Length: 7 (fast RSI)

Overbought: 70

Oversold: 30

Volume Settings

MA Length: 10

Extreme Multiplier: 2.5x

High Multiplier: 1.5x

Low Multiplier: 0.5x

Liquidity Zone Settings

Lookback Periods: 20

Swing Strength: 3

Show Liquidity Zones: On/Off

Show Liquidity Sweeps: On/Off

Support/Resistance Settings

Volume Lookback: 100 bars (~2 hours on 1-min chart)

Order Flow Settings

Imbalance Threshold: 2.0 (2:1 ratio)

Color Customization

All volume colors customizable

All signal colors customizable

All liquidity colors customizable

📊 Volume Legend (Top Right)

The small table in the top-right corner shows the volume intensity key:

Extreme: >2.5x average volume

High: >1.5x average volume

Normal: 0.5x to 1.5x average volume

Low: <0.5x average volume

🔔 Built-in Alerts

Set up these alerts to never miss a trade:

High Quality Long Scalp: Triggers when entry_long and score ≥5

High Quality Short Scalp: Triggers when entry_short and score ≥5

Bullish Liquidity Sweep: Triggers when sell-side liquidity is swept

Bearish Liquidity Sweep: Triggers when buy-side liquidity is swept

To set up: Right-click chart → Add Alert → Select condition → Create

💡 Pro Tips

Understanding Liquidity Zones

Buy-Side Liquidity = Where shorts have their stops = Price tends to wick up here

Sell-Side Liquidity = Where longs have their stops = Price tends to wick down here

Liquidity Sweep = Institution triggers stops, absorbs liquidity, then reverses

Best trades = Enter AFTER the sweep when price reverses back

Reading the Dashboard

All Green Dots + Yellow Volume = Strong Long Setup

All Red Dots + Yellow Volume = Strong Short Setup

Mixed Colors = Choppy/Neutral = Wait

Score 6+ = Highest probability trades

Score 3 or less = Avoid

Confluence is Key

Never trade on a single indicator. Wait for:

Dashboard score ≥5

Volume surge (yellow background)

At support/resistance OR liquidity zone

CVD and momentum aligned

Price structure confirmation (triangle marker)

Avoid These Situations

❌ Low volume periods (gray candles)

❌ Dashboard shows "WAIT"

❌ Score below 4

❌ No volume surge during entry

❌ Trading against higher timeframe trend

Best Trading Sessions

Forex: London open (3-5 AM EST), NY open (8-10 AM EST)

Crypto: Works 24/7, best during high volume periods

Stocks: First hour (9:30-10:30 AM EST), last hour (3-4 PM EST)

Futures: US session open (9:30 AM EST)

🎓 Understanding the Scoring System

The indicator calculates a quality score (0-8) for both long and short setups:

+1 point for each:

EMA bias aligned (price above/below EMA structure)

CVD momentum bias aligned (buying/selling pressure)

Buy/Sell pressure ratio aligned (>1.5x or <0.67x)

Volume strength (surge detected)

Order flow imbalance (>2:1 ratio)

Tape speed (>1.3x average)

Price structure (higher highs or lower lows)

Liquidity bias (sweep detected)

Score Interpretation:

7-8: Extremely high probability (rare, take immediately)

6: Very high probability (excellent trade)

5: High probability (good trade)

4: Decent probability (acceptable with tight stop)

3 or less: Low probability (wait for better setup)

📋 Quick Reference Card

Entry Checklist

Dashboard shows LONG or SHORT

Score is ≥5

Multiple indicators aligned (green or red dots)

Volume surge present (yellow background)

At support/resistance or liquidity zone

Triangle marker appeared on chart

Risk:Reward ratio is at least 1:2

Exit Strategy

Take Profit: At opposite liquidity zone or resistance/support

Stop Loss: Below sell-side liquidity (longs) or above buy-side liquidity (shorts)

Trail Stop: Move to breakeven after 1:1 risk:reward achieved

⚠️ Important Notes

This is NOT a holy grail: No indicator is 100% accurate. Always use proper risk management.

Backtest first: Paper trade or backtest on your specific instrument before using real money.

Market conditions matter: This indicator works best in trending or volatile markets, not in tight consolidation.

Combine with price action: Use the indicator as confluence with your own price action reading.

Adjust for your instrument: Different assets may require tweaking the sensitivity settings.

Lower timeframes = More noise: 1-minute charts have more false signals than 5-minute charts.

🔄 Version History

v1.0 - Initial release

Multi-indicator dashboard

Volume-based candle coloring

Support/Resistance detection

Entry signal generation

v2.0 - Current version

Added liquidity zone detection

Added liquidity sweep identification

Enhanced scoring system (now 0-8)

Added liquidity bias to entries

New alerts for liquidity sweeps

Improved dashboard with Liq indicator

📞 Support & Feedback

If you find this indicator helpful, please:

⭐ Give it a boost

💬 Share your results in the comments

🐛 Report any bugs or issues

💡 Suggest improvements

Disclaimer: This indicator is for educational purposes only. Trading involves significant risk. Past performance does not guarantee future results. Always trade responsibly and never risk more than you can afford to lose.

🏆 Credits

Created for serious scalpers who want institutional-level insights on retail charts. Combines order flow analysis, volume profiling, and liquidity mapping into one comprehensive tool.

Happy Scalping! 🚀📈

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.