PROTECTED SOURCE SCRIPT

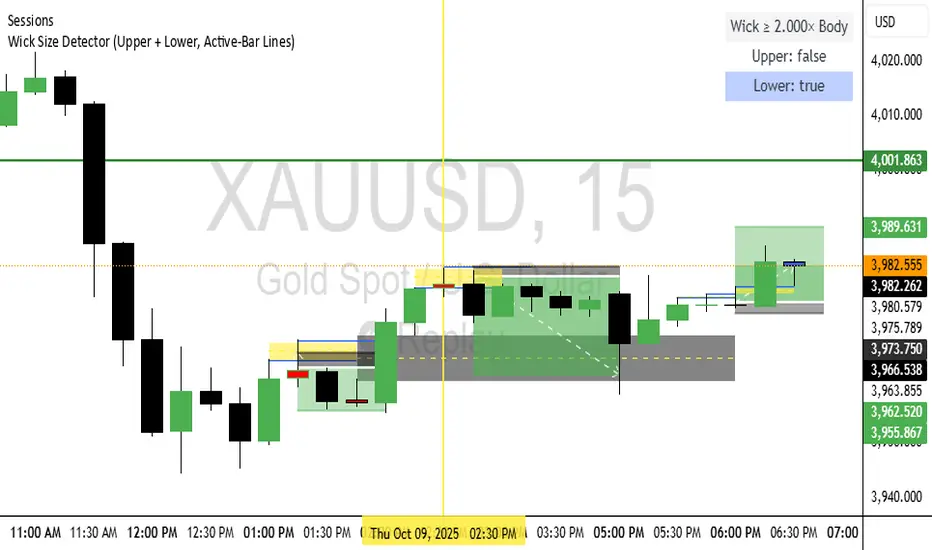

Wick Size Detector (Upper + Lower, Active-Bar Lines)

🧭 1. Understanding What the Indicator Tells You

Each signal means a potential shift in intent — a wick implies rejection of price at one extreme.

Upper Wick (red) → Sellers rejected higher prices → potential short setup.

Lower Wick (green) → Buyers rejected lower prices → potential long setup.

Dual Wick (both large) → Exhaustion / indecision → likely reversal or range start.

The wick is not a trade by itself — it’s a context clue telling you where liquidity was swept and which side failed.

🧩 2. Framework for Trading Wick Signals

Use a two-stage decision model: context → confirmation.

Stage 1: Context Filter

Before taking any wick, make sure the background aligns:

Higher timeframe (1H / 4H / Daily) bias using:

Market structure (higher highs/lows)

EMA slope or Fair Value Gap alignment

Key liquidity (PDH, PDL, Daily Open)

Example:

4H is bullish (higher lows + above 50 EMA) → focus only on green lower-wick signals.

4H is bearish → focus only on red upper-wick signals.

This avoids trading against momentum.

Stage 2: Confirmation & Entry

Once a valid wick signal appears in context:

✅ Entry Logic

Wait for candle with qualifying wick (per indicator).

On next candle:

For a lower wick (buy setup) →

Enter long near the midpoint or discount (50–62%) of the wick candle’s range.

For an upper wick (sell setup) →

Enter short near the midpoint or premium (50–62%) of the wick candle’s range.

🛑 Stop Loss

Below the wick low for buys.

Above the wick high for sells.

🎯 Take Profit

Target prior liquidity points:

For buys → previous highs or equilibrium.

For sells → previous lows or daily open.

Or use a fixed R:R (e.g., 2:1).

⚖️ Optional: Wait for Confirmation (Displacement / MSS)

If you combine this with your ICT-style workflow:

Wait for a market structure shift in direction of the wick.

Confirm the Change in State of Delivery (CISD) before entry.

🧠 3. Example Walkthrough

Setup:

You’re on the 15-minute chart, wickMultiplier = 1.2.

Price makes a big upper wick → indicator flashes red.

On 1H and 4H, you see price near a premium area or PDH.

Next candle opens → you short at the midpoint of that wick candle.

Stop above the wick high.

Take profit near the prior swing low or 2× risk distance.

If you see MSS confirmation → add confluence.

💡 4. Tips for Real Implementation

Multi-timeframe filter: Only take wick signals in alignment with HTF bias.

Session discipline: Limit signals to high-volume sessions (London / New York).

Avoid strong trend continuation candles (small wicks, big bodies).

Combine with displacement → your best trades come when a large wick forms into liquidity, then displacement confirms it.

Avoid every signal: Some wicks are just noise. Wait for those near obvious liquidity (previous highs/lows).

Each signal means a potential shift in intent — a wick implies rejection of price at one extreme.

Upper Wick (red) → Sellers rejected higher prices → potential short setup.

Lower Wick (green) → Buyers rejected lower prices → potential long setup.

Dual Wick (both large) → Exhaustion / indecision → likely reversal or range start.

The wick is not a trade by itself — it’s a context clue telling you where liquidity was swept and which side failed.

🧩 2. Framework for Trading Wick Signals

Use a two-stage decision model: context → confirmation.

Stage 1: Context Filter

Before taking any wick, make sure the background aligns:

Higher timeframe (1H / 4H / Daily) bias using:

Market structure (higher highs/lows)

EMA slope or Fair Value Gap alignment

Key liquidity (PDH, PDL, Daily Open)

Example:

4H is bullish (higher lows + above 50 EMA) → focus only on green lower-wick signals.

4H is bearish → focus only on red upper-wick signals.

This avoids trading against momentum.

Stage 2: Confirmation & Entry

Once a valid wick signal appears in context:

✅ Entry Logic

Wait for candle with qualifying wick (per indicator).

On next candle:

For a lower wick (buy setup) →

Enter long near the midpoint or discount (50–62%) of the wick candle’s range.

For an upper wick (sell setup) →

Enter short near the midpoint or premium (50–62%) of the wick candle’s range.

🛑 Stop Loss

Below the wick low for buys.

Above the wick high for sells.

🎯 Take Profit

Target prior liquidity points:

For buys → previous highs or equilibrium.

For sells → previous lows or daily open.

Or use a fixed R:R (e.g., 2:1).

⚖️ Optional: Wait for Confirmation (Displacement / MSS)

If you combine this with your ICT-style workflow:

Wait for a market structure shift in direction of the wick.

Confirm the Change in State of Delivery (CISD) before entry.

🧠 3. Example Walkthrough

Setup:

You’re on the 15-minute chart, wickMultiplier = 1.2.

Price makes a big upper wick → indicator flashes red.

On 1H and 4H, you see price near a premium area or PDH.

Next candle opens → you short at the midpoint of that wick candle.

Stop above the wick high.

Take profit near the prior swing low or 2× risk distance.

If you see MSS confirmation → add confluence.

💡 4. Tips for Real Implementation

Multi-timeframe filter: Only take wick signals in alignment with HTF bias.

Session discipline: Limit signals to high-volume sessions (London / New York).

Avoid strong trend continuation candles (small wicks, big bodies).

Combine with displacement → your best trades come when a large wick forms into liquidity, then displacement confirms it.

Avoid every signal: Some wicks are just noise. Wait for those near obvious liquidity (previous highs/lows).

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.