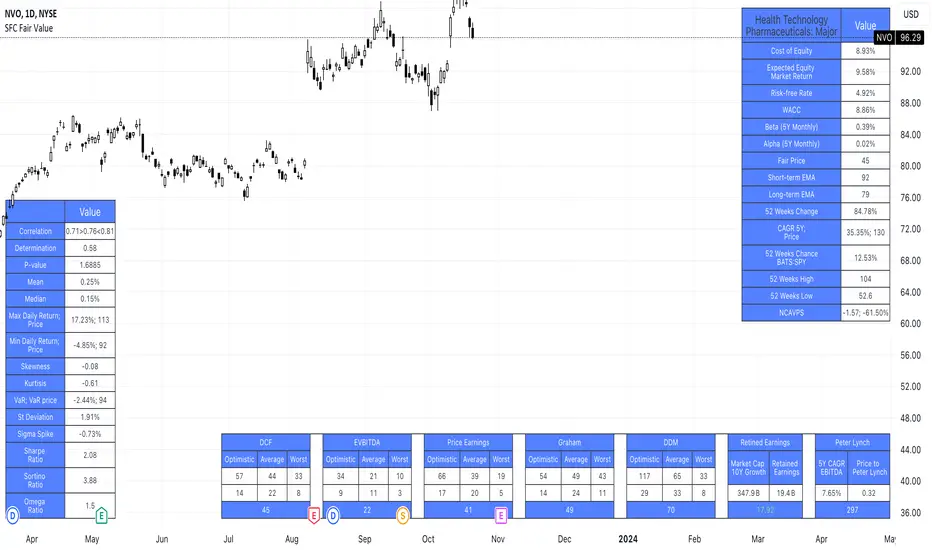

SFC Valuation Model - Fair Value

Fundamental analysis is often employed in valuation, although several other methods may be employed such as the capital asset pricing model (CAPM) or the dividend discount model (DDM), Discounted Cash Flow (DCF) and many others.

A valuation can be useful when trying to determine the fair value of a security, which is determined by what a buyer is willing to pay a seller, assuming both parties enter the transaction willingly. When a security trades on an exchange, buyers and sellers determine the market value of a stock or bond.

There is no universal standard for calculating the intrinsic value of a company or stock. Financial analysts attempt to determine an asset's intrinsic value by using fundamental and technical analyses to gauge its actual financial performance.

Intrinsic value is useful because it can help an investor understand whether a potential investment is overvalued or undervalued.

This indicator allows investors to simulate different scenarios depending on their view of the stock's value. It calculates different models automatically, but users can define the fair value manually by changing the settings.

For example: change the weight of the model; choose how conservatively want to evaluate the stock; use different growth rate or discount rate and so on.

The indicator shows other useful metrics in order to help investors to evaluate the stock.

This indicator can save users hours of searching financial data and calculating fair value.

There are few valuation methods/steps

- Macroeconomics - analyse the current economic;

- Define how the sector is performing;

- Relative valuation method - compare few stocks and find the Outlier;

- Absolute valuation method historically- define how the stock performed in the past;

- Absolute valuation method - define how the stock is performed now and find the fair value;

- Technical analysis

How to use:

1. Once you have completed the initial evaluation steps, simply load the indicator.

2. Check the default settings and see if they suit you.

3. Find the fair value and wait for the stock to reach it.

- added more metrics for full analysis

- added Graham valuation model

- added Net current asset value per share (NCAVPS)

Скрипт с ограниченным доступом

Доступ к этому скрипту имеют только пользователи, одобренные автором. Вам необходимо запросить и получить разрешение на его использование. Обычно оно предоставляется после оплаты. Для получения подробной информации следуйте инструкциям автора ниже или свяжитесь напрямую с SerpentForexClub.

TradingView НЕ рекомендует оплачивать или использовать скрипт, если вы полностью не доверяете его автору и не понимаете, как он работает. Вы также можете найти бесплатные, открытые альтернативы в наших скриптах сообщества.

Инструкции от автора

Отказ от ответственности

Скрипт с ограниченным доступом

Доступ к этому скрипту имеют только пользователи, одобренные автором. Вам необходимо запросить и получить разрешение на его использование. Обычно оно предоставляется после оплаты. Для получения подробной информации следуйте инструкциям автора ниже или свяжитесь напрямую с SerpentForexClub.

TradingView НЕ рекомендует оплачивать или использовать скрипт, если вы полностью не доверяете его автору и не понимаете, как он работает. Вы также можете найти бесплатные, открытые альтернативы в наших скриптах сообщества.