PROTECTED SOURCE SCRIPT

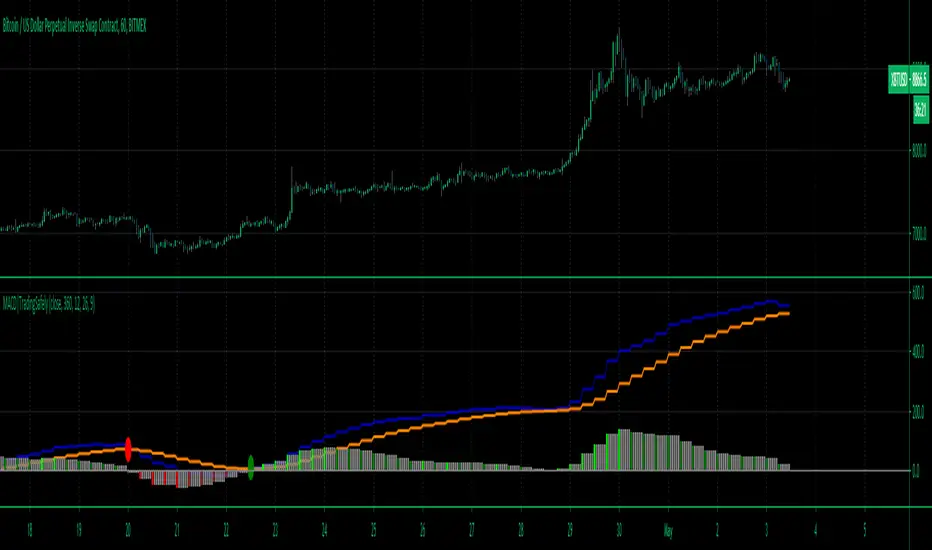

Trading Safely Multiple Time Frame Dynamic MACD

Our Multi-Time frame MACD is a Zero-Lag (well near zero-lag) We make this claim because MACD utilizes Moving Averages and as you know moving averages are lagging indicators.

For our MACD we utilize The McGinley Dynamic which looks like a moving average line yet it is a smoothing mechanism for prices that turns out to track far better than any moving average.

The McGinley Dynamic minimizes price separation, price whipsaws and hugs prices much more closely.

The McGinley Dynamic does this automatically as this is a factor of the formula.

Because of the calculation, the Dynamic Line speeds up in down markets as it follows prices yet moves more slowly in up markets.

As traders we want to be quick to sell in a down market, yet ride an up market as long as possible.

How to Trade.

It best to use lower time frame charts and higher time frame MACD settings such as 1H chart and 6H (360min) MACD time frame

You can input any time frame in minutes from 1 min to 1440 minutes on the MACD settings.

1H = 60

2H = 120

3H = 180

4H = 240

6H = 360

12H = 720

24H = 1440

Week = W

Month = M

You can set alerts for bullish and bearish crossovers which are good indications of a potential entry into a long or short trade.

shout out to lonesometheblue for inspiration.

For our MACD we utilize The McGinley Dynamic which looks like a moving average line yet it is a smoothing mechanism for prices that turns out to track far better than any moving average.

The McGinley Dynamic minimizes price separation, price whipsaws and hugs prices much more closely.

The McGinley Dynamic does this automatically as this is a factor of the formula.

Because of the calculation, the Dynamic Line speeds up in down markets as it follows prices yet moves more slowly in up markets.

As traders we want to be quick to sell in a down market, yet ride an up market as long as possible.

How to Trade.

It best to use lower time frame charts and higher time frame MACD settings such as 1H chart and 6H (360min) MACD time frame

You can input any time frame in minutes from 1 min to 1440 minutes on the MACD settings.

1H = 60

2H = 120

3H = 180

4H = 240

6H = 360

12H = 720

24H = 1440

Week = W

Month = M

You can set alerts for bullish and bearish crossovers which are good indications of a potential entry into a long or short trade.

shout out to lonesometheblue for inspiration.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.