OPEN-SOURCE SCRIPT

Volatility Forecast

/*==============================================================================

Volatility Forecast — Publishable Documentation

Author: BB_9791

License: Mozilla Public License 2.0

WHAT THIS INDICATOR SHOWS

- A daily volatility estimate in percent points, called sigma_day.

- A slow volatility anchor, the 10-year EMA of sigma_day.

- A blended volatility series in percent points:

sigma_blend = (1 − p) * sigma_day + p * EMA_10y(sigma_day)

where p is the Slow weight %, default 30.

- Optional annualization by multiplying by 16, this is a daily-to-annual

conversion used by Robert Carver in his writings.

METHODOLOGY, CREDIT

The estimator follows the approach popularized by Robert Carver

("Systematic Trading", "Advanced Futures Trading Strategies", blog qoppac).

Current daily volatility is computed as an exponentially weighted standard

deviation of daily percent returns, with alpha = 2 / (span + 1).

The slow leg is a long EMA of that volatility series, about 10 years.

The blend uses fixed weights. This keeps the slow leg meaningful through

large price level changes, since the blend is done in percent space first.

MATH DETAILS

Let r_t be daily percent return:

r_t = 100 * (Close_t / Close_{t−1} − 1)

EWMA mean and variance:

m_t = α * r_t + (1 − α) * m_{t−1}

v_t = α * (r_t − m_t)^2 + (1 − α) * v_{t−1}

where α = 2 / (span_current + 1)

Current daily sigma in percent points:

sigma_day = sqrt(v_t)

Slow leg:

sigma_10y = EMA(sigma_day, span_long)

Blend:

sigma_blend = (1 − p) * sigma_day + p * sigma_10y

Annualized option:

sigma_ann = 16 * sigma_blend

INPUTS

- Threshold (percent points): horizontal guide level on the chart.

- Short term span (days): EW stdev span for sigma_day.

- Long term span (days): EMA span for the slow leg, choose about 2500 for 10 years.

- Slow weight %: p in the blend.

- Annualize (x16): plot daily or annualized values.

- Show components: toggles Current and 10y EMA lines.

- The script uses the chart symbol by default.

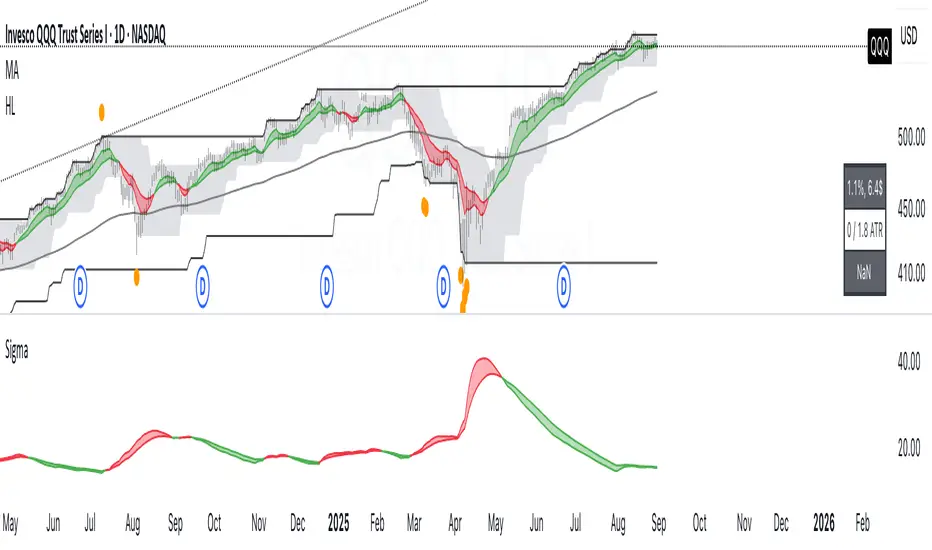

PLOTS

- Blended σ% as the main line.

- Optional Current σ% and 10y EMA σ%.

- Editable horizontal threshold line in the same units as the plot

(percent points per day or per year).

- Optional EMA 9 and EMA 20 cloud on the blended series, green for uptrend

when EMA 9 is above EMA 20, red otherwise. Opacity is configurable.

HOW TO READ

- Values are percent points of movement per day when not annualized,

for example 1.2 means about 1.2% typical daily move.

- With annualize checked, values are percent points per year, for example 18

means about 18% annualized volatility.

- Use the threshold and the EMA cloud to mark high or low volatility regimes.

NOTES

- All calculations use daily data via request.security at the chart symbol.

- The blend is done in percent space, then optionally annualized, which avoids

bias from the price level.

- This script does not produce trading signals by itself, it is a risk and

regime indicator.

CREDITS

Volatility forecasting method and scaling convention credited to Robert Carver.

See his books and blog for background and parameter choices.

VERSION

v1.0 Initial public release.

==============================================================================*/

Volatility Forecast — Publishable Documentation

Author: BB_9791

License: Mozilla Public License 2.0

WHAT THIS INDICATOR SHOWS

- A daily volatility estimate in percent points, called sigma_day.

- A slow volatility anchor, the 10-year EMA of sigma_day.

- A blended volatility series in percent points:

sigma_blend = (1 − p) * sigma_day + p * EMA_10y(sigma_day)

where p is the Slow weight %, default 30.

- Optional annualization by multiplying by 16, this is a daily-to-annual

conversion used by Robert Carver in his writings.

METHODOLOGY, CREDIT

The estimator follows the approach popularized by Robert Carver

("Systematic Trading", "Advanced Futures Trading Strategies", blog qoppac).

Current daily volatility is computed as an exponentially weighted standard

deviation of daily percent returns, with alpha = 2 / (span + 1).

The slow leg is a long EMA of that volatility series, about 10 years.

The blend uses fixed weights. This keeps the slow leg meaningful through

large price level changes, since the blend is done in percent space first.

MATH DETAILS

Let r_t be daily percent return:

r_t = 100 * (Close_t / Close_{t−1} − 1)

EWMA mean and variance:

m_t = α * r_t + (1 − α) * m_{t−1}

v_t = α * (r_t − m_t)^2 + (1 − α) * v_{t−1}

where α = 2 / (span_current + 1)

Current daily sigma in percent points:

sigma_day = sqrt(v_t)

Slow leg:

sigma_10y = EMA(sigma_day, span_long)

Blend:

sigma_blend = (1 − p) * sigma_day + p * sigma_10y

Annualized option:

sigma_ann = 16 * sigma_blend

INPUTS

- Threshold (percent points): horizontal guide level on the chart.

- Short term span (days): EW stdev span for sigma_day.

- Long term span (days): EMA span for the slow leg, choose about 2500 for 10 years.

- Slow weight %: p in the blend.

- Annualize (x16): plot daily or annualized values.

- Show components: toggles Current and 10y EMA lines.

- The script uses the chart symbol by default.

PLOTS

- Blended σ% as the main line.

- Optional Current σ% and 10y EMA σ%.

- Editable horizontal threshold line in the same units as the plot

(percent points per day or per year).

- Optional EMA 9 and EMA 20 cloud on the blended series, green for uptrend

when EMA 9 is above EMA 20, red otherwise. Opacity is configurable.

HOW TO READ

- Values are percent points of movement per day when not annualized,

for example 1.2 means about 1.2% typical daily move.

- With annualize checked, values are percent points per year, for example 18

means about 18% annualized volatility.

- Use the threshold and the EMA cloud to mark high or low volatility regimes.

NOTES

- All calculations use daily data via request.security at the chart symbol.

- The blend is done in percent space, then optionally annualized, which avoids

bias from the price level.

- This script does not produce trading signals by itself, it is a risk and

regime indicator.

CREDITS

Volatility forecasting method and scaling convention credited to Robert Carver.

See his books and blog for background and parameter choices.

VERSION

v1.0 Initial public release.

==============================================================================*/

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.