OPEN-SOURCE SCRIPT

Weather Score1000,100Modules 10 Families × 10 Variants

Weather Score 1000 — 100 Modules (10×10)

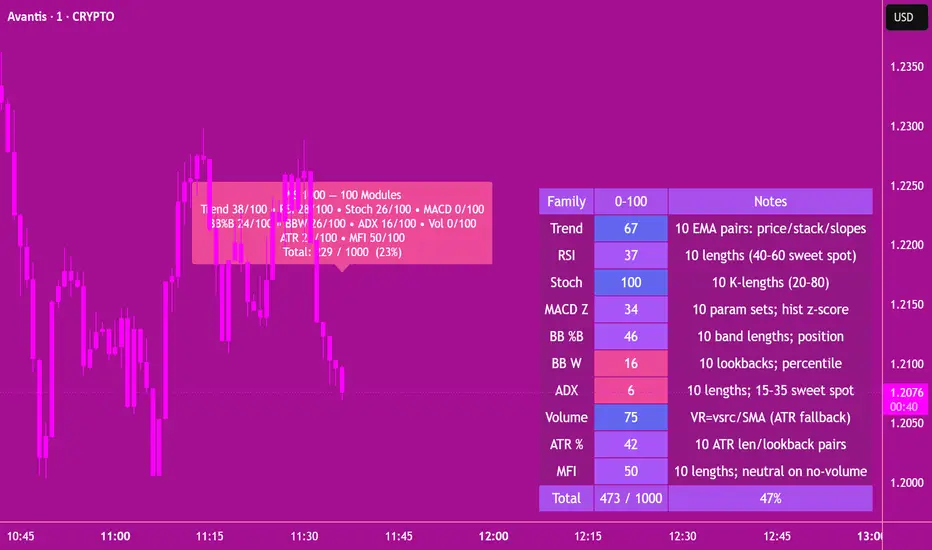

A plug-n-play market “weather station” that compresses 100 popular signals into one composite grade. Ten indicator families × ten variants each → a 0–100% readiness score (with GO / NO-GO alerts), plus a mini dashboard table and a draggable badge.

What it measures

10 families (each scored 0–100):

Trend: 10 EMA fast/slow pairs (price > fast/slow, stack & slope bonus)

RSI: 10 lengths, mapped by sweet-spot normalization (40–60)

Stochastic: 10 %K lengths, normalized to 20–80

MACD Z: manual MACD (no tuple quirks) with per-set histogram z-score

BB %B: price location inside the band (10 band lengths)

BB Width: band width percentile vs lookback (10 lookbacks)

ADX: Wilder’s ADX across 10 lengths (15–35 “power zone”)

Volume Pulse: volume vs SMA as a ratio (ATR fallback if no volume)

ATR %: ATR vs its own min/max percentile (10 len/lookback pairs)

MFI: custom MFI using running sums (robust to missing volume; neutral=50)

All families are normalized, then summed. Toggle families on/off; each on contributes up to 100 points toward the composite.

Why it’s robust

No ta.sum pitfalls: MFI uses rolling sums; stable across all assets.

Manual MACD: avoids tuple re-declarations and version quirks.

ATR fallback for volume: works on symbols with missing volume.

Percentile & sweet-spot scoring: adapts to regime shifts and scale.

How to read it

Composite: 0–100% readiness.

GO alert: composite ≥ your threshold (default 80%).

NO-GO alert: composite ≤ your threshold (default 20%).

Badge: quick readout of each family’s score + totals.

Mini table: per-family color heat, short notes, and the grand total.

Signals & visuals

GO / NO-GO alerts once per bar close.

Optional painted bars (soft lime for GO, soft red for NO-GO).

Draggable badge shows current breakdown.

Customization tips

Use the family toggles to fit your style (e.g., disable BB on crypto scalps).

Tighten GO for trend-following; loosen for mean-reversion.

Lower NO-GO if you want earlier exits.

Works across timeframes; many users like 15m–4h for entries and 1D for bias.

Best practices

Treat GO as context & timing, not a blind entry. Pair with SR/structure.

Look for confluence: price above fast/slow EMAs + MACD z > 0 + ADX in 15–35 zone + BBW rising.

On illiquid assets, lean more on ATR/Trend and less on Volume/MFI.

Limitations

Needs some history to warm up long lookbacks (e.g., 300–500 bars).

On gaps or tiny sessions, width/ATR percentiles can momentarily jump.

A plug-n-play market “weather station” that compresses 100 popular signals into one composite grade. Ten indicator families × ten variants each → a 0–100% readiness score (with GO / NO-GO alerts), plus a mini dashboard table and a draggable badge.

What it measures

10 families (each scored 0–100):

Trend: 10 EMA fast/slow pairs (price > fast/slow, stack & slope bonus)

RSI: 10 lengths, mapped by sweet-spot normalization (40–60)

Stochastic: 10 %K lengths, normalized to 20–80

MACD Z: manual MACD (no tuple quirks) with per-set histogram z-score

BB %B: price location inside the band (10 band lengths)

BB Width: band width percentile vs lookback (10 lookbacks)

ADX: Wilder’s ADX across 10 lengths (15–35 “power zone”)

Volume Pulse: volume vs SMA as a ratio (ATR fallback if no volume)

ATR %: ATR vs its own min/max percentile (10 len/lookback pairs)

MFI: custom MFI using running sums (robust to missing volume; neutral=50)

All families are normalized, then summed. Toggle families on/off; each on contributes up to 100 points toward the composite.

Why it’s robust

No ta.sum pitfalls: MFI uses rolling sums; stable across all assets.

Manual MACD: avoids tuple re-declarations and version quirks.

ATR fallback for volume: works on symbols with missing volume.

Percentile & sweet-spot scoring: adapts to regime shifts and scale.

How to read it

Composite: 0–100% readiness.

GO alert: composite ≥ your threshold (default 80%).

NO-GO alert: composite ≤ your threshold (default 20%).

Badge: quick readout of each family’s score + totals.

Mini table: per-family color heat, short notes, and the grand total.

Signals & visuals

GO / NO-GO alerts once per bar close.

Optional painted bars (soft lime for GO, soft red for NO-GO).

Draggable badge shows current breakdown.

Customization tips

Use the family toggles to fit your style (e.g., disable BB on crypto scalps).

Tighten GO for trend-following; loosen for mean-reversion.

Lower NO-GO if you want earlier exits.

Works across timeframes; many users like 15m–4h for entries and 1D for bias.

Best practices

Treat GO as context & timing, not a blind entry. Pair with SR/structure.

Look for confluence: price above fast/slow EMAs + MACD z > 0 + ADX in 15–35 zone + BBW rising.

On illiquid assets, lean more on ATR/Trend and less on Volume/MFI.

Limitations

Needs some history to warm up long lookbacks (e.g., 300–500 bars).

On gaps or tiny sessions, width/ATR percentiles can momentarily jump.

Скрипт с открытым кодом

В истинном духе TradingView автор этого скрипта опубликовал его с открытым исходным кодом, чтобы трейдеры могли понять, как он работает, и проверить на практике. Вы можете воспользоваться им бесплатно, но повторное использование этого кода в публикации регулируется Правилами поведения.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.

Скрипт с открытым кодом

В истинном духе TradingView автор этого скрипта опубликовал его с открытым исходным кодом, чтобы трейдеры могли понять, как он работает, и проверить на практике. Вы можете воспользоваться им бесплатно, но повторное использование этого кода в публикации регулируется Правилами поведения.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.