OPEN-SOURCE SCRIPT

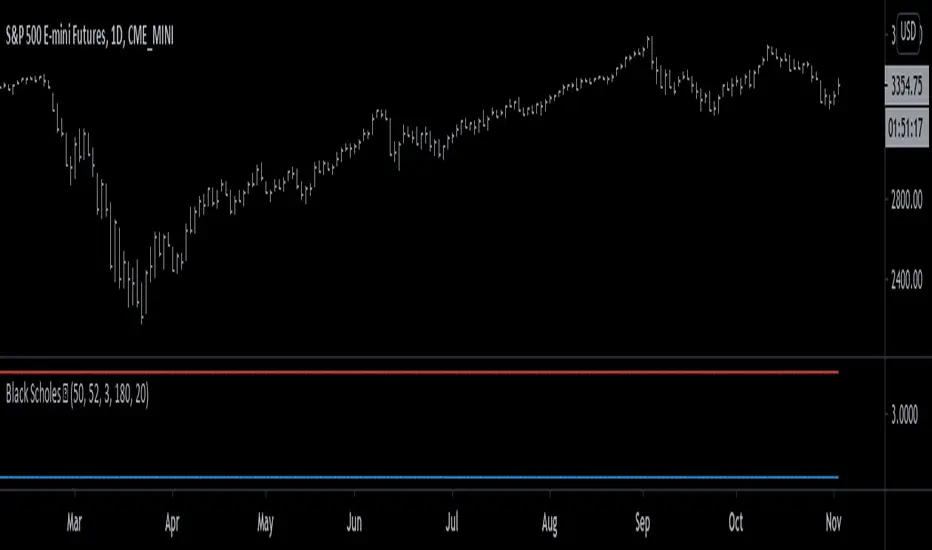

Black Scholes Model [racer8]

This is the Black Scholes Model. This indicator tells you the prices of both a call option & a put option.

Input variables are spot price, strike price, risk free rate %, days to maturity, and implied volatility %.

This indicator was made generally for educational purposes.

By using this indicator, you will develop a better understanding of how options are priced.

This indicator was made to be as simple as possible so that the user can easily understand it.

I recreated the Black Scholes Model because there is very little scripts on TV that are based on the Black Scholes Model.

I am aware that are Black Scholes Model (BSM) scripts already on TV, but mine is not the same. Correct me if I'm wrong, but I don't think there is a BSM script out there yet that relies on the exact same inputs that mine does.

Why use this indicator?

If you don't already have your own IV indicator...

You can use this indicator to approximate the value of implied volatility %.

You already know every input variable except IV%, and you know the call & put option prices.

So put in the numbers for each input and put a random number between 0 to 100 into the IV% input to get the options prices.

Adjust that random number for IV% until the output (options prices) matches correctly with what you already know they are to be.

This is called the trial and error method.

On the other hand, if you already know all input variables including IV%. Then you can use this indicator to find the call & put options prices directly.

Hope this helps. Enjoy 🙂

Input variables are spot price, strike price, risk free rate %, days to maturity, and implied volatility %.

This indicator was made generally for educational purposes.

By using this indicator, you will develop a better understanding of how options are priced.

This indicator was made to be as simple as possible so that the user can easily understand it.

I recreated the Black Scholes Model because there is very little scripts on TV that are based on the Black Scholes Model.

I am aware that are Black Scholes Model (BSM) scripts already on TV, but mine is not the same. Correct me if I'm wrong, but I don't think there is a BSM script out there yet that relies on the exact same inputs that mine does.

Why use this indicator?

If you don't already have your own IV indicator...

You can use this indicator to approximate the value of implied volatility %.

You already know every input variable except IV%, and you know the call & put option prices.

So put in the numbers for each input and put a random number between 0 to 100 into the IV% input to get the options prices.

Adjust that random number for IV% until the output (options prices) matches correctly with what you already know they are to be.

This is called the trial and error method.

On the other hand, if you already know all input variables including IV%. Then you can use this indicator to find the call & put options prices directly.

Hope this helps. Enjoy 🙂

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.