OPEN-SOURCE SCRIPT

Dow Theory Indicator

## 🎯 Key Features of the Indicator

### 📈 Complete Implementation of Dow Theory

- Three-tier trend structure: primary trend (50 periods), secondary trend (20 periods), and minor trend (10 periods).

- Swing point analysis: automatically detects critical swing highs and lows.

- Trend confirmation mechanism: strict confirmation logic based on consecutive higher highs/higher lows or lower highs/lower lows.

- Volume confirmation: ensures price moves are supported by trading volume.

### 🕐 Flexible Timeframe Parameters

All key parameters are adjustable, making it especially suitable for U.S. equities:

Trend analysis parameters:

- Primary trend period: 20–200 (default 50; recommended 50–100 for U.S. stocks).

- Secondary trend period: 10–100 (default 20; recommended 15–30 for U.S. stocks).

- Minor trend period: 5–50 (default 10; recommended 5–15 for U.S. stocks).

Dow Theory parameters:

- Swing high/low lookback: 5–50 (default 10).

- Trend confirmation bar count: 1–10 (default 3).

- Volume confirmation period: 10–100 (default 20).

### 🇺🇸 U.S. Market Optimizations

- Session awareness: distinguishes Regular Trading Hours (9:30–16:00 EST) from pre-market and after-hours.

- Pre/post-market weighting: adjustable weighting factor for signals during extended hours.

- Earnings season filter: automatically adjusts sensitivity during earnings periods.

- U.S.-optimized default parameters.

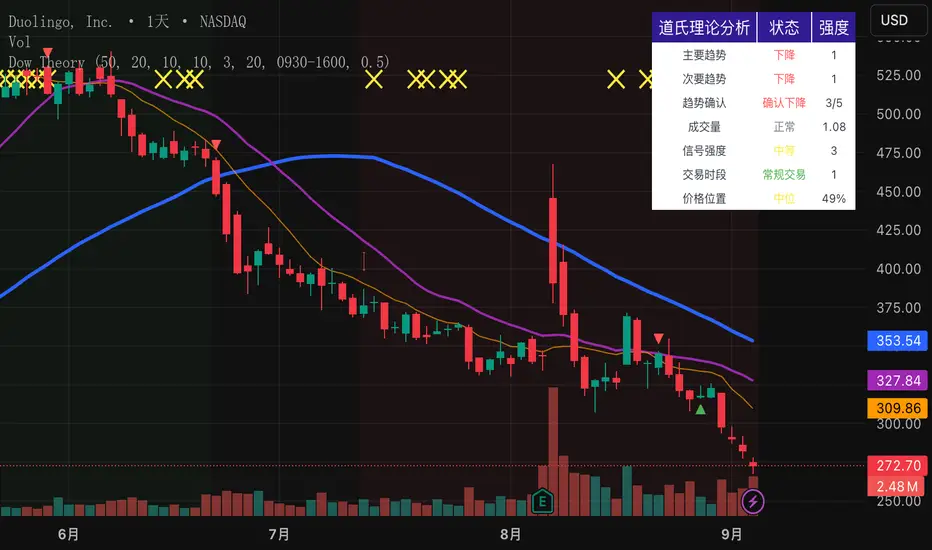

## 🎨 Visualization

1. Trend lines: three differently colored trend lines.

2. Background fill: green (uptrend) / red (downtrend) / gray (neutral).

3. Signal markers: arrows, labels, and warning icons.

4. Swing point markers: small triangles at key turning points.

5. Info panel: real-time display of eight key metrics.

## 🚨 Alert System

- Trend turning to up/down.

- Strong bullish/bearish signals (dual confirmation).

- Volume divergence warning.

- New swing high/low formed.

## 📋 How to Use

1. Open the Pine Editor in TradingView.

2. Copy the contents of dow_theory_indicator.pine.

3. Paste and click “Add to chart.”

4. Adjust parameters based on trading style:

- Long-term investing: increase all period parameters.

- Swing trading: use the default parameters.

- Short-term trading: decrease all period parameters.

## 💡 Parameter Tips for U.S. Stocks

- Large-cap blue chips (AAPL, MSFT): primary 60–80, secondary 25–30.

- Mid-cap growth stocks: primary 40–60, secondary 18–25.

- Small-cap high-volatility stocks: primary 30–50, secondary 15–20.[1][2][3]

### 📈 Complete Implementation of Dow Theory

- Three-tier trend structure: primary trend (50 periods), secondary trend (20 periods), and minor trend (10 periods).

- Swing point analysis: automatically detects critical swing highs and lows.

- Trend confirmation mechanism: strict confirmation logic based on consecutive higher highs/higher lows or lower highs/lower lows.

- Volume confirmation: ensures price moves are supported by trading volume.

### 🕐 Flexible Timeframe Parameters

All key parameters are adjustable, making it especially suitable for U.S. equities:

Trend analysis parameters:

- Primary trend period: 20–200 (default 50; recommended 50–100 for U.S. stocks).

- Secondary trend period: 10–100 (default 20; recommended 15–30 for U.S. stocks).

- Minor trend period: 5–50 (default 10; recommended 5–15 for U.S. stocks).

Dow Theory parameters:

- Swing high/low lookback: 5–50 (default 10).

- Trend confirmation bar count: 1–10 (default 3).

- Volume confirmation period: 10–100 (default 20).

### 🇺🇸 U.S. Market Optimizations

- Session awareness: distinguishes Regular Trading Hours (9:30–16:00 EST) from pre-market and after-hours.

- Pre/post-market weighting: adjustable weighting factor for signals during extended hours.

- Earnings season filter: automatically adjusts sensitivity during earnings periods.

- U.S.-optimized default parameters.

## 🎨 Visualization

1. Trend lines: three differently colored trend lines.

2. Background fill: green (uptrend) / red (downtrend) / gray (neutral).

3. Signal markers: arrows, labels, and warning icons.

4. Swing point markers: small triangles at key turning points.

5. Info panel: real-time display of eight key metrics.

## 🚨 Alert System

- Trend turning to up/down.

- Strong bullish/bearish signals (dual confirmation).

- Volume divergence warning.

- New swing high/low formed.

## 📋 How to Use

1. Open the Pine Editor in TradingView.

2. Copy the contents of dow_theory_indicator.pine.

3. Paste and click “Add to chart.”

4. Adjust parameters based on trading style:

- Long-term investing: increase all period parameters.

- Swing trading: use the default parameters.

- Short-term trading: decrease all period parameters.

## 💡 Parameter Tips for U.S. Stocks

- Large-cap blue chips (AAPL, MSFT): primary 60–80, secondary 25–30.

- Mid-cap growth stocks: primary 40–60, secondary 18–25.

- Small-cap high-volatility stocks: primary 30–50, secondary 15–20.[1][2][3]

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.