PROTECTED SOURCE SCRIPT

Обновлено TrendReversal

Strategy Description

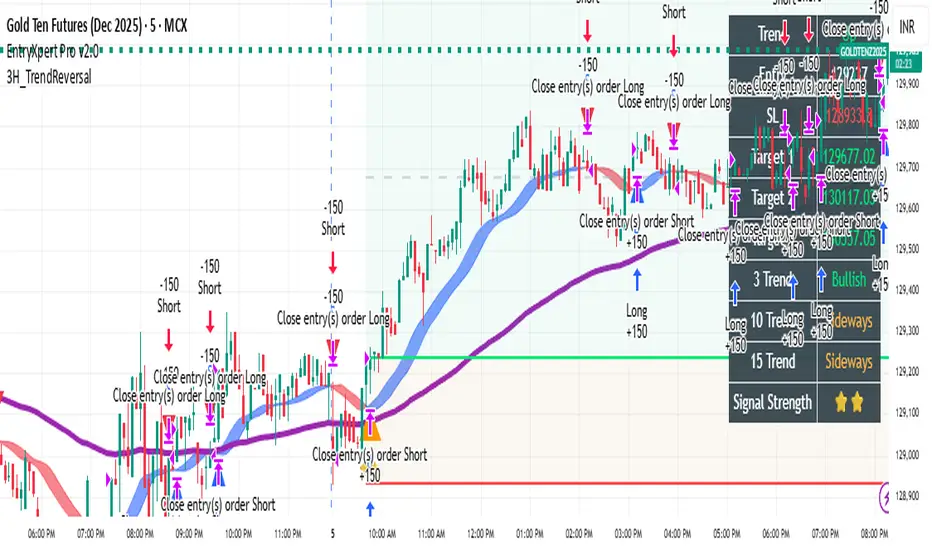

This is a noise-filtered, intraday reversal strategy that uses advanced Hull Moving Average (HULL) crossovers to generate fast and reliable trade signals with minimal false breakouts.

Key Features:

Core Logic: The strategy employs a Hull Moving Average (HULL) calculated using three selectable MA modes—HMA, EHMA, or THMA. It generates buy signals when the signal line (SHULL) crosses below the main HULL line, and sell signals when SHULL crosses above HULL. This crossover approach identifies momentum reversals with reduced repainting.

Noise Filtering: Built-in cooldown mechanism prevents consecutive same-side signals, reducing whipsaws. Users can adjust the minimum bars between same-side signals (default: 2 bars) to customize signal frequency and filter noise.

Trend Filter (Optional): An optional EMA(100) trend filter allows traders to only take long trades above the 100-period EMA and short trades below it, adding directional bias and improving win rate on trending days.

Customizable Inputs:

MA Mode: Choose between HMA, EHMA, or THMA

Length: Default 16 (adjustable 1+)

Length Multiplier: Fine-tune HULL sensitivity

Cooldown Bars: Control signal frequency (1–50 bars)

Band Visualization: Toggle HULL band display for visual support/resistance

Trend Filter: Optional EMA(100) directional bias

Position Management: Reversal-style entries close opposing positions before entering new trades. Position sizing defaults to 10% of equity per trade (adjustable).

Ideal For: Intraday traders, scalpers, and swing traders seeking a clean, signal-based system with minimal false entries on volatile instruments.

Note: This strategy performs best on high-volatility assets and intraday timeframes (5m–60m). Backtest and paper trade before live deployment.

This is a noise-filtered, intraday reversal strategy that uses advanced Hull Moving Average (HULL) crossovers to generate fast and reliable trade signals with minimal false breakouts.

Key Features:

Core Logic: The strategy employs a Hull Moving Average (HULL) calculated using three selectable MA modes—HMA, EHMA, or THMA. It generates buy signals when the signal line (SHULL) crosses below the main HULL line, and sell signals when SHULL crosses above HULL. This crossover approach identifies momentum reversals with reduced repainting.

Noise Filtering: Built-in cooldown mechanism prevents consecutive same-side signals, reducing whipsaws. Users can adjust the minimum bars between same-side signals (default: 2 bars) to customize signal frequency and filter noise.

Trend Filter (Optional): An optional EMA(100) trend filter allows traders to only take long trades above the 100-period EMA and short trades below it, adding directional bias and improving win rate on trending days.

Customizable Inputs:

MA Mode: Choose between HMA, EHMA, or THMA

Length: Default 16 (adjustable 1+)

Length Multiplier: Fine-tune HULL sensitivity

Cooldown Bars: Control signal frequency (1–50 bars)

Band Visualization: Toggle HULL band display for visual support/resistance

Trend Filter: Optional EMA(100) directional bias

Position Management: Reversal-style entries close opposing positions before entering new trades. Position sizing defaults to 10% of equity per trade (adjustable).

Ideal For: Intraday traders, scalpers, and swing traders seeking a clean, signal-based system with minimal false entries on volatile instruments.

Note: This strategy performs best on high-volatility assets and intraday timeframes (5m–60m). Backtest and paper trade before live deployment.

Информация о релизе

Strategy DescriptionThis is a noise-filtered, intraday reversal strategy that uses advanced Hull Moving Average (HULL) crossovers to generate fast and reliable trade signals with minimal false breakouts.

Key Features:

Core Logic: The strategy employs a Hull Moving Average (HULL) calculated using three selectable MA modes—HMA, EHMA, or THMA. It generates buy signals when the signal line (SHULL) crosses below the main HULL line, and sell signals when SHULL crosses above HULL. This crossover approach identifies momentum reversals with reduced repainting.

Noise Filtering: Built-in cooldown mechanism prevents consecutive same-side signals, reducing whipsaws. Users can adjust the minimum bars between same-side signals (default: 2 bars) to customize signal frequency and filter noise.

Trend Filter (Optional): An optional EMA(100) trend filter allows traders to only take long trades above the 100-period EMA and short trades below it, adding directional bias and improving win rate on trending days.

Customizable Inputs:

MA Mode: Choose between HMA, EHMA, or THMA

Length: Default 16 (adjustable 1+)

Length Multiplier: Fine-tune HULL sensitivity

Cooldown Bars: Control signal frequency (1–50 bars)

Band Visualization: Toggle HULL band display for visual support/resistance

Trend Filter: Optional EMA(100) directional bias

Position Management: Reversal-style entries close opposing positions before entering new trades. Position sizing defaults to 10% of equity per trade (adjustable).

Ideal For: Intraday traders, scalpers, and swing traders seeking a clean, signal-based system with minimal false entries on volatile instruments.

Note: This strategy performs best on high-volatility assets and intraday timeframes (5m–60m). Backtest and paper trade before live deployment.

Информация о релизе

TrendReversal (Hull MA Crossover)Overview: This is a trend-following algorithm designed to capture market reversals early by using lag-reduced Moving Averages (Hull MA suite). It employs a "Stop and Reverse" (SAR) logic, meaning it is always in the market—either Long or Short—flipping direction instantly upon detecting a valid signal.

Core Logic & Indicators:

Primary Signal: The strategy calculates a Hull Moving Average (User selectable: HMA, EHMA, or THMA). It generates signals based on the crossover between the Current Hull MA and a Delayed Hull MA (shifted back by 3 bars).

Rationale: This crossover detects changes in momentum direction faster than standard MA crossovers.

Trend Filter (Optional): An EMA 100 (Exponential Moving Average) acts as a baseline.

Logic: Longs are only taken if the price is above the EMA 100; Shorts are only taken if the price is below the EMA 100.

Noise Reduction: A "Cooldown" mechanism prevents the strategy from generating multiple same-side signals in rapid succession (e.g., during choppy consolidation), requiring a minimum bar gap between trades.

Entry Conditions:

LONG (Buy):

The Delayed Hull Band crosses UNDER the Current Hull Band.

(If Filter Active): Close price is ABOVE the EMA 100.

Cooldown period has passed since the last Buy signal.

SHORT (Sell):

The Delayed Hull Band crosses OVER the Current Hull Band.

(If Filter Active): Close price is BELOW the EMA 100.

Cooldown period has passed since the last Sell signal.

Exit Conditions:

Reversal: The strategy does not use fixed targets or stop-losses in the code. A "Long" position is closed immediately when a valid "Short" signal is generated, and vice versa (Stop and Reverse).

Key Settings (Customizable):

MA Mode: HMA (Hull), EHMA (Exponential Hull), or THMA (Triple Hull).

Length: Lookback period for the MA (Default: 16).

Cooldown: Minimum bars to wait before repeating a signal (Default: 2).

Technical Summary for Tradetron:

Trigger Type: alert() function (One-shot trigger).

Frequency: Once per Bar Close (to prevent repainting).

Alert Behavior: A single alert fires containing the JSON payload, initiating the entry and simultaneously closing the opposing position.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.