OPEN-SOURCE SCRIPT

Wave Consolidation [LuxAlgo]

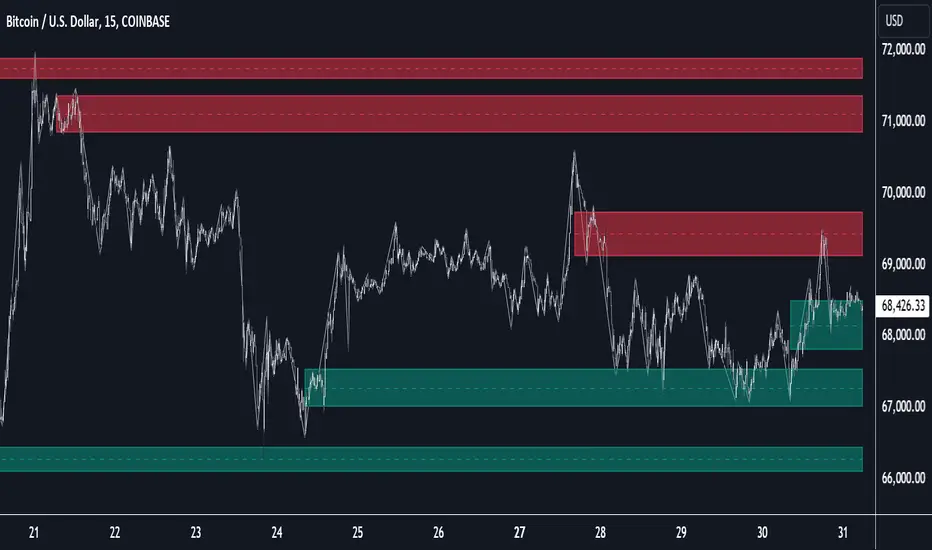

The Wave Consolidation indicator uses market profiles to highlight consolidation zones based on upward and downward moves determined when a Higher-High or Lower-Low is created.

Users can control the amount of consolidation zones to display and the sensitivity of the swing point detection used to return those zones.

🔶 USAGE

These zones are intended as areas of interest to traders where price has seen historical interactions, which can be interpreted as support and resistance. By identifying these areas of interest before the price returns to them, traders are able to anticipate and prepare for various scenarios and respond dynamically to the behavior of the market, as seen below.

Below is an example of the Rejection and Consolidation scenarios described above.

Note: By analyzing the tests and retests of these zones, traders can also gain further insight into where participants are interacting in the market.

🔶 DETAILS

The full process for acquiring and managing these zones is described in the sub-sections below.

🔹 Creation

By only considering market movements creating a higher-high or lower-low, we can identify meaningful, directional, moves which can then be used to calculate zones.

Once a move is identified, the script calculates a volume profile spanning the length of the given move.

The width of the zones is determined starting from the POC of the profile and expanding outwards until the value of the profile's row falls below the profile's average.

Note: By increasing the "Multiplier" Input, Users can increase the threshold the script uses to determine zone width in multiples of Standard Deviations above the Average.

While this area is similar to a VP Value Area, it is not intended to replicate a value zone. The calculation is not concerned with capturing any % of the total profile's volume within the zone and only analyzes based on a fixed inclusion threshold.

🔹 Management

To keep clutter to a minimum, If a new zone overlaps a recently created zone, the zones are grouped as one. This is especially helpful in areas where prices are ranging, creating multiple zones in a very similar area.

Zones before management:

Zones after management:

🔹 Deletion

Just because a zone is crossed, does not make it immediately unimportant!

Once a Zone is mitigated (crossed in the opposite direction of its bias) it is reduced to a single dotted line representing the outer threshold for the zone. These lines are important to watch, as the price will often retest a break. For this reason, they will stay on the chart until the next swing point is detected when they will finally be deleted for good.

Below is an example of activity around a broken zone before it is deleted.

Below is the same example 2bBars later, once the new swing is confirmed, the dotted lines are deleted and new zones are created.

Notice how the newly formed resistance zone is in the same area where we noticed sellers previously.

🔶 SETTINGS

🔹Structure

🔹Zones

🔹Style

Users can control the amount of consolidation zones to display and the sensitivity of the swing point detection used to return those zones.

🔶 USAGE

These zones are intended as areas of interest to traders where price has seen historical interactions, which can be interpreted as support and resistance. By identifying these areas of interest before the price returns to them, traders are able to anticipate and prepare for various scenarios and respond dynamically to the behavior of the market, as seen below.

- Rejection: A quick move away from the zone may indicate that the area is either overvalued or undervalued, leading to a fast movement in the opposite direction.

- Breakthrough: Moving beyond a zone could indicate acceptance at that specific price, potentially signaling a shift in momentum or the start of a new trend. In a strong major trend, zones created from smaller trends could be used as price targets for taking profit and managing risk.

- Consolidation: Holding these zones might suggest a market in balance at these levels, this could lead to opportunities for range-bound trading.

Below is an example of the Rejection and Consolidation scenarios described above.

Note: By analyzing the tests and retests of these zones, traders can also gain further insight into where participants are interacting in the market.

🔶 DETAILS

The full process for acquiring and managing these zones is described in the sub-sections below.

🔹 Creation

By only considering market movements creating a higher-high or lower-low, we can identify meaningful, directional, moves which can then be used to calculate zones.

Once a move is identified, the script calculates a volume profile spanning the length of the given move.

The width of the zones is determined starting from the POC of the profile and expanding outwards until the value of the profile's row falls below the profile's average.

Note: By increasing the "Multiplier" Input, Users can increase the threshold the script uses to determine zone width in multiples of Standard Deviations above the Average.

While this area is similar to a VP Value Area, it is not intended to replicate a value zone. The calculation is not concerned with capturing any % of the total profile's volume within the zone and only analyzes based on a fixed inclusion threshold.

🔹 Management

To keep clutter to a minimum, If a new zone overlaps a recently created zone, the zones are grouped as one. This is especially helpful in areas where prices are ranging, creating multiple zones in a very similar area.

Zones before management:

Zones after management:

🔹 Deletion

Just because a zone is crossed, does not make it immediately unimportant!

Once a Zone is mitigated (crossed in the opposite direction of its bias) it is reduced to a single dotted line representing the outer threshold for the zone. These lines are important to watch, as the price will often retest a break. For this reason, they will stay on the chart until the next swing point is detected when they will finally be deleted for good.

Below is an example of activity around a broken zone before it is deleted.

Below is the same example 2bBars later, once the new swing is confirmed, the dotted lines are deleted and new zones are created.

Notice how the newly formed resistance zone is in the same area where we noticed sellers previously.

🔶 SETTINGS

🔹Structure

- Display Structure: Determines if swing structures are displayed.

- Structure Length: Sets Length for structure identification.

🔹Zones

- Volume-Based Calculations: Opt to use a "Volume" based Profile Calculation instead of the default "Price Action" based Calculation.

- Display Count: Sets the specific number of bullish and bearish zones to display on the chart.

- Multiplier: Sets the multiplier to use for the value cut-off for determining zone boundaries.

🔹Style

- Display Average Lines: Toggles on/off the average (mid) lines for the zones.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.