OPEN-SOURCE SCRIPT

Обновлено Multiple Bollinger Bands + Volatility [AlgoTraderPro]

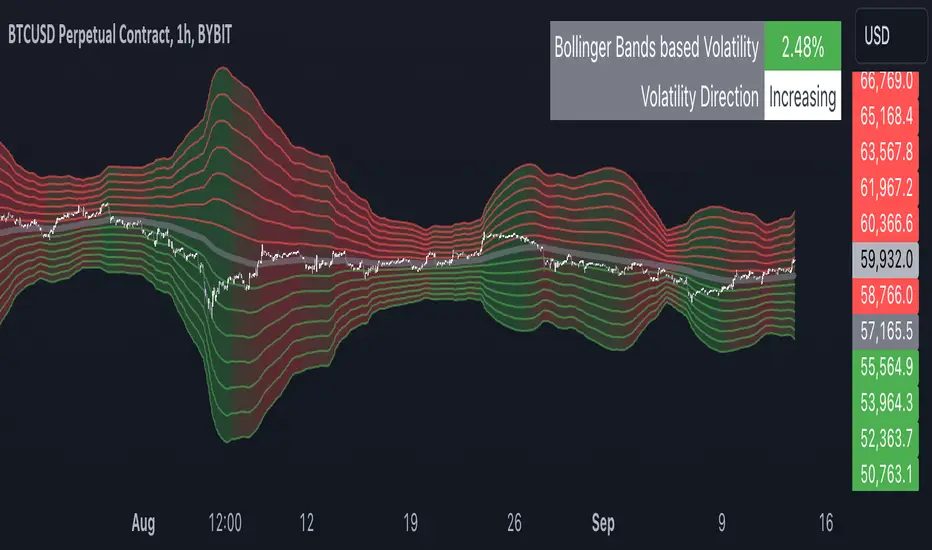

This indicator helps traders visualize price ranges and volatility changes. Designed to assist in identifying potential consolidation zones, the indicator uses multiple layers of Bollinger Bands combined with volatility-based shading. This can help traders spot periods of reduced price movement, which are often followed by breakouts or trend reversals.

█ FEATURES

█ HOW TO USE

█ NOTES

• The indicator is useful in consolidating markets where price movement is limited, offering insights into potential breakout areas.

• Adjust the settings based on asset and market conditions for optimal results.

█ FEATURES

- Multiple Bollinger Bands: Displays up to seven bands with customizable standard deviations, providing a layered view of price range activity.

- Volatility Measurement: Tracks changes in Bollinger Band width to display volatility percentage and direction (increasing, decreasing, or neutral).

- Volatility Shading: Uses color-coded shading between the outermost bands to indicate changes in volatility, helping to visualize potential consolidation zones.

- Customizable Inputs: Modify lookback periods, moving average lengths, and standard deviations for each band to tailor the analysis to your strategy.

- Volatility Table: Displays a table on the chart showing real-time volatility data and direction for quick reference.

█ HOW TO USE

- Add the Indicator: Apply it to your TradingView chart.

- Adjust Settings: Customize the Bollinger Bands’ parameters to suit your trading timeframe and strategy.

- Analyze Consolidation Zones: Use the multiple bands and volatility shading to identify areas of reduced price activity, signaling potential breakouts.

- Monitor Volatility: Refer to the volatility table to track real-time shifts in market volatility.

- Use in Different Markets: Adapt the settings for various assets and timeframes to assess market conditions effectively.

█ NOTES

• The indicator is useful in consolidating markets where price movement is limited, offering insights into potential breakout areas.

• Adjust the settings based on asset and market conditions for optimal results.

Информация о релизе

Bug fixes.Информация о релизе

Minor fixes.Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Trade Smarter, Not Harder!

TradeCreator9

algotraderpro.io/tradecreator9/

TradeCreator9

algotraderpro.io/tradecreator9/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Trade Smarter, Not Harder!

TradeCreator9

algotraderpro.io/tradecreator9/

TradeCreator9

algotraderpro.io/tradecreator9/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.