OPEN-SOURCE SCRIPT

Change in State of Delivery CISD ICT [TradingFinder] Liquidity 1

🔵Introduction

🟣What is CISD ?

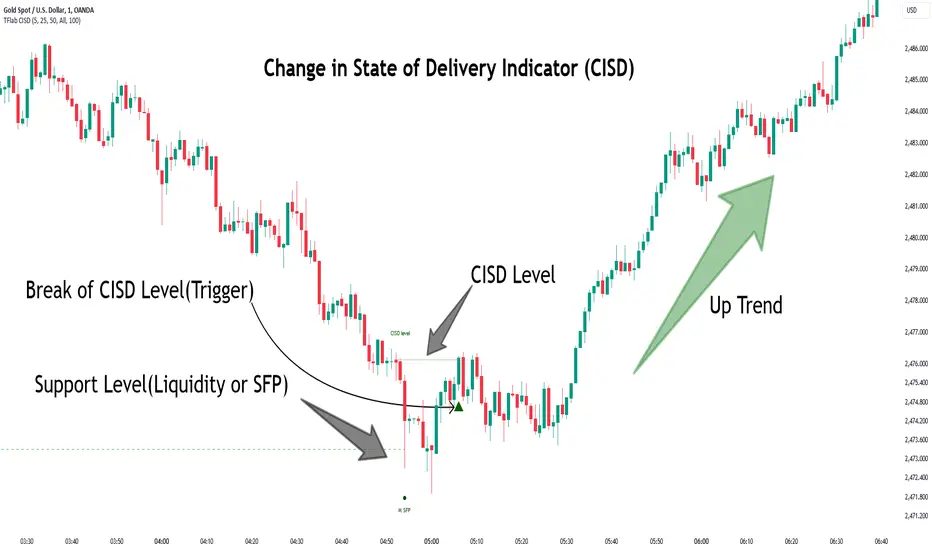

Change in State of Delivery (CISD) is a key concept in technical analysis, similar to Change of Character (ChoCh) and Market Structure Shift (MSS) in the ICT (Inner Circle Trader) and Smart Money trading styles. Like ChoCh and MSS, CISD helps traders identify critical changes in market structure and make timely entries into trades.

To determine the CISD Level, traders typically review the last 1 to 4 candles to identify the first positive or negative candle. The CISD Level is then set using the opening price of the next candle.

In this version of the indicator, support and resistance levels are defined based on liquidity, which includes patterns such as SFP (Swing Failure Pattern), fake breakout, and false breakout.

Bullish CISD:

Bearish CISD:

🔵How to Use

🟣Bullish CISD (Change in State of Delivery Upward)

In Bullish CISD, the trend shifts from bearish to bullish after the price hits a liquidity zone, typically indicated by patterns such as SFP, fake breakout, or false breakout.

The steps to identify Bullish CISD are as follows:

🟣Bearish CISD (Change in State of Delivery Downward)

In Bearish CISD, the trader looks for a shift from a bullish to a bearish trend. This change typically occurs when the price hits a liquidity level, indicated by patterns such as SFP or false breakout.

The steps to identify Bearish CISD are:

🟣CISD Compared to ChoCh and MSS (CISD Vs ChoCh/ MSS)

CISD, ChoCh, and MSS are all tools for identifying trend changes in the market, but they have some differences:

🔵Settings

🟣CISD Logical settings

Bar Back Check: Determining the return of candles to identify the CISD level.

CISD Level Validity: CISD level validity period based on the number of candles.

🟣SFP Logical settings

Swing period: You can set the swing detection period.

Max Swing Back Method: It is in two modes "All" and "Custom". If it is in "All" mode, it will check all swings, and if it is in "Custom" mode, it will check the swings to the extent you determine.

Max Swing Back: You can set the number of swings that will go back for checking.

🟣CISD Display settings

Displaying or not displaying swings and setting the color of labels and lines.

🟣SFP Display settings

Displaying or not displaying swings and setting the color of labels and lines.

🔵Conclusion

CISD is a powerful tool for identifying trend reversals using liquidity patterns and key candle analysis. Traders can use the CISD Level to detect trend changes and find optimal entry and exit points.

This concept is similar to ChoCh and MSS but stands out with its focus on confirming trend changes through liquidity and specific patterns. With the right approach, CISD helps traders capitalize on market movements more effectively.

🟣What is CISD ?

Change in State of Delivery (CISD) is a key concept in technical analysis, similar to Change of Character (ChoCh) and Market Structure Shift (MSS) in the ICT (Inner Circle Trader) and Smart Money trading styles. Like ChoCh and MSS, CISD helps traders identify critical changes in market structure and make timely entries into trades.

To determine the CISD Level, traders typically review the last 1 to 4 candles to identify the first positive or negative candle. The CISD Level is then set using the opening price of the next candle.

In this version of the indicator, support and resistance levels are defined based on liquidity, which includes patterns such as SFP (Swing Failure Pattern), fake breakout, and false breakout.

Bullish CISD:

Bearish CISD:

🔵How to Use

🟣Bullish CISD (Change in State of Delivery Upward)

In Bullish CISD, the trend shifts from bearish to bullish after the price hits a liquidity zone, typically indicated by patterns such as SFP, fake breakout, or false breakout.

The steps to identify Bullish CISD are as follows:

- Identify the liquidity zone (SFP, fake breakout).

- Review the candles and find the first positive candle.

- Set the CISD Level using the opening price of the next candle after the positive candle.

- Confirm the change in state of delivery when the price closes above the CISD Level.

- Enter the trade after CISD confirmation.

🟣Bearish CISD (Change in State of Delivery Downward)

In Bearish CISD, the trader looks for a shift from a bullish to a bearish trend. This change typically occurs when the price hits a liquidity level, indicated by patterns such as SFP or false breakout.

The steps to identify Bearish CISD are:

- Identify the liquidity zone.

- Review the candles and find the first negative candle.

- Set the CISD Level using the opening price of the next candle after the negative candle.

- Confirm the change in state of delivery when the price closes below the CISD Level.

- Enter a short trade after CISD confirmation.

🟣CISD Compared to ChoCh and MSS (CISD Vs ChoCh/ MSS)

CISD, ChoCh, and MSS are all tools for identifying trend changes in the market, but they have some differences:

- CISD: Focuses on a change in the state of delivery and uses liquidity patterns (SFP, fake breakout) and key candles to confirm trend reversals.

- ChoCh: Identifies a change in the market’s character, often signaling rapid shifts in trend direction.

- MSS: Focuses on changes in market structure and identifies the breaking of key levels as a signal of trend shifts.

🔵Settings

🟣CISD Logical settings

Bar Back Check: Determining the return of candles to identify the CISD level.

CISD Level Validity: CISD level validity period based on the number of candles.

🟣SFP Logical settings

Swing period: You can set the swing detection period.

Max Swing Back Method: It is in two modes "All" and "Custom". If it is in "All" mode, it will check all swings, and if it is in "Custom" mode, it will check the swings to the extent you determine.

Max Swing Back: You can set the number of swings that will go back for checking.

🟣CISD Display settings

Displaying or not displaying swings and setting the color of labels and lines.

🟣SFP Display settings

Displaying or not displaying swings and setting the color of labels and lines.

🔵Conclusion

CISD is a powerful tool for identifying trend reversals using liquidity patterns and key candle analysis. Traders can use the CISD Level to detect trend changes and find optimal entry and exit points.

This concept is similar to ChoCh and MSS but stands out with its focus on confirming trend changes through liquidity and specific patterns. With the right approach, CISD helps traders capitalize on market movements more effectively.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.