PROTECTED SOURCE SCRIPT

CPR+PIVOT+HL+EMA_ by Jit's

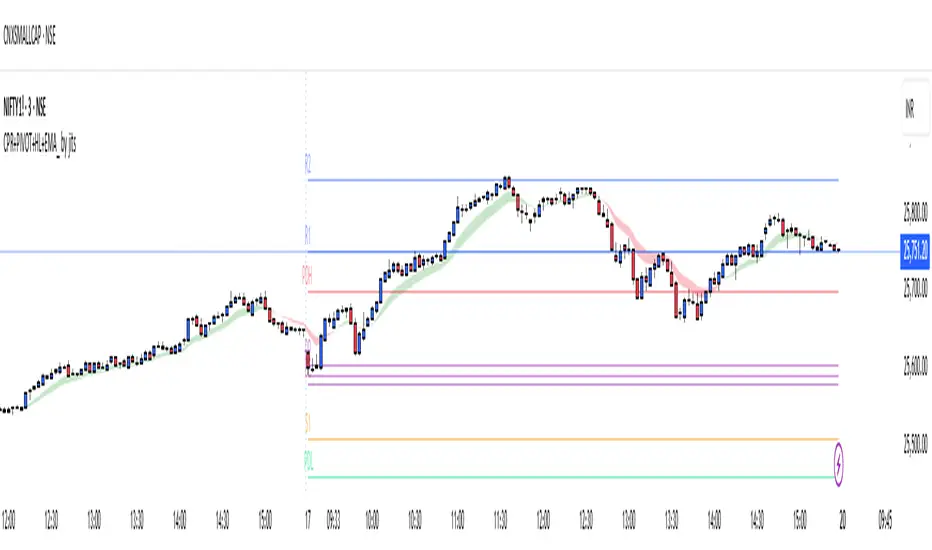

The **CPR+PIVOT+HL+EMA_ by Jit's** is a custom Trading View indicator designed especially for **index intraday trading** (like NIFTY, BANKNIFTY, and FINNIFTY). It integrates four powerful analytical components—Central Pivot Range (CPR), Pivot Points, Previous Day High/Low, and 9/15 Exponential Moving Averages (EMA)—to provide traders a comprehensive market structure and trend confirmation tool.

Core Components

**1. Central Pivot Range (CPR)**

The CPR forms the central structure of this indicator. It is derived from the previous day’s **high, low, and close** values:

- Pivot (P) = (H + L + C) / 3

- Bottom Central (BC) = (H + L) / 2

- Top Central (TC) = (P - BC) + P

These three levels together represent the market’s “value area.”

A **narrow CPR** suggests a potential trending day ahead, while a **wide CPR** indicates likely consolidation.

**2. Pivot Points & Support/Resistance Levels**

The indicator extends beyond CPR by adding **traditional or Fibonacci pivots**, dynamically plotting resistance (R1–R5) and support (S1–S5) zones. These levels assist in spotting breakout levels and intraday reversal zones.

**3. Previous Day High and Low (PDH/PDL)**

These levels are essential for understanding market context. When price stays **above PDH**, it often signals strong bullish momentum; breaking **below PDL** indicates bearish pressure. Many traders use PDH/PDL along with CPR as key validation points for entries or exits.

**4. EMA (9 and 15 periods)**

The moving averages provide short-term trend confirmation.

- **EMA(9)** captures immediate momentum.

- **EMA(15)** represents short-term trend alignment.

A crossover of EMA(9) above EMA(15) usually supports a **buy signal**, while the opposite indicates a sell bias.

Use Case in Index Trading

This indicator setup is highly suited for **index-based intraday trading** because:

- CPR gives a bias for the day (bullish/bearish).

- PDH/PDL exhibit clear breakout or reversal areas.

- EMAs refine timing for entry/exit.

- Pivot levels mark precise target and stop zones.

**1. Central Pivot Range (CPR)**

The CPR forms the central structure of this indicator. It is derived from the previous day’s **high, low, and close** values:

- Pivot (P) = (H + L + C) / 3

- Bottom Central (BC) = (H + L) / 2

- Top Central (TC) = (P - BC) + P

These three levels together represent the market’s “value area.”

A **narrow CPR** suggests a potential trending day ahead, while a **wide CPR** indicates likely consolidation.

**2. Pivot Points & Support/Resistance Levels**

The indicator extends beyond CPR by adding **traditional or Fibonacci pivots**, dynamically plotting resistance (R1–R5) and support (S1–S5) zones. These levels assist in spotting breakout levels and intraday reversal zones.

**3. Previous Day High and Low (PDH/PDL)**

These levels are essential for understanding market context. When price stays **above PDH**, it often signals strong bullish momentum; breaking **below PDL** indicates bearish pressure. Many traders use PDH/PDL along with CPR as key validation points for entries or exits.

**4. EMA (9 and 15 periods)**

The moving averages provide short-term trend confirmation.

- **EMA(9)** captures immediate momentum.

- **EMA(15)** represents short-term trend alignment.

A crossover of EMA(9) above EMA(15) usually supports a **buy signal**, while the opposite indicates a sell bias.

Use Case in Index Trading

This indicator setup is highly suited for **index-based intraday trading** because:

- CPR gives a bias for the day (bullish/bearish).

- PDH/PDL exhibit clear breakout or reversal areas.

- EMAs refine timing for entry/exit.

- Pivot levels mark precise target and stop zones.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с защищённым кодом

Этот скрипт опубликован с закрытым исходным кодом. Однако вы можете использовать его свободно и без каких-либо ограничений — читайте подробнее здесь.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.