OPEN-SOURCE SCRIPT

Обновлено MTF CCI + Realtime Divergences

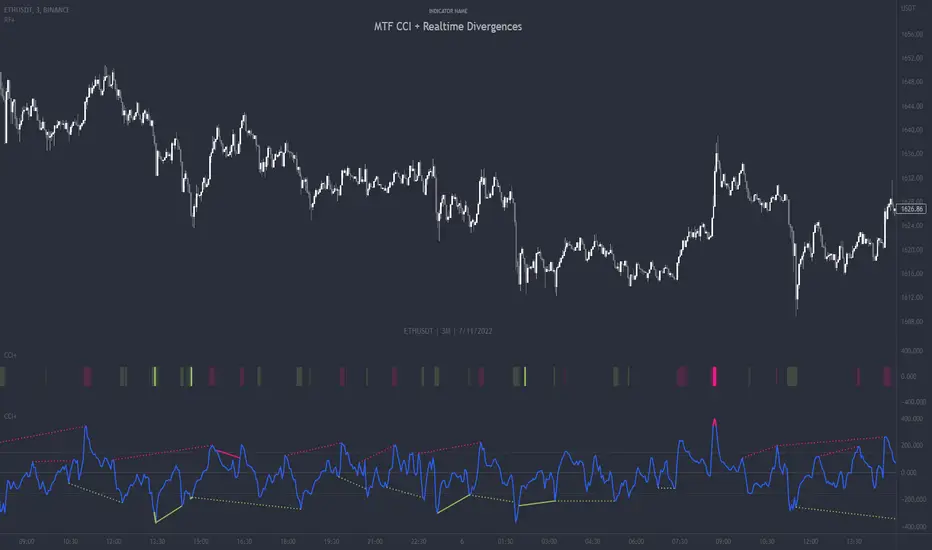

Multi-timeframe Commodity Channel Index (CCI) + Realtime Divergences + Alerts

This version of the CCI includes the following features:

- Optional 2x sets of triple-timeframe overbought and oversold signals with fully configurable timeframes and overbought and oversold thresholds, can indicate where 3 selected timeframes are all overbought or all oversold at the same time, with alert option.

- Optional divergence lines drawn directly onto the oscillator in realtime, with alert options.

- Configurable pivot periods to fine tune the divergences drawn in order to suit different trading styles and timeframes, including the ability to enable automatic adjustment of pivot period per chart timeframe.

- Alternate timeframe feature allows you to configure the oscillator to use data from a different timeframe than the chart it is loaded on.

- 'Hide oscillator' feature allows traders to hide the oscillator itself, leaving only the background colours indicating the overbought and oversold periods and/or MTF overbought and oversold confluences, as seen in the chart image.

- Also includes standard configurable CCI options, including CCI length and source type. Defaults set to length 20, and hlc3 source type.

- Optional Flip oscillator feature, allows users to flip the oscillator upside down, for use with Tradingviews 'Flip chart' feature (Alt+i), for the purpose of manually spotting divergences, where the trader has a strong natural bias in one direction, so that they can flip both the chart and the oscillator.

- Optional 'Fade oscillator' feature, which will fade out all but the most recent period, reducing visual noise on the chart.

While this version of the CCI has the ability to draw divergences in realtime along with related alerts so you can be notified as divergences occur without spending all day watching the charts, the main purpose of this indicator was to provide the triple-timeframe overbought and oversold confluence signals, in an attempt to add more confluence, weight and reliability to the single timeframe overbought and oversold states, commonly used for trade entry confluence. It's primary purpose is intended for scalping reversal trades on lower timeframes, typically between 1-15 minutes, which can be used in conjunction with the regular divergences the indicator can highlight. The triple timeframe overbought can often indicate near term reversals to the downside, with the triple timeframe oversold often indicating neartime reversals to the upside. The default timeframes for this confluence are set to check the 1m, 5m and 15m timeframes together, ideal for scalping the < 15 minute charts. The default settings for the MTF #1 timeframes (1m, 5m and 15m) are best used on a <5 minute chart.

Its design and use case is based upon the original MTF Stoch RSI + Realtime Divergences found here.

Commodity Channel Index (CCI)

Investopedia has described the popular oscillator as follows:

“The Commodity Channel Index (CCI) is a momentum-based oscillator used to help determine when an investment vehicle is reaching a condition of being overbought or oversold.

Developed by Donald Lambert, this technical indicator assesses price trend direction and strength, allowing traders to determine if they want to enter or exit a trade, refrain from taking a trade, or add to an existing position. In this way, the indicator can be used to provide trade signals when it acts in a certain way.”

You can read more about the CCI, its use cases and calculations here.

How do traders use overbought and oversold levels in their trading?

The oversold level, that is traditionally when the CCI is above the 100 level is typically interpreted as being 'overbought', and below the -100 level is typically considered 'oversold'. Traders will often use the CCI at an overbought level as a confluence for entry into a short position, and the CCI at an oversold level as a confluence for an entry into a long position. These levels do not mean that price will necessarily reverse at those levels in a reliable way, however. This is why this version of the CCI employs the triple timeframe overbought and oversold confluence, in an attempt to add a more confluence and reliability to this usage of the CCI. While traditionally, the overbought and oversold levels are below -100 for oversold, and above 100 for overbought, he default threshold settings of this indicator have been increased to provide fewer, stronger signals, especially suited to the low timeframes and highly volatile assets.

What are divergences?

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

There are 4 main types of divergence, which are split into 2 categories;

regular divergences and hidden divergences. Regular divergences indicate possible trend reversals, and hidden divergences indicate possible trend continuation.

Regular bullish divergence: An indication of a potential trend reversal, from the current downtrend, to an uptrend.

Regular bearish divergence: An indication of a potential trend reversal, from the current uptrend, to a downtrend.

Hidden bullish divergence: An indication of a potential uptrend continuation.

Hidden bearish divergence: An indication of a potential downtrend continuation.

How do traders use divergences in their trading?

A divergence is considered a leading indicator in technical analysis , meaning it has the ability to indicate a potential price move in the short term future.

Hidden bullish and hidden bearish divergences, which indicate a potential continuation of the current trend are sometimes considered a good place for traders to begin, since trend continuation occurs more frequently than reversals, or trend changes.

When trading regular bullish divergences and regular bearish divergences, which are indications of a trend reversal, the probability of it doing so may increase when these occur at a strong support or resistance level . A common mistake new traders make is to get into a regular divergence trade too early, assuming it will immediately reverse, but these can continue to form for some time before the trend eventually changes, by using forms of support or resistance as an added confluence, such as when price reaches a moving average, the success rate when trading these patterns may increase.

Typically, traders will manually draw lines across the swing highs and swing lows of both the price chart and the oscillator to see whether they appear to present a divergence, this indicator will draw them for you, quickly and clearly, and can notify you when they occur.

Setting alerts.

With this indicator you can set alerts to notify you when any/all of the above types of divergences occur, on any chart timeframe you choose, and also when the triple timeframe overbought and oversold confluences occur.

Configurable pivot period.

You can adjust the default pivot period values to suit your prefered trading style and timeframe. If you like to trade a shorter time frame, lowering the default lookback values will make the divergences drawn more sensitive to short term price action. By default, this indicator has enabled the automatic adjustment of the pivot periods for 4 configurable timeframes, in a bid to optimise the divergences drawn when the indicator is loaded onto any of the 4 timeframes. These timeframes and the auto adjusted pivot periods on each of them can also be reconfigured within the settings menu.

Disclaimer: This script includes code adapted from the Divergence for Many Indicators v4 by LonesomeTheBlue. With special thanks.

This version of the CCI includes the following features:

- Optional 2x sets of triple-timeframe overbought and oversold signals with fully configurable timeframes and overbought and oversold thresholds, can indicate where 3 selected timeframes are all overbought or all oversold at the same time, with alert option.

- Optional divergence lines drawn directly onto the oscillator in realtime, with alert options.

- Configurable pivot periods to fine tune the divergences drawn in order to suit different trading styles and timeframes, including the ability to enable automatic adjustment of pivot period per chart timeframe.

- Alternate timeframe feature allows you to configure the oscillator to use data from a different timeframe than the chart it is loaded on.

- 'Hide oscillator' feature allows traders to hide the oscillator itself, leaving only the background colours indicating the overbought and oversold periods and/or MTF overbought and oversold confluences, as seen in the chart image.

- Also includes standard configurable CCI options, including CCI length and source type. Defaults set to length 20, and hlc3 source type.

- Optional Flip oscillator feature, allows users to flip the oscillator upside down, for use with Tradingviews 'Flip chart' feature (Alt+i), for the purpose of manually spotting divergences, where the trader has a strong natural bias in one direction, so that they can flip both the chart and the oscillator.

- Optional 'Fade oscillator' feature, which will fade out all but the most recent period, reducing visual noise on the chart.

While this version of the CCI has the ability to draw divergences in realtime along with related alerts so you can be notified as divergences occur without spending all day watching the charts, the main purpose of this indicator was to provide the triple-timeframe overbought and oversold confluence signals, in an attempt to add more confluence, weight and reliability to the single timeframe overbought and oversold states, commonly used for trade entry confluence. It's primary purpose is intended for scalping reversal trades on lower timeframes, typically between 1-15 minutes, which can be used in conjunction with the regular divergences the indicator can highlight. The triple timeframe overbought can often indicate near term reversals to the downside, with the triple timeframe oversold often indicating neartime reversals to the upside. The default timeframes for this confluence are set to check the 1m, 5m and 15m timeframes together, ideal for scalping the < 15 minute charts. The default settings for the MTF #1 timeframes (1m, 5m and 15m) are best used on a <5 minute chart.

Its design and use case is based upon the original MTF Stoch RSI + Realtime Divergences found here.

Commodity Channel Index (CCI)

Investopedia has described the popular oscillator as follows:

“The Commodity Channel Index (CCI) is a momentum-based oscillator used to help determine when an investment vehicle is reaching a condition of being overbought or oversold.

Developed by Donald Lambert, this technical indicator assesses price trend direction and strength, allowing traders to determine if they want to enter or exit a trade, refrain from taking a trade, or add to an existing position. In this way, the indicator can be used to provide trade signals when it acts in a certain way.”

You can read more about the CCI, its use cases and calculations here.

How do traders use overbought and oversold levels in their trading?

The oversold level, that is traditionally when the CCI is above the 100 level is typically interpreted as being 'overbought', and below the -100 level is typically considered 'oversold'. Traders will often use the CCI at an overbought level as a confluence for entry into a short position, and the CCI at an oversold level as a confluence for an entry into a long position. These levels do not mean that price will necessarily reverse at those levels in a reliable way, however. This is why this version of the CCI employs the triple timeframe overbought and oversold confluence, in an attempt to add a more confluence and reliability to this usage of the CCI. While traditionally, the overbought and oversold levels are below -100 for oversold, and above 100 for overbought, he default threshold settings of this indicator have been increased to provide fewer, stronger signals, especially suited to the low timeframes and highly volatile assets.

What are divergences?

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

There are 4 main types of divergence, which are split into 2 categories;

regular divergences and hidden divergences. Regular divergences indicate possible trend reversals, and hidden divergences indicate possible trend continuation.

Regular bullish divergence: An indication of a potential trend reversal, from the current downtrend, to an uptrend.

Regular bearish divergence: An indication of a potential trend reversal, from the current uptrend, to a downtrend.

Hidden bullish divergence: An indication of a potential uptrend continuation.

Hidden bearish divergence: An indication of a potential downtrend continuation.

How do traders use divergences in their trading?

A divergence is considered a leading indicator in technical analysis , meaning it has the ability to indicate a potential price move in the short term future.

Hidden bullish and hidden bearish divergences, which indicate a potential continuation of the current trend are sometimes considered a good place for traders to begin, since trend continuation occurs more frequently than reversals, or trend changes.

When trading regular bullish divergences and regular bearish divergences, which are indications of a trend reversal, the probability of it doing so may increase when these occur at a strong support or resistance level . A common mistake new traders make is to get into a regular divergence trade too early, assuming it will immediately reverse, but these can continue to form for some time before the trend eventually changes, by using forms of support or resistance as an added confluence, such as when price reaches a moving average, the success rate when trading these patterns may increase.

Typically, traders will manually draw lines across the swing highs and swing lows of both the price chart and the oscillator to see whether they appear to present a divergence, this indicator will draw them for you, quickly and clearly, and can notify you when they occur.

Setting alerts.

With this indicator you can set alerts to notify you when any/all of the above types of divergences occur, on any chart timeframe you choose, and also when the triple timeframe overbought and oversold confluences occur.

Configurable pivot period.

You can adjust the default pivot period values to suit your prefered trading style and timeframe. If you like to trade a shorter time frame, lowering the default lookback values will make the divergences drawn more sensitive to short term price action. By default, this indicator has enabled the automatic adjustment of the pivot periods for 4 configurable timeframes, in a bid to optimise the divergences drawn when the indicator is loaded onto any of the 4 timeframes. These timeframes and the auto adjusted pivot periods on each of them can also be reconfigured within the settings menu.

Disclaimer: This script includes code adapted from the Divergence for Many Indicators v4 by LonesomeTheBlue. With special thanks.

Информация о релизе

- Added a barcolor option to signal the MTF overbought and oversold confluences, disabled by default.Информация о релизе

- Removed the unused source input option from pivot period settings.Информация о релизе

- Added a 'Flipped' warning label to the panel to indicate when the oscillator is in 'flip oscillator' mode.Информация о релизе

- Updated MTF overbought and oversold alerts to only alert once if following bars remain overbought / oversold.- Updated divergence alerts to only alert once if following bars reprint that same divergence.

- Updated divergence alerts to allows for alerting any type of divergence in a single alert.

Информация о релизе

- Added a feature to the settings menu to optionally present the 3x oscillator values of the MTF #1 timeframes as a table.Информация о релизе

- Minor settings label text change to last updateИнформация о релизе

- Added an optional table that presents the oscillator values for each of the 3 MTF #1 timeframes, with colour coded values when they reach their overbought and oversold thresholds.Информация о релизе

- Updated the MTF values table with additional features to optionally show MTF #1 values only, MTF #2 values only, or the values of both sets of MTF confluences.Информация о релизе

- Hidden extra labels seen in 7 axis when label values were selected in Tradingview.Информация о релизе

- Added a 'Flip oscillator' setting for use with flipped chart (Alt+i) to help manually spot divergences where the user has a naturally long/short bias.Информация о релизе

- Adjusted MTF table column width so it doesn't shrink on mobileСкрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.