OPEN-SOURCE SCRIPT

Ichimoku PourSamadi Signal [TradingFinder] KijunSen Magic Number

🔵Introduction

The Ichimoku Kinko Hyo system is one of the most comprehensive market analysis tools ever created. Developed by Goichi Hosoda, a Japanese journalist in the 1930s, its purpose was to allow traders to recognize the balance between price, time, and momentum at a single glance. (In Japanese, Ichimoku literally means “one look.”)

At the core of the system lie five key components: Tenkan-sen (Conversion Line), Kijun-sen (Baseline), Chikou Span (Lagging Line), and the two leading spans, Senkou Span A and Senkou Span B, which together form the well-known Kumo or cloud representing both temporal structure and equilibrium zones in the market.

Although Ichimoku is commonly used to identify trends and support/resistance levels, a deeper layer of time philosophy exists within it. Ichimoku was not designed solely for price analysis but equally for time analysis.

In the classical model, the numerical cycles 9, 26, 52 reflect the natural rhythm of the market originally based on the Tokyo Stock Exchange’s trading schedule in the 1930s.

These values repeat across the system’s calculations, forming the foundation of Ichimoku’s time symmetry where price and time ultimately seek equilibrium.

In recent years, modern analysts have explored new approaches to extract time-based turning points from Ichimoku’s structure. One such approach is the analysis of flat segments on the Kijun-sen and Senkou B lines.

Whenever one of these lines remains flat for a period, it signals temporary balance between buyers and sellers; when the flat breaks, the market exits equilibrium and a new cycle begins.

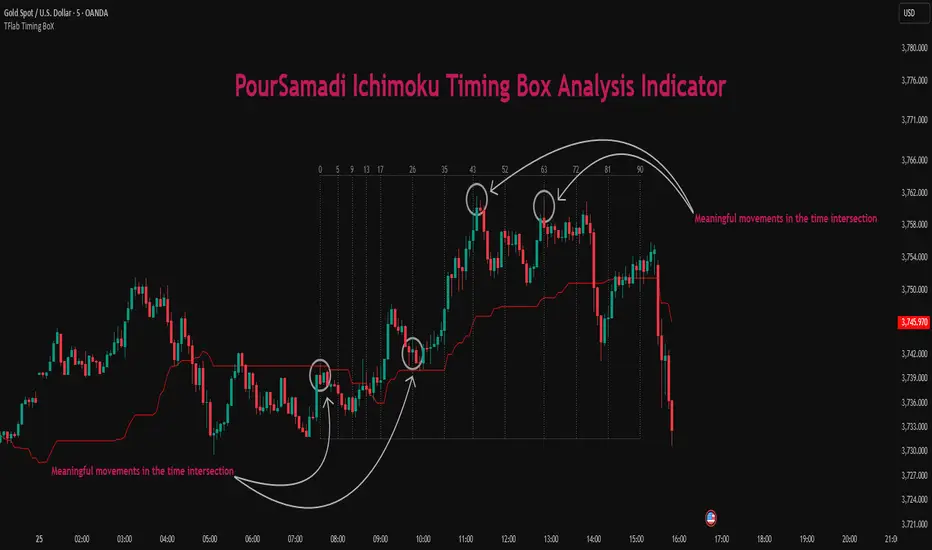

This indicator is built precisely upon that philosophy. Following the timing methodology introduced by M.A. Poursamadi, the focus shifts away from price signals and line crossovers toward identifying flat periods on Kijun-sen (period 52) as time anchors.

From the first candle that changes the line’s slope, the tool begins a temporal count using a fixed sequence of key numbers: 5, 9, 13, 17, 26, 35, 43, 52, 63, 72, 81, 90.

Derived from both classical Ichimoku cycles and empirical testing, these numbers mark potential timing nodes where a market wave may end, a correction may begin, or a new leg may form.

Thus, this method serves not merely as another Ichimoku tool but as a temporal metronome for market structure a way to visualize moments when the market is ready to change rhythm, often before candles reveal it.

🔵How to Use

The Kijun Timing BoX is built entirely on Ichimoku’s concept of time analysis.

Its core idea is that within every flat segment of the Kijun-sen, the market enters a temporary balance between opposing forces.

When that flat breaks, a new time cycle begins. From that first breakout candle, the indicator starts counting forward through the predefined time sequence(5, 9, 13, 17, 26, 35, 43, 52, 63, 72, 81, 90).

This counting framework creates a temporal map of market behavior, where each number represents an area where meaningful price fluctuations often occur.

A “meaningful fluctuation” does not necessarily imply reversal or continuation; rather, it marks a moment when the market’s internal energy balance shifts, typically visible as noticeable reactions on lower timeframes.

🟣Identifying the Anchor Point

The first step is recognizing a valid flat zone on the Kijun-sen.

When this line remains flat for several candles and then changes slope, the indicator marks that bar as the Anchor, initiating the time count.

From that point onward, vertical gray lines appear at each interval in the key-number sequence, visualizing the time nodes ahead.

🟣Reading the Timing Lines

Each numbered line represents a timing node a temporal point where a change in price rhythm is statistically more likely to occur.

At these nodes, the market may:

These behaviors do not imply a specific direction; they only highlight zones where time-based activity tends to cluster, giving traders a clearer view of cyclical rhythm.

🟣Applying Time Analysis

The indicator’s primary use is to observe temporal order, not to predict price direction.

By tracking the distance between Anchors and the reactions that appear near major timing lines, traders can empirically identify each market’s characteristic rhythm—its own time DNA.

For example, one asset may consistently show significant fluctuations around the 13- and 26-bar marks,while another might react closer to 9 or 52. Recognizing such patterns helps traders understand how long typical cycles last before new phases of volatility emerge.

🟣Combining with Other Tools

The indicator does not generate buy/sell signals on its own.

Its best use is in combination with price- or structure-based methods, to see whether meaningful price reactions occur around the same timing nodes.

In practice, it helps distinguish structured time-based fluctuations from random, noise-driven moves an insight often overlooked in conventional market analysis.

🔵Settings

🟣Logical Settings

KijunSen Period: Defines the baseline period used for timing analysis. Default = 52. It is the main line for detecting flats and generating time anchors.

Flat Event Filter: Controls how flat segments are validated before triggering a new timing event.

Update Timing Analysis BoX Per Event: If enabled, a new Timing Box is drawn each time a new flat event occurs. If disabled, the box completes its 90-bar window before refreshing.

🟣Ichimoku Settings

TenkanSen Period: Defines the period for the Conversion Line (Tenkan-sen). Default = 9.

KijunSen Period: Sets the standard Ichimoku baseline (not the timing line). Default = 26.

Span B Period: Defines the period for Senkou Span B, the slower cloud boundary. Default = 52.

Shift Lines: Offsets cloud projection into the future. Default = 26.

🟣Display Settings

Users can show or hide all Ichimoku lines Tenkan-sen, Kijun-sen, Chikou Span, Span A, and Span B as well as the Ichimoku Cloud.

They can also customize the color of each element to match personal chart preferences and improve visibility.

🔵Conclusion

This analytical approach transforms Ichimoku’s time philosophy into a visual and measurable framework. A flat Kijun-sen represents a moment of market equilibrium; when its slope shifts, a new temporal cycle begins.

The purpose is not to forecast price direction but to highlight periods when meaningful fluctuations are more likely to develop.

Through this perspective, traders can observe the hidden rhythm of market time and expand their analysis beyond price into a broader time-cycle dimension.

Ultimately, the method revives Ichimoku’s original principle: the market can only be truly understood through the simultaneous harmony of price, time, and balance.

The Ichimoku Kinko Hyo system is one of the most comprehensive market analysis tools ever created. Developed by Goichi Hosoda, a Japanese journalist in the 1930s, its purpose was to allow traders to recognize the balance between price, time, and momentum at a single glance. (In Japanese, Ichimoku literally means “one look.”)

At the core of the system lie five key components: Tenkan-sen (Conversion Line), Kijun-sen (Baseline), Chikou Span (Lagging Line), and the two leading spans, Senkou Span A and Senkou Span B, which together form the well-known Kumo or cloud representing both temporal structure and equilibrium zones in the market.

Although Ichimoku is commonly used to identify trends and support/resistance levels, a deeper layer of time philosophy exists within it. Ichimoku was not designed solely for price analysis but equally for time analysis.

In the classical model, the numerical cycles 9, 26, 52 reflect the natural rhythm of the market originally based on the Tokyo Stock Exchange’s trading schedule in the 1930s.

These values repeat across the system’s calculations, forming the foundation of Ichimoku’s time symmetry where price and time ultimately seek equilibrium.

In recent years, modern analysts have explored new approaches to extract time-based turning points from Ichimoku’s structure. One such approach is the analysis of flat segments on the Kijun-sen and Senkou B lines.

Whenever one of these lines remains flat for a period, it signals temporary balance between buyers and sellers; when the flat breaks, the market exits equilibrium and a new cycle begins.

This indicator is built precisely upon that philosophy. Following the timing methodology introduced by M.A. Poursamadi, the focus shifts away from price signals and line crossovers toward identifying flat periods on Kijun-sen (period 52) as time anchors.

From the first candle that changes the line’s slope, the tool begins a temporal count using a fixed sequence of key numbers: 5, 9, 13, 17, 26, 35, 43, 52, 63, 72, 81, 90.

Derived from both classical Ichimoku cycles and empirical testing, these numbers mark potential timing nodes where a market wave may end, a correction may begin, or a new leg may form.

Thus, this method serves not merely as another Ichimoku tool but as a temporal metronome for market structure a way to visualize moments when the market is ready to change rhythm, often before candles reveal it.

🔵How to Use

The Kijun Timing BoX is built entirely on Ichimoku’s concept of time analysis.

Its core idea is that within every flat segment of the Kijun-sen, the market enters a temporary balance between opposing forces.

When that flat breaks, a new time cycle begins. From that first breakout candle, the indicator starts counting forward through the predefined time sequence(5, 9, 13, 17, 26, 35, 43, 52, 63, 72, 81, 90).

This counting framework creates a temporal map of market behavior, where each number represents an area where meaningful price fluctuations often occur.

A “meaningful fluctuation” does not necessarily imply reversal or continuation; rather, it marks a moment when the market’s internal energy balance shifts, typically visible as noticeable reactions on lower timeframes.

🟣Identifying the Anchor Point

The first step is recognizing a valid flat zone on the Kijun-sen.

When this line remains flat for several candles and then changes slope, the indicator marks that bar as the Anchor, initiating the time count.

From that point onward, vertical gray lines appear at each interval in the key-number sequence, visualizing the time nodes ahead.

🟣Reading the Timing Lines

Each numbered line represents a timing node a temporal point where a change in price rhythm is statistically more likely to occur.

At these nodes, the market may:

- Enter a consolidation or minor correction phase.

- Develop range-bound movement.

- Or simply alter the speed and intensity of its move.

These behaviors do not imply a specific direction; they only highlight zones where time-based activity tends to cluster, giving traders a clearer view of cyclical rhythm.

🟣Applying Time Analysis

The indicator’s primary use is to observe temporal order, not to predict price direction.

By tracking the distance between Anchors and the reactions that appear near major timing lines, traders can empirically identify each market’s characteristic rhythm—its own time DNA.

For example, one asset may consistently show significant fluctuations around the 13- and 26-bar marks,while another might react closer to 9 or 52. Recognizing such patterns helps traders understand how long typical cycles last before new phases of volatility emerge.

🟣Combining with Other Tools

The indicator does not generate buy/sell signals on its own.

Its best use is in combination with price- or structure-based methods, to see whether meaningful price reactions occur around the same timing nodes.

In practice, it helps distinguish structured time-based fluctuations from random, noise-driven moves an insight often overlooked in conventional market analysis.

🔵Settings

🟣Logical Settings

KijunSen Period: Defines the baseline period used for timing analysis. Default = 52. It is the main line for detecting flats and generating time anchors.

Flat Event Filter: Controls how flat segments are validated before triggering a new timing event.

- All: Every flat triggers a new Timing Box.

- Automatic: Only flats longer than the historical average are used (recommended).

- Custom: User manually defines the minimum flat length via Custom Count.

Update Timing Analysis BoX Per Event: If enabled, a new Timing Box is drawn each time a new flat event occurs. If disabled, the box completes its 90-bar window before refreshing.

🟣Ichimoku Settings

TenkanSen Period: Defines the period for the Conversion Line (Tenkan-sen). Default = 9.

KijunSen Period: Sets the standard Ichimoku baseline (not the timing line). Default = 26.

Span B Period: Defines the period for Senkou Span B, the slower cloud boundary. Default = 52.

Shift Lines: Offsets cloud projection into the future. Default = 26.

🟣Display Settings

Users can show or hide all Ichimoku lines Tenkan-sen, Kijun-sen, Chikou Span, Span A, and Span B as well as the Ichimoku Cloud.

They can also customize the color of each element to match personal chart preferences and improve visibility.

🔵Conclusion

This analytical approach transforms Ichimoku’s time philosophy into a visual and measurable framework. A flat Kijun-sen represents a moment of market equilibrium; when its slope shifts, a new temporal cycle begins.

The purpose is not to forecast price direction but to highlight periods when meaningful fluctuations are more likely to develop.

Through this perspective, traders can observe the hidden rhythm of market time and expand their analysis beyond price into a broader time-cycle dimension.

Ultimately, the method revives Ichimoku’s original principle: the market can only be truly understood through the simultaneous harmony of price, time, and balance.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.