OPEN-SOURCE SCRIPT

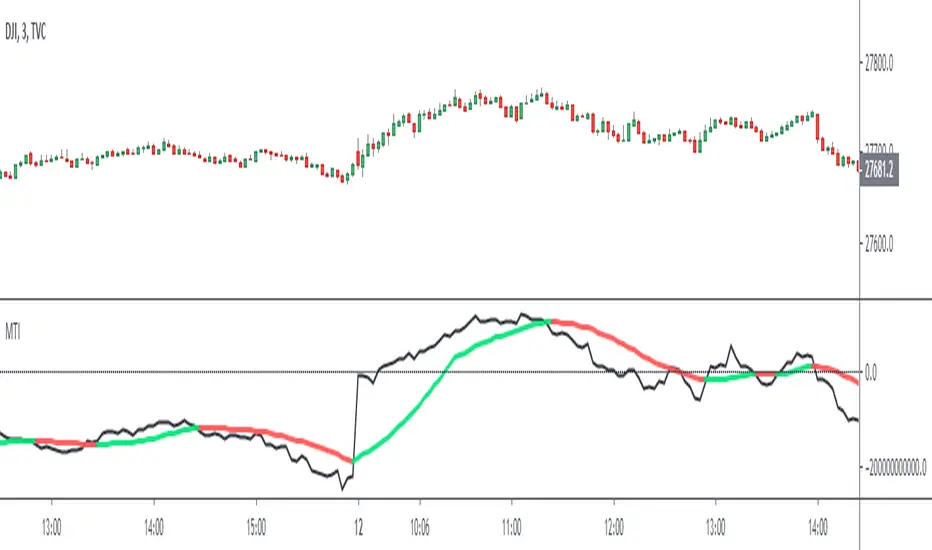

Market Thrust Indicator

The Market Thrust indicator is a powerful measure of the stock market's internal strength or weakness. There are four components to this indicator:

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.