OPEN-SOURCE SCRIPT

Kernel Channel [BackQuant]

Kernel Channel [BackQuant]

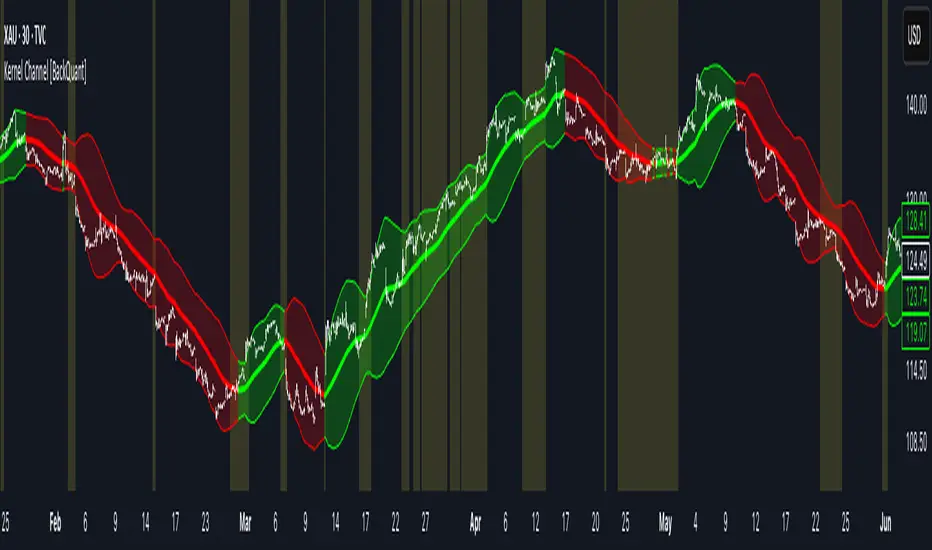

A non-parametric, kernel-weighted trend channel that adapts to local structure, smooths noise without lagging like moving averages, and highlights volatility compressions, expansions, and directional bias through a flexible choice of kernels, band types, and squeeze logic.

What this is

This indicator builds a full trend channel using kernel regression rather than classical averaging. Instead of a simple moving average or exponential weighting, the midline is computed as a kernel-weighted expectation of past values. This allows it to adapt to local shape, give more weight to nearby bars, and reduce distortion from outliers.

You can think of it as a sliding local smoother where you define both the “window” of influence (Window Length) and the “locality strength” (Bandwidth). The result is a flexible midline with optional upper and lower bands derived from kernel-weighted ATR or kernel-weighted standard deviation, letting you visualize volatility in a structurally consistent way.

Three plotting modes help demonstrate this difference:

When the midline is shown alone, you get a smooth, adaptive baseline that behaves almost like a regression moving average, as shown in this view: tradingview.com/x/VPv2yYtZ/.

When full channels are enabled, you see how standard deviation reacts to local structure with dynamically widening and tightening bands, a mode illustrated here: tradingview.com/x/XzSaXVln/.

When ATR mode is chosen instead of StdDev, band width reflects breadth of movement rather than variance, creating a volatility-aware envelope like the example here: tradingview.com/x/njkeQAIr/.

Why kernels

Classical moving averages allocate fixed weights. Kernels let the user define weighting shape:

Using these in combination with a bandwidth parameter gives fine control over smoothness vs responsiveness. Smaller bandwidths give sharper local sensitivity, larger bandwidths give smoother curvature.

How it works (core logic)

The indicator computes three building blocks:

1) Kernel-weighted midline

For every bar, a sliding window looks back Window Length bars. Each bar in this window receives a kernel weight depending on:

Weights form the denominator, weighted values form the numerator, and the resulting ratio is the kernel regression mean. This midline is the central trend.

2) Kernel-based width

You choose one of two band types:

Width is scaled using Band Multiplier, controlling how far the envelope extends.

3) Upper and lower channels

Provided midline and width exist, the channel edges are:

These create smooth structures around price that adapt continuously.

Plotting modes

The indicator supports multiple visual styles depending on what you want to emphasize.

When only the midline is displayed, you get a pure kernel trend: a smooth regression-like curve that reacts to local structure while filtering noise, demonstrated here: tradingview.com/x/VPv2yYtZ/. This provides a clean read on direction and slope.

With full channels enabled, the behavior of the bands becomes visible. Standard deviation mode creates elastic boundaries that tighten during compressions and widen during turbulence, which you can see in the band-focused demonstration: tradingview.com/x/XzSaXVln/. This helps identify expansion events, volatility clusters, and breakouts.

ATR mode shifts interpretation from statistical variance to raw movement amplitude. This makes channels less sensitive to outliers and more consistent across trend phases, as shown in this ATR variation example: tradingview.com/x/njkeQAIr/. This mode is particularly useful for breakout systems and bar-range regimes.

Regime detection and bar coloring

The slope of the midline defines directional bias:

A secondary regime filter compares close to the channel:

Bar coloring is optional and can be toggled for cleaner charts.

Squeeze logic

The indicator includes non-standard squeeze detection based on relative width, defined as:

width / |midline|

This gives a dimensionless measure of how “tight” or “loose” the channel is, normalized for trend level.

A rolling window evaluates the percentile rank of current width relative to past behavior. If the width is in the lowest X% of its last N observations, the script flags a squeeze environment. This highlights compression regions that may precede breakouts or regime shifts.

Deviation highlighting

When using Kernel StdDev mode, you may enable deviation flags that highlight bars where price moves outside the channel:

This is turned off in ATR mode because ATR widths do not represent distributional variance.

Alerts included

These help automate regime changes and breakout detection.

How to use it

Trend identification

The midline acts as a bias filter. Rising midline means trend strength upward, falling midline means downward behavior. The channel width contextualizes confidence.

Breakout anticipation

Kernel StdDev compressions highlight areas where price is coiling. Breakouts often follow narrow relative width. ATR mode provides structural expansion cues that are smooth and robust.

Mean reversion

StdDev mode is suitable for fade setups. Moves to outer bands during low volatility often revert to the midline.

Continuation logic

If price breaks above the upper band while midline is rising, the indicator flags strong directional expansion. Same logic for breakdowns on the lower band.

Volatility characterization

Kernel ATR maps raw bar movements and is excellent for identifying regime shifts in markets where variance is unstable.

Tuning guidance

For smoother long-term trend tracking

For swing trading / short-term structure

For breakout systems

For mean-reversion systems

Settings overview

Kernel Settings

Channel Width

Visuals

Trading applications

Notes

The Kernel Channel is not a signal generator by itself, but a structural map. It helps classify trend direction, volatility environment, distribution shape, and compression cycles. Combine it with your entry and exit framework, risk parameters, and higher-timeframe confirmation.

It is designed to behave consistently across markets, to avoid the bluntness of classical averages, and to reveal subtle curvature in price that traditional channels miss. Adjust kernel type, bandwidth, and band source to match the noise profile of your instrument, then use squeeze logic and deviation highlighting to guide timing.

A non-parametric, kernel-weighted trend channel that adapts to local structure, smooths noise without lagging like moving averages, and highlights volatility compressions, expansions, and directional bias through a flexible choice of kernels, band types, and squeeze logic.

What this is

This indicator builds a full trend channel using kernel regression rather than classical averaging. Instead of a simple moving average or exponential weighting, the midline is computed as a kernel-weighted expectation of past values. This allows it to adapt to local shape, give more weight to nearby bars, and reduce distortion from outliers.

You can think of it as a sliding local smoother where you define both the “window” of influence (Window Length) and the “locality strength” (Bandwidth). The result is a flexible midline with optional upper and lower bands derived from kernel-weighted ATR or kernel-weighted standard deviation, letting you visualize volatility in a structurally consistent way.

Three plotting modes help demonstrate this difference:

When the midline is shown alone, you get a smooth, adaptive baseline that behaves almost like a regression moving average, as shown in this view: tradingview.com/x/VPv2yYtZ/.

When full channels are enabled, you see how standard deviation reacts to local structure with dynamically widening and tightening bands, a mode illustrated here: tradingview.com/x/XzSaXVln/.

When ATR mode is chosen instead of StdDev, band width reflects breadth of movement rather than variance, creating a volatility-aware envelope like the example here: tradingview.com/x/njkeQAIr/.

Why kernels

Classical moving averages allocate fixed weights. Kernels let the user define weighting shape:

- Epanechnikov — emphasizes bars near the current bar, fades fast, stable and smooth.

- Triangular — linear decay, simple and responsive.

- Laplacian — exponential decay from the current point, sharper reactivity.

- Cosine — gentle periodic decay, balanced smoothness for trend filters.

Using these in combination with a bandwidth parameter gives fine control over smoothness vs responsiveness. Smaller bandwidths give sharper local sensitivity, larger bandwidths give smoother curvature.

How it works (core logic)

The indicator computes three building blocks:

1) Kernel-weighted midline

For every bar, a sliding window looks back Window Length bars. Each bar in this window receives a kernel weight depending on:

- its index distance from the present

- the chosen kernel shape

- the bandwidth parameter (locality)

Weights form the denominator, weighted values form the numerator, and the resulting ratio is the kernel regression mean. This midline is the central trend.

2) Kernel-based width

You choose one of two band types:

- Kernel ATR — ATR values are kernel-averaged, producing a smooth, volatility-based width that is not dependent on variance. Ideal for directional trend channels and regime separation.

- Kernel StdDev — local variance around the midline is computed through kernel weighting. This produces a true statistical envelope that narrows in quiet periods and widens in noisy areas.

Width is scaled using Band Multiplier, controlling how far the envelope extends.

3) Upper and lower channels

Provided midline and width exist, the channel edges are:

- Upper = midline + bandMult × width

- Lower = midline − bandMult × width

These create smooth structures around price that adapt continuously.

Plotting modes

The indicator supports multiple visual styles depending on what you want to emphasize.

When only the midline is displayed, you get a pure kernel trend: a smooth regression-like curve that reacts to local structure while filtering noise, demonstrated here: tradingview.com/x/VPv2yYtZ/. This provides a clean read on direction and slope.

With full channels enabled, the behavior of the bands becomes visible. Standard deviation mode creates elastic boundaries that tighten during compressions and widen during turbulence, which you can see in the band-focused demonstration: tradingview.com/x/XzSaXVln/. This helps identify expansion events, volatility clusters, and breakouts.

ATR mode shifts interpretation from statistical variance to raw movement amplitude. This makes channels less sensitive to outliers and more consistent across trend phases, as shown in this ATR variation example: tradingview.com/x/njkeQAIr/. This mode is particularly useful for breakout systems and bar-range regimes.

Regime detection and bar coloring

The slope of the midline defines directional bias:

- Up-slope → green

- Down-slope → red

- Flat → gray

A secondary regime filter compares close to the channel:

- Trend Up Strong — close above upper band and midline rising.

- Trend Down Strong — close below lower band and midline falling.

- Trend Up Weak — close between midline and upper band with rising slope.

- Trend Down Weak — close between lower band and midline with falling slope.

- Compression mode — squeeze conditions.

Bar coloring is optional and can be toggled for cleaner charts.

Squeeze logic

The indicator includes non-standard squeeze detection based on relative width, defined as:

width / |midline|

This gives a dimensionless measure of how “tight” or “loose” the channel is, normalized for trend level.

A rolling window evaluates the percentile rank of current width relative to past behavior. If the width is in the lowest X% of its last N observations, the script flags a squeeze environment. This highlights compression regions that may precede breakouts or regime shifts.

Deviation highlighting

When using Kernel StdDev mode, you may enable deviation flags that highlight bars where price moves outside the channel:

- Above upper band → bullish momentum overextension

- Below lower band → bearish momentum overextension

This is turned off in ATR mode because ATR widths do not represent distributional variance.

Alerts included

- Kernel Channel Long — midline turns up.

- Kernel Channel Short — midline turns down.

- Price Crossed Midline — crossover or crossunder of the midline.

- Price Above Upper — early momentum expansion.

- Price Below Lower — downward volatility expansion.

These help automate regime changes and breakout detection.

How to use it

Trend identification

The midline acts as a bias filter. Rising midline means trend strength upward, falling midline means downward behavior. The channel width contextualizes confidence.

Breakout anticipation

Kernel StdDev compressions highlight areas where price is coiling. Breakouts often follow narrow relative width. ATR mode provides structural expansion cues that are smooth and robust.

Mean reversion

StdDev mode is suitable for fade setups. Moves to outer bands during low volatility often revert to the midline.

Continuation logic

If price breaks above the upper band while midline is rising, the indicator flags strong directional expansion. Same logic for breakdowns on the lower band.

Volatility characterization

Kernel ATR maps raw bar movements and is excellent for identifying regime shifts in markets where variance is unstable.

Tuning guidance

For smoother long-term trend tracking

- Larger window (150–300).

- Moderate bandwidth (1.0–2.0).

- Epanechnikov or Cosine kernel.

- ATR mode for stable envelopes.

For swing trading / short-term structure

- Window length around 50–100.

- Bandwidth 0.6–1.2.

- Triangular for speed, Laplacian for sharper reactions.

- StdDev bands for precise volatility compression.

For breakout systems

- Smaller bandwidth for sharp local detection.

- ATR mode for stable envelopes.

- Enable squeeze highlighting for identifying setups early.

For mean-reversion systems

- Use StdDev bands.

- Moderate window length.

- Highlight deviations to locate overextended bars.

Settings overview

Kernel Settings

- Source

- Window Length

- Bandwidth

- Kernel Type (Epanechnikov, Triangular, Laplacian, Cosine)

Channel Width

- Band Type (Kernel ATR or Kernel StdDev)

- Band Multiplier

Visuals

- Show Bands

- Color Bars By Regime

- Highlight Squeeze Periods

- Highlight Deviation

- Lookback and Percentile settings

- Colors for uptrend, downtrend, squeeze, flat

Trading applications

- Trend filtering — trade only in direction of the midline slope.

- Breakout confirmation — expansion outside the bands while slope agrees.

- Squeeze timing — compression periods often precede the next directional leg.

- Volatility-aware stops — ATR mode makes channel edges suitable for adaptive stop placement.

- Structural swing mapping — StdDev bands help locate midline pullbacks vs distributional extremes.

- Bias rotation — bar coloring highlights when regime shifts occur.

Notes

The Kernel Channel is not a signal generator by itself, but a structural map. It helps classify trend direction, volatility environment, distribution shape, and compression cycles. Combine it with your entry and exit framework, risk parameters, and higher-timeframe confirmation.

It is designed to behave consistently across markets, to avoid the bluntness of classical averages, and to reveal subtle curvature in price that traditional channels miss. Adjust kernel type, bandwidth, and band source to match the noise profile of your instrument, then use squeeze logic and deviation highlighting to guide timing.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.