OPEN-SOURCE SCRIPT

Обновлено Liquidation Reversal Signals [AlgoAlpha]

🟠OVERVIEW

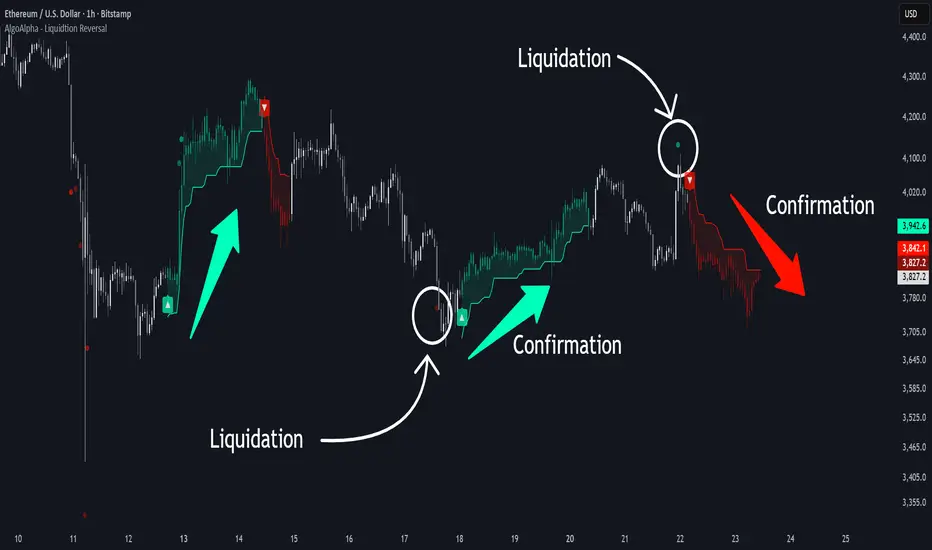

This tool detects potential liquidation-driven reversals by combining z-score analysis of up/down volume with the classic Supertrend. It watches for abnormal surges in directional volume (on a lower timeframe) and links them to trend flips on the main chart. When both align within a short window, it flags a probable reversal caused by forced liquidations. The goal is to help traders identify exhaustion points where aggressive liquidation moves may mark the end of a trend leg.

🟠CONCEPTS

The logic revolves around Z-score normalization of up and down volume to locate statistical extremes. When up-volume z-scores exceed a threshold during a bearish Supertrend, it implies trapped shorts being squeezed; the opposite applies for long liquidations. The script tracks these liquidation spikes and monitors whether a Supertrend regime change follows soon after. If confirmed within the allowed timeout, a colored signal marks the event.

In essence:

This pairing reduces false positives by ensuring that both volatility structure and order-flow extremes agree before flagging a reversal.

🟠FEATURES

🟠USAGE

This tool detects potential liquidation-driven reversals by combining z-score analysis of up/down volume with the classic Supertrend. It watches for abnormal surges in directional volume (on a lower timeframe) and links them to trend flips on the main chart. When both align within a short window, it flags a probable reversal caused by forced liquidations. The goal is to help traders identify exhaustion points where aggressive liquidation moves may mark the end of a trend leg.

🟠CONCEPTS

The logic revolves around Z-score normalization of up and down volume to locate statistical extremes. When up-volume z-scores exceed a threshold during a bearish Supertrend, it implies trapped shorts being squeezed; the opposite applies for long liquidations. The script tracks these liquidation spikes and monitors whether a Supertrend regime change follows soon after. If confirmed within the allowed timeout, a colored signal marks the event.

In essence:

- Z-score outliers = potential forced liquidations.

- Supertrend = structural regime context.

- Combined = statistically confirmed reversal signals, not random flips.

This pairing reduces false positives by ensuring that both volatility structure and order-flow extremes agree before flagging a reversal.

🟠FEATURES

- Z-score detection for liquidation spikes with adjustable lookback and threshold.

- Confirmation logic linking liquidations to Supertrend flips.

- Alerts for liquidation spikes and confirmed reversal starts.

- On-chart “No Volume” warning to avoid misreads on illiquid assets.

🟠USAGE

- Setup: Add the script to your main chart. Choose a lower timeframe (default 15m) to capture more granular liquidation flows. Adjust Z-Score Length to control how far back the script measures normal behavior and Threshold to decide what counts as extreme. Keep Timeout Bars low (e.g. 20–50) for faster reversals, or higher for slower markets.

- Read the chart:

• Circles appear below bars when long liquidations occur; above bars for short liquidations.

• A Supertrend flip with a recent liquidation spike will display an arrow and color shift.

• Fills between candles and trend lines show which side dominates: green for bullish reversal, red for bearish.

• Candle color fades based on the magnitude of liquidation pressure. - Settings that matter:

• Z-Score Length: Longer smooths noise but delays signal; shorter reacts faster.

• Z-Score Threshold: Higher means only extreme liquidations trigger; lower finds smaller squeezes.

• Timeout Bars: Defines how long after a liquidation the Supertrend flip remains valid.

• Lower Timeframe: Determines the precision of volume readings; too low may increase noise.

Информация о релизе

Update TitleСкрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

🚨Get premium (50% OFF DISCOUNT EXPIRES SOON): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.

Скрипт с открытым кодом

В истинном духе TradingView, создатель этого скрипта сделал его открытым исходным кодом, чтобы трейдеры могли проверить и убедиться в его функциональности. Браво автору! Вы можете использовать его бесплатно, но помните, что перепубликация кода подчиняется нашим Правилам поведения.

🚨Get premium (50% OFF DISCOUNT EXPIRES SOON): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Отказ от ответственности

Информация и публикации не предназначены для предоставления и не являются финансовыми, инвестиционными, торговыми или другими видами советов или рекомендаций, предоставленных или одобренных TradingView. Подробнее читайте в Условиях использования.