Индикаторы, стратегии и библиотеки

This Indicator show Options Data on signal dashboard , that help trader to analyse the market. Options data consist of two things , Call and Put. Every Strike has its Call and Put price. So if user Opens any chart which is traded in options , dashboard will show total 16 Call and 16 Put strikes 8 Above from ATM and 8 Below from ATM. On left hand side of...

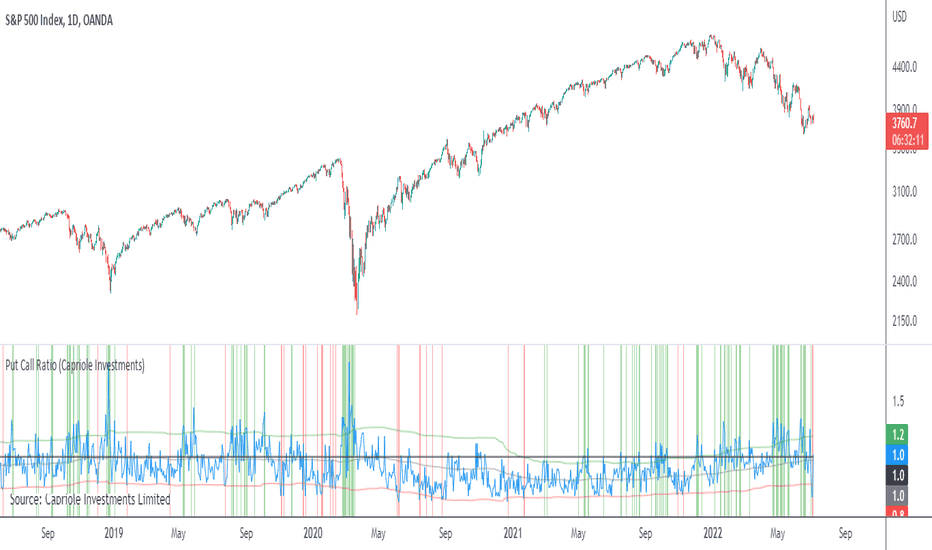

Hello! Excited to share this with the community! This is actually a very simple indicator but actually usurpingly helpful, especially for those who trade indices such as SPX, IWM, QQQ, etc. Before I get into the indicator itself, let me explain to you its development. I have been interested in the use of option data to detect sentiment and potential reversals...

This is an updated version of the Accumulated P/C Ratio. Some changes include: - Pinescript privacy changed from protected to open. - Utilizes the "request.security_lower_tf" function for weekly and monthly charts. - Now acquires and sums raw put volume (ticker: PVOL) and call volume (ticker: CVOL) separately, then divides the aggregate put to aggregate call to...

Implied Volatility Estimator using Black Scholes derives a estimation of implied volatility using the Black Scholes options pricing model. The Bisection algorithm is used for our purposes here. This includes the ability to adjust for dividends. Implied Volatility The implied volatility (IV) of an option contract is that value of the volatility of the...

Cox-Ross-Rubinstein Binomial Tree Options Pricing Model is an options pricing panel calculated using an N-iteration (limited to 300 in Pine Script due to matrices size limits) "discrete-time" (lattice based) method to approximate the closed-form Black–Scholes formula. Joshi (2008) outlined varying binomial options pricing model furnishes a numerical approach...

This script allows you to calculate returns on double butterfly options, specifically for 0 DTE and 1 DTE(days to expiration) for options that have expiration on Monday, Tuesday and Friday(Mostly SPY). The script is bi-directional, meaning it will calculate the returns on a put and call butterfly simultaneously, not just a put or just a call butterfly. The script...

This script is useful as a quick glance for checking the theoritcal price of the Call and Put option strike. Spot price is automatically derived from live market. Enter the strike price and IV value. For NSE stocks, use 6% as risk free rate if not sure.

Usage: 1. Set the put and call strike inputs to values of your choosing. 2. Select "days to expiration". 3. Set the put and call standard deviations using the output table. The indicator is meant help price a strangle using historical data and a volatility model. By default, the model is an ewma-method historical volatility. After selecting strikes and standard...

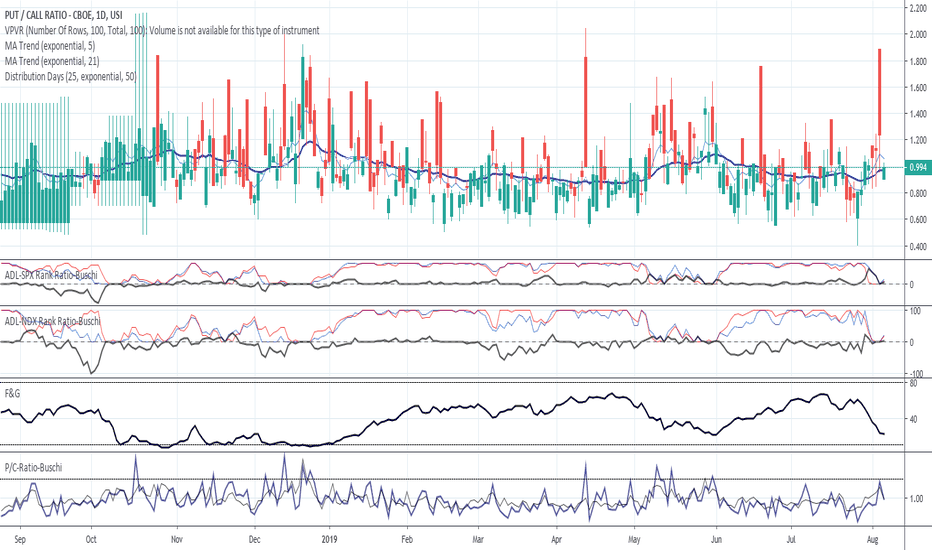

Plots the CBOE Put Call Ratio and marks up locations of extremities. Useful as a factor of confluence in identifying extremities in the market.

English: This script shows the Put/Call-Ratio as seen on the Cboe-Website: www.cboe.com A higher Put/Call-Ratio means a higher trading volume of puts compared to calls, which is a sign of a higher need for protection in the market. For best reflection of the Cboe's data, which is shown in 30 minutes intervals, a 30 min-chart is recommended. 30 min-data as...

![Implied Volatility Estimator using Black Scholes [Loxx] SPY: Implied Volatility Estimator using Black Scholes [Loxx]](https://s3.tradingview.com/x/xT4abuhx_mid.png)

![Cox-Ross-Rubinstein Binomial Tree Options Pricing Model [Loxx] ES1!: Cox-Ross-Rubinstein Binomial Tree Options Pricing Model [Loxx]](https://s3.tradingview.com/h/hw252XKE_mid.png)